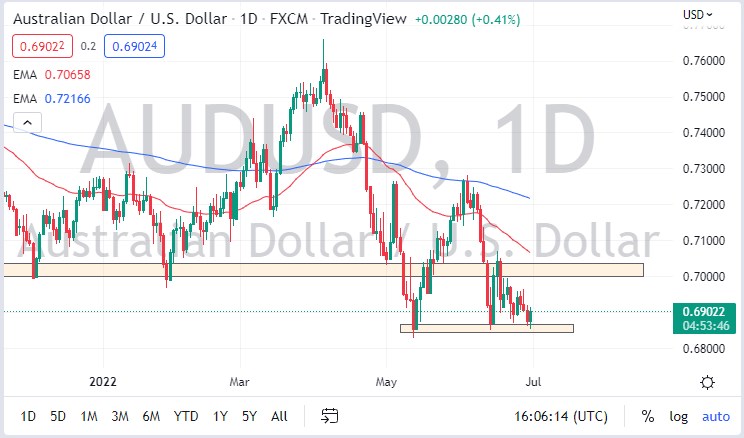

The Australian dollar looked as if it was going to break down during the trading session on Thursday but turned around and bounced rather hard from the 0.6850 region. This is an area that has been crucial more than once, so it’s not a huge surprise to see a bit of support in this area. Whether or not this is a sustainable move is the real question, and I suspect that it is not.

The 0.70 level above should offer a significant amount of psychological and structural resistance, so somewhere between here and there, I will be looking for signs of exhaustion so that I can start selling again. Interest rates in America continue to climb, although it must be stated that the Thursday session was probably a bit out of bounds anyway, as it was “end of the month rebalancing” for US stock traders and large institutions.

That being said, the first signs of exhaustion between here and the effort mentioned 0.70 level, I am more than willing to start shorting. If we were to break above the 0.70 level, then I might step back and let the market bounce even higher before starting to short again. It is near the 0.7250 level that I would consider the trend may be changed, but only if we get a sustainable daily close above there. I think that the Australian dollar will continue to suffer at the hands of the commodity markets getting squeezed, as global growth is almost certainly going to dissipate. If that’s going to be the case, it’s very difficult to imagine a scenario where some of these commodity currencies will really start to take off.

Keep in mind that the Federal Reserve is hell-bent on taming inflation, meaning that they are not paying attention to most markets. In fact, some have even stated that they are “waiting for something to break.” I don’t think it will be the Australian dollar, but obviously, there will be a risk appetite component to whatever happens next. That will show up on this chart, as the Australian dollar is considered to be a “risky asset”, mainly because of its exposure to China and hard commodities in general. The US dollar is a “safe haven currency”, skewed than in the back of your mind as well. As long as there is fear and uncertainty, this market has a hard road ahead.