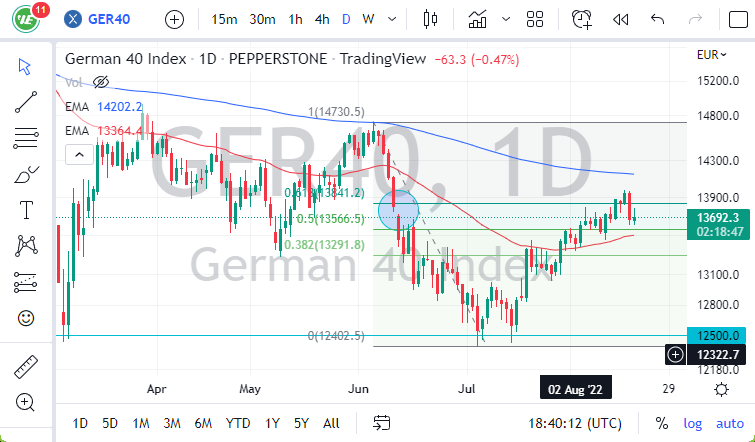

- The DAX index gained a little over 15 basis points during the trading session on Thursday, but gave back quite a bit of the gain to form an inverted hammer.

- This suggests that perhaps we have a bit of negativity ahead of us, as we go looking toward the 50 Day EMA underneath.

- The 50 Day EMA obviously is an indicator that a lot of pay close attention to, and therefore you should as well.

DAX Break Down Scenario

If we were to break down below the 50 Day EMA, then it’s very possible that this market could break down further. At that point, it opens up the possibility of dropping down to the €13,100 level, which is an area that had launched the DAX higher previously. Breaking down below that level almost certainly sends this market down toward the “double bottom” at the €12,500 level.

It’s also worth noting that we have just filled a gap in the DAX, which typically means to be a scenario where we will find quite a bit of selling pressure. Alternatively, if we break above that level, then we may start to test the 200 Day EMA above there, and really start to threaten a major uptrend. The 61.8% Fibonacci level is right where we had just filled the gap back, so a lot of things are moving at the same time that could push this market lower.

The DAX is going to be difficult to get a gauge on, simply because the European Union has a whole host of problems, but markets have been trained that bad news is good news, because the central bank is going to bail people out. However, the situations that the EU finds itself in are far beyond the norm, because energy is going to be a big issue. In other words, it’s not that the economy may slow down, there’s a possibility that some countries will completely stop. Because of this, I think any hope of the ECB bailing people out is a good thing for price, but might be overlooked before it’s all said and done. Markets around the world are a bit skittish at the moment, and traders and most certainly bearish. It’ll be interesting to see if we get a little bit of follow-through that the downside heading into the weekend, or if people are willing to hang on to this index.

Ready to trade our DAX forecast? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.