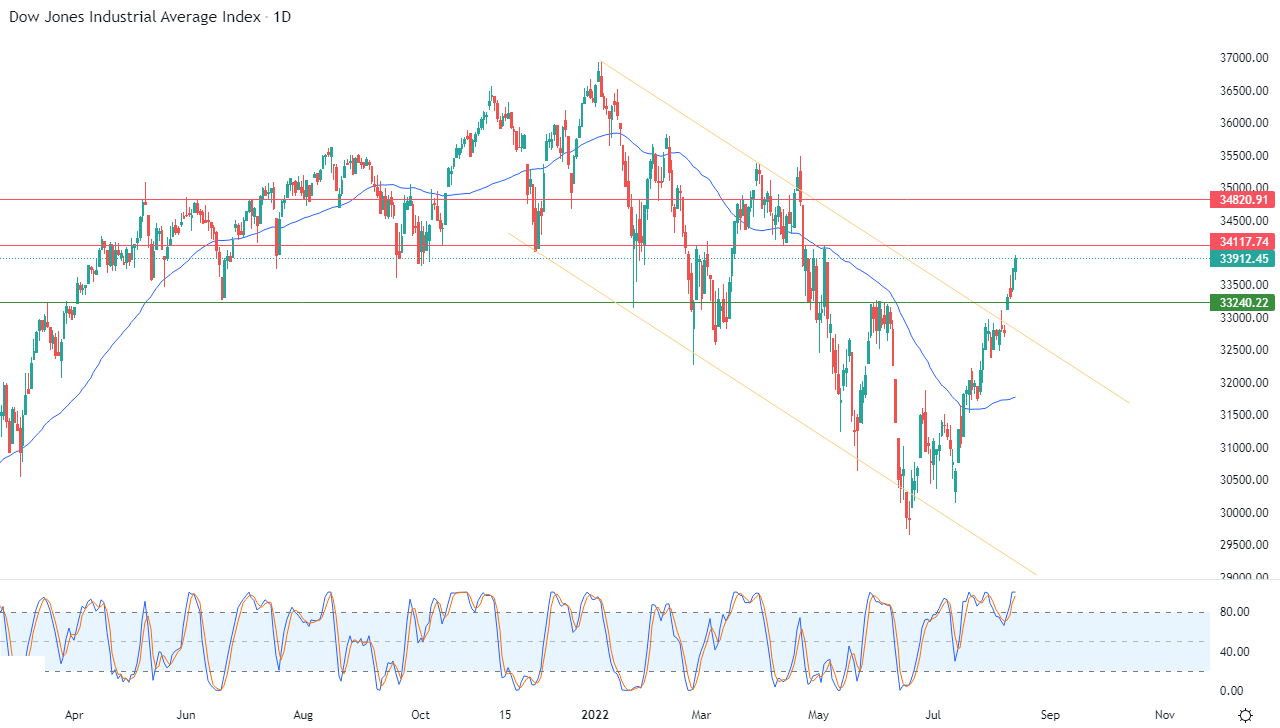

The Dow Jones Industrial Average Index rose during its recent trading at intraday levels, to achieve gains for the fourth consecutive day, by 0.45%. It added about 151.39 points and settled at the end of trading at the level of 33,912.45. It is achieving the longest series of gains since late May After rising by 1.27% during trading on Friday, last week the index rose by 2.92%.

The Federal Reserve Bank of New York's Empire State Business Conditions Survey, a measure of manufacturing activity in the state for August, fell 42 points from July to -31.3. This was well below economists' consensus of +5.0 before the release, down 6 points. It's also the second largest monthly drop in the survey's history.

The drop in the survey came from new orders and shipments, one positive side may be that there are signs of easing price pressures in August, supporting the narrative of peak inflation that has boosted markets recently. Analysts are also playing down the reading, if only temporarily, because manufacturing in New York is a small part of the country's manufacturing base.

This is why we should be interested in the next regional business survey coming Thursday from the Philadelphia Fed. If it's as bad as New York then recession fears could return quickly, which should affect stock prices, commodity prices, bond yields and the dollar.

Dow Jones Technical Outlook

Technically, the index continues to rise as a result of being affected by leaving the range of a bearish corrective price channel that limited its previous trading in the short term. It is shown in the attached chart for a (daily) period, with the positive signs appearing on the relative strength indicators. This is despite reaching overbought areas, In addition, it is benefiting from the continuation of the positive support due to its trading above its simple moving average for the previous 50 days.

Therefore, our positive expectations surrounding the index continue during its upcoming trading, as we expect it to rise to target the first resistance levels at 34,820.90, in preparation for attacking it. This positive scenario will continue as long as the support level 33,240 remains intact.

Ready to trade our Dow Jones trading signals? Here are the best CFD brokers to choose from.