The Dow Jones Industrial Average declined during its recent trading at the intraday levels, to record losses in its last sessions, by -0.18%, to lose about -58.13 points. It settled at the end of trading at the level of 32,774.42, after rising during trading at the beginning of the week on Monday by a rate of 0.09%.

Investors now see a 68.5% chance that the Fed will raise rates by 75 basis points at its next meeting in September, which would be the third big increase in a row.

Given the importance of the July CPI release which is due later Wednesday and will be watched closely by traders, economists anticipate that the decline in energy prices could help slow the pace of consumer price increases, which are at their highest levels in decades. YoY headline CPI rose 9.1% in June, the highest level in four decades. Economists polled by FactSet expect the core CPI to slow to 8.7%, but analysts warned that a hotter-than-expected reading on the headline or core number - which excludes volatile food and energy prices could rattle markets.

Analysts said a drop in the New York Fed's gauge of consumer inflation expectations on Monday was a positive sign, but strong wage growth data in the July jobs report released on Friday and a sharp rise in unit labor costs in data released on Tuesday were a concern.

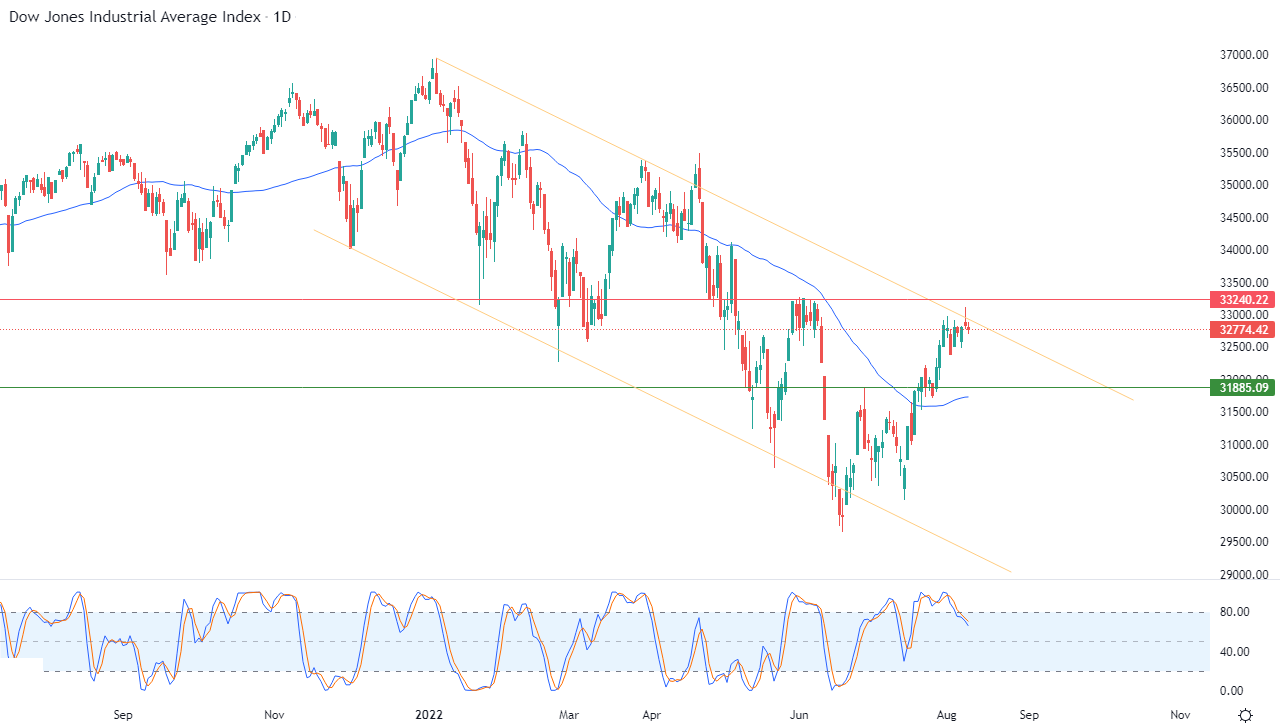

Dow Jones Technical Outlook

The index found some negative pressure after testing the ceiling of that bearish corrective price channel that limits its recent trading in the short term. It is shown in the attached chart for a period of time (daily), especially with the influx of negative signals on the relative strength indicators, after their arrival earlier. Overbought areas, all of this comes in light of the continuation of positive support for its trading above its simple moving average for the previous 50 days, which curbed the index's recent losses.

Therefore, our expectations indicate a decline in the index during its upcoming trading, throughout the stability of the resistance 33,240, to target the support level 31,885.

Ready to trade the Dow Jones 30? We’ve shortlisted the best CFD brokers in the industry for you.

Ready to trade the Dow Jones 30? We’ve shortlisted the best CFD brokers in the industry for you.