Last week's trading was generally bullish for the EUR/USD currency pair, as the European Central Bank raised interest rates for the first time in 11 years, at a higher percentage than what the markets had expected. Accordingly, the euro dollar moved towards the 1.0278 resistance, and by the end of the trading of the same week, the euro dollar fell towards the 1.0130 support level and settled around the 1.0215 level in the beginning of this important week's trading. As the markets are on track with a new hike in the US interest rate and the announcement of US economic growth and inflation figures in the Eurozone.

The European Central Bank (ECB) cited the fall in the EUR/USD exchange rate in July as a major influence on its thinking on inflation and as a driver of its decision to time the era of negative interest rates with a larger than expected increase in its key benchmarks for borrowing costs. July's drop from above 1.04 against the dollar appeared to be among the factors that prompted the European Central Bank to favor a larger-than-expected increase that raised the commercial bank deposit rate to zero last Thursday.

ECB Governor Christine Lagarde said at the press conference in July, “The reason we decided, completely unanimously around the table, to walk away from the signal we made in Amsterdam, was twofold. Number one, we had a clear understanding of the upside risks of inflation. I can give you a list. In addition, which is mainly related to inflation, the EUR/USD rate has fallen significantly in the past few weeks, which obviously has an impact on future inflation. So it's based on that critical group - she later added that the policy and position-related elements we took."

Thursday's decision prompted the euro to make another attempt to reverse the decline that caused it to briefly trade below par with the dollar last week, which was notable among the effects that stimulated the board.

Will Inflation Continue to Increase?

The ECB has often said in the past that it is not targeting exchange rates with its monetary policy, although this was not the same as saying it was not paying attention to it and not being the same as saying it would not target it. Sometimes it takes them into account in pursuit of an inflation target. However, if there is any reason to be skeptical, President Lagarde has been clear when putting the EUR/USD in the spotlight in this latter sense. Lagarde added: “We expect inflation to remain undesirably high for some time, due to ongoing pressures from energy and food prices and pipeline pressures in the pricing chain. The higher inflationary pressures also stem from the depreciation of the euro exchange rate.

According to the economic analysis, the EUR/USD currency pair is trading affected by the announcement that the European Central Bank will raise the key interest rate by 50 basis points to 0.5% from 0%. The market had been expecting a 25bps rate hike to 0.25%. The European Central Bank also raised its deposit rate by the same margin to 0% from -0.5%, beating market estimates of -0.25%. On Friday, the S&P Global Composite PMI and Manufacturing and Services PMIs for July missed expectations.

In the US, initial and continuing jobless claims came out against expectations at 240 thousand and 1.34 million, respectively, with readings of 251 thousand and 1.384 million. The Philadelphia Fed Manufacturing Survey for July also came in below 0 with -12.3. By the end of the week, the S&P Global Composite PMI for July fell 51.7 to 47.5. On the other hand, the manufacturing PMI beat expectations by 52 with a reading of 52.3, while the services PMI came in less than expected by 52.6 with a reading of 47.

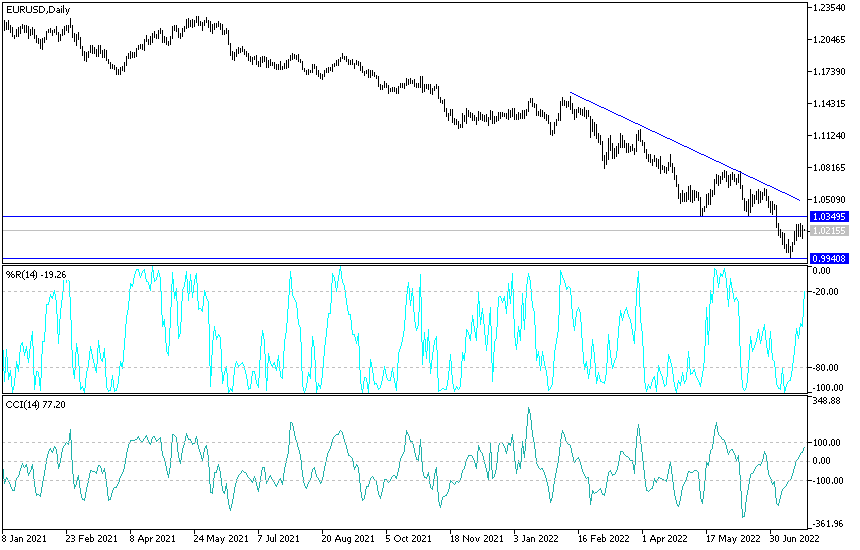

EUR/USD Technical Forecast:

In the near term and according to the hourly chart, it appears that the EUR/USD is trading within a descending channel formation. This indicates a slight short-term bearish momentum in the market sentiment. Therefore, the bulls - the bulls - are looking to extend the current rebound towards the 1.0269 resistance or above to the 1.0320 resistance. On the other hand, the bears will look to pounce on pullbacks around 1.0171 or lower at 1.0121.

In the long term and according to the performance on the daily chart, it appears that the EUR/USD is trading within the formation of a descending channel. This indicates a significant long-term bearish momentum in market sentiment. Therefore, the bears will look to extend the current downside trend towards 1.0016 or below to the 0.9865 support. On the other hand, the bulls will target long-term profits at around 1.0414 or higher at the 1.0593 resistance.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.