Despite the recent stability in the performance of the GBP/USD currency pair with gains on the cusp of the 1.2100 resistance level, the pessimistic expectations about the future of the British economy stagnation and the disparity in the pace of interest rate hike between the Federal Reserve and the Bank of England, along with British political anxiety may bring the pair currencies selling again.

The price of the pound against the dollar GBP/USD will fall amid a “significant rise” on the part of the Federal Reserve, according to Western Union. The British Pound and the Dollar could see high volatility over the next 48 hours with the Federal Reserve expected to raise interest rates again on Wednesday and release US GDP data on Thursday.

Accordingly, analyst George Vessey at Western Union Business Solutions says that those who monitor the forex foreign exchange market should be wary of a potential "significant rally" from the Fed, as rates are raised by more than 75 basis points. Accordingly, “although it is unlikely at this point, that the dollar will rise if it surprises the Federal Reserve with a 100 basis point hike this week.”

The exchange rate of the pound against the dollar proved remarkably flexible during the past 24 hours, and settled above the level of 1.20 despite the sharp decline in the exchange rate of the euro against the dollar in response to the rise in European gas prices. Thus, flexibility is likely to persist if the Fed enters the market and delivers the expected 75 basis point rise. The analyst added, “Markets are expecting a 75 basis point rise by the US Federal Reserve (Fed) with a 90% probability of that happening. A significant 100 basis point rise is unlikely given the weak leading economic indicators and the lack of support by some Federal Reserve officials.”

He explains that interest rate speculation is the main driver of forex volatility, and a larger 100 basis point lift was soon enjoyed by money market managers after US inflation hit a new 40-year high in June and a stronger-than-expected US jobs report . This month.

Expectations for a 100 basis point rise were raised following the release of inflation data this month, which showed US inflation rose 9.1% year-on-year in June. But a number of Fed members immediately dismissed this shift in market expectations in speeches and in media appearances, which cooled market expectations.

This has since been helped by some lower-than-expected US economic data readings that indicate the US economy will slow sharply over the coming months, reducing the Fed's need to crush activity and cool inflation by raising interest rates. Accordingly, the analyst adds, “The main economic results indicated weak growth and weaker inflation on the horizon, which led to the weakness of the US dollar last week. EUR/USD is up over 1.3% and GBP/USD is up over 1% over the week.”

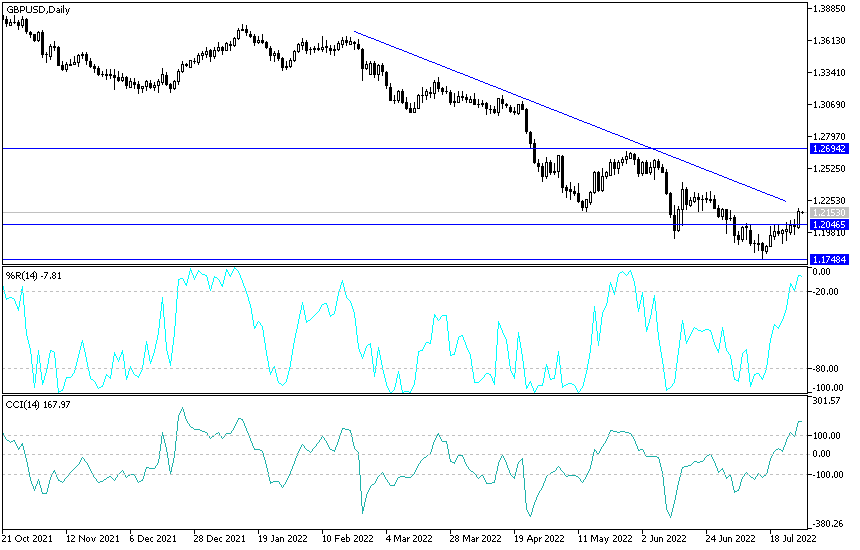

GBP/USD analysis:

Amid the state of pessimism about the future of the British economy, the political situation, and the difference in the rate hike path between the Federal Reserve and the Bank of England, I expect that the next GBP/USD gains will be subject to selling again. The closest resistance levels for the currency pair are 1.2120 and 1.2230, respectively. On the other hand, according to the performance on the daily chart, the currency pair's move towards the 1.1940 support level will confirm any bullish expectations for the pair and start expecting to test new record levels of support.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex brokers in the industry for you.