For three trading sessions in a row, the price of the USD/JPY currency pair is moving amid a bearish momentum that reached the 135.56 support level, before resuming stability around the 136.60 level since the start of trading this week. The US dollar pairs are watching this week a new hike in the US interest rate. The Fed set itself on the right track in June to raise US interest rates to a "moderately restricted" level believed to be between 3.25% and 4% by the end of the year, but it also indicated that reaching the neutral level of 2.5% could prompt it to restart and assess how quickly prices are raised going forward.

This is relevant in light of recent market concerns about the path of the US economy, the latest business surveys suggesting that key parts of the economy may slow faster than federal policy makers had anticipated, and due to recent trends in employment at some of the largest companies.

For his part, Fed Governor Powell said, "The rate of policy is going to go up where we think it should be. And then the question would be: Are you slowing down? Does that make you -- you're going to make these judgments about, is it appropriate now to slow down -- from 50 to 25, let's say." The June plan to push the federal funds rate to "moderately restrictive" levels by the end of the year was driven by a desire to cool the economy so that US inflation would begin to fall and eventually return to the Fed's 2% target, and there were indications that the Fed was having some success. early in this regard.

It is worth noting that putting aside the latest business surveys, hiring freezes in major US companies and global heads of industries suggest a cooling of the labor market that would dampen wage growth rates and reduce the risk of inflation continuing to rise beyond the short term.

A strong US labor market was a key target for the Fed, something that could lead it to prefer sticking to the plan already announced in June. To encourage a “hard” repricing of US interest rate expectations tomorrow, Wednesday. This type of outcome is likely to take profits from the parts of the market harboring bullish bets on the dollar, keeping the currency pair's directional risk up and creating room for a potential test of the 140.00 historical high at the earliest.

This week’s important events

Commenting on the most important event for the markets this week. “We don't expect the accompanying statement to give investors much reason to question the ongoing tightening guidance of the upcoming several FOMC meetings this year," says Kevin Cummins, chief economist at Natwest Markets. We also don't doubt that Powell is willing to speculate on a specific volume hike at the September meeting,” the analyst added, adding, “If the Fed has any surprises waiting for us, they are likely to bail them out for some time after the summer when they have more information on hand.

While Wednesday's Federal Reserve decision is the highlight for the dollar and many other currencies this week, Thursday's US Q2 GDP data and Friday's release of the core PCE price index for July will be closely scrutinized to see what could be done. The policy outlook on the Federal Reserve refers to it.

Commenting on this, Joseph Caporso, an analyst at the Commonwealth Bank of Australia says: “If the second consecutive quarter of GDP contracts in the second quarter of 2022, the US will meet the traditional definition of a recession (even if the US uses a different definition).” And “if the recession is interpreted as isolating for the US, the dollar could fall. But if the recession is seen as a precursor to a recession elsewhere, the US dollar may jump as the main safe-haven currency.”

Much of the recent market commentary has been concerned about the risk of the US economy sliding into a technical recession as soon as possible in the second quarter although the consensus of economists is that Thursday's data is likely to reveal a 0.4% increase in GDP for the period. It is not clear whether this will have a significant impact on the Fed's policy outlook and Friday's core PCE inflation reading will likely be more relevant, given that it is the Fed's preferred measure of US inflation.

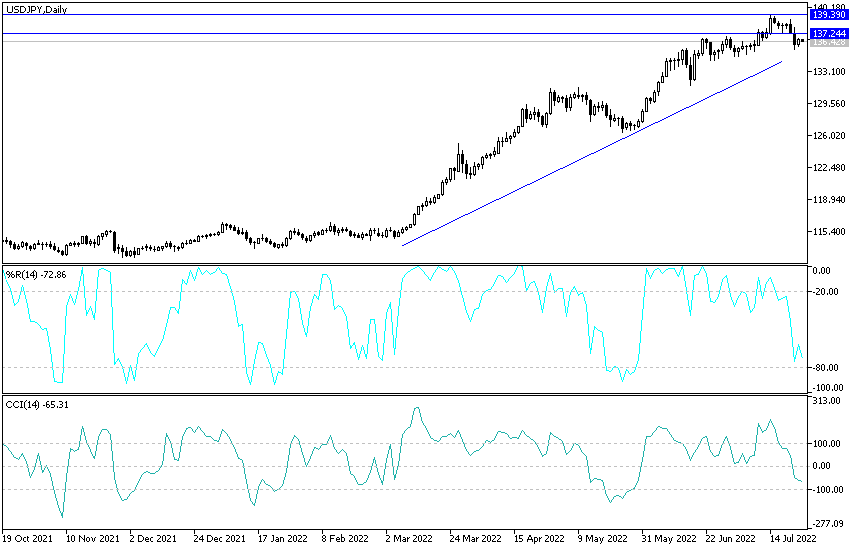

Technical forecast for the dollar yen pair:

On the daily chart, the price of the USD/JPY currency pair is heading towards buying levels that formed a previous base for buying. The currency pair launched from it to the resistance 139.38, its highest in 24 years, in the middle of this month's trading. The closest buying levels for the dollar are 135.40 and 134.00 yen, respectively. On the other hand, it will be important to break the resistance 138.40 again, to expect the psychological resistance of 140.00 as soon as possible.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex brokers in the industry for you.