Global market sentiment still generally dominates the British pound on the day the UK released some mixed labor market data. This coincided with the decline of the US dollar, which allowed the GBP/USD currency pair to rebound towards the 1.2045 resistance level, the highest for the currency pair in two weeks. It is stable around the 1.2010 level at the time of writing.

Britain's unemployment rate held steady at 3.8% in May according to the Office for National Statistics, defying analyst expectations for a rise to 3.9% as 296,000 people were added to the workforce in the three months to May. However, average wages came in well below expectations with growth of 6.2% in May, less than an expected 6.7% and less than 6.8% in April. This confirms the continuing decline in real wages in the UK and contributes to expectations of a consumer-led economic slowdown over the coming months.

Commenting on the figures, Viraj Patel, analyst at Vanda Research said, “Real wages in the UK are now officially the lowest on record. Wage growth has begun to moderate in the private sector. And the monthly salary figures were revised less sharply. Aside from the May employment numbers which were solid...there is not much good reading in this jobs report.”

In real terms (adjusted for inflation) gross wages decreased 0.9% over the year and regular wages decreased 2.8%. Sterling was largely flat in the wake of the data with few major new signals coming from the numbers. Instead, the British currency is likely to continue to receive guidance from global drivers, specifically European gas prices and investor sentiment in general.

A worrying concern for the economic outlook is the number of people who are not actively looking for work, which acts as a constraint on activity. The economic idle rate decreased by 0.4 percentage points to 21.1% in March through May 2022. This continued demand from businesses means that the number of job vacancies in April to June 2022 rose to 1,294,000. However, the growth rate of job vacancies continued to slow.

The UK labor market data comes amid expectations of another interest rate hike in the Bank of England in August, but the next hike could be an unusually high 50 basis points. In the face of high inflation, the British central bank has made it increasingly clear that it intends to deal with higher rates, and a number of BoE spokespeople have done little to back off expectations for a 50 basis point hike in recent weeks.

But, says Valentin Marinov, FX analyst at Crédit Agricole, “Any setback in economic data may raise some questions about market pricing for a 50 basis point rate hike for the next few meetings of the Bank of England, as the Monetary Policy Committee has thus far begun to Cautious tightening steps of 25 basis points. On another note. Britain's inflation is due out today and when combined with labor market statistics should give markets a clearer idea of how the economy is developing and whether a 50 basis point rate hike is justified.

GBP/USD Forecast

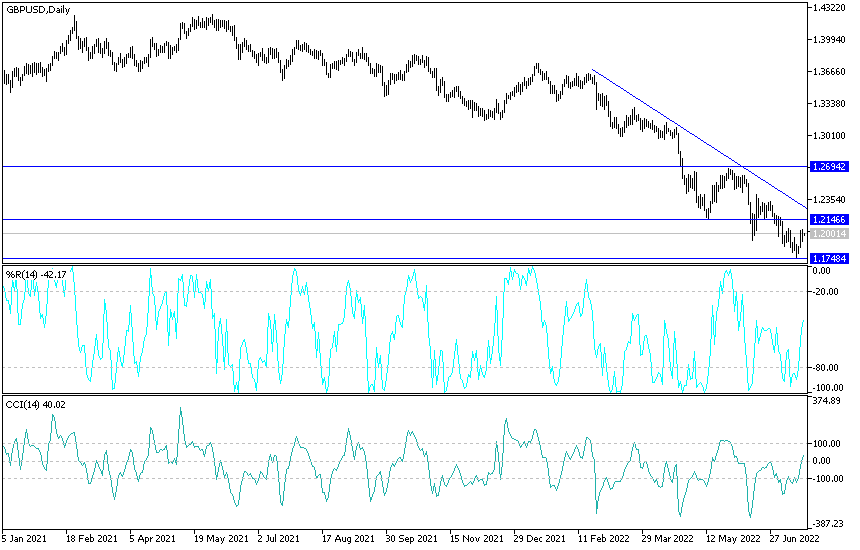

According to the performance on the daily chart, the GBP/USD price is preparing to form an ascending channel, opposite to the general trend which is still bearish. Stability below the psychological support 1.2000 still supports bears control. As I mentioned before, GBP/USD gains will remain subject to selling for a while, as long as the British political concern exists and as long as the US dollar is stronger than expectations of raising interest rates. The closest resistance levels for the GBP/USD pair are currently 1.2085, 1.2130 and 1.2220, respectively.

On the other hand, over the same period of time, breaking the 1.1885 support level will restore to the markets the expectations of a further downside collapse of the GBP/USD currency pair.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex trading brokers in the industry for you.