Today's recommendation on the lira against the dollar

Risk 0.50%.

The sell trade of the recommendation was activated yesterday, and the deal is still in circulation

Best selling entry points

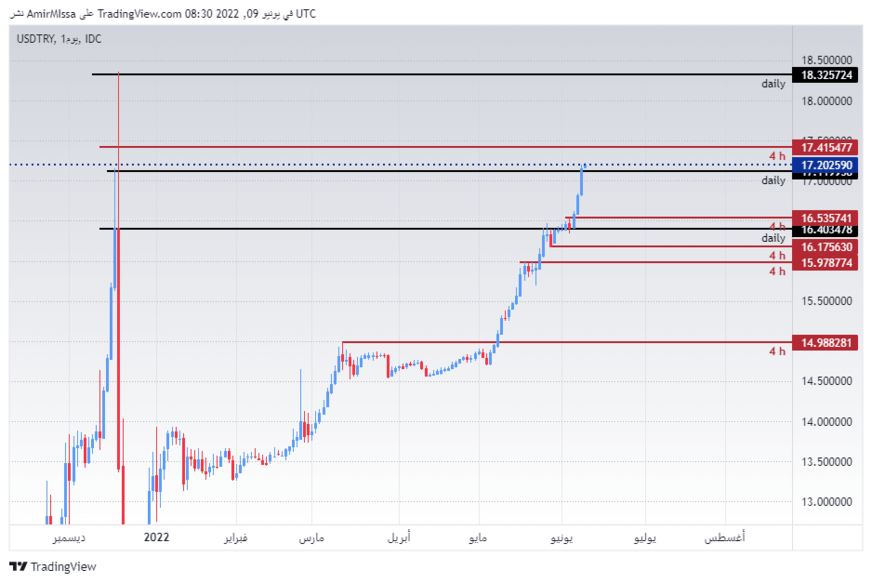

- Entering a sell position with a pending order from 17.41 levels

- Set a stop-loss point to close the lowest support levels 17.65.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 55 pips and leave the rest of the contracts until the strong resistance levels at 16.40.

Best entry points buy

- Entering a buy position with a pending order from 17.00 levels

- The best points for setting the stop loss are closing the highest levels of 16.88.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 55 pips and leave the rest of the contracts until the support levels 17.40

The lira continues to decline against the major currencies, especially the dollar. The lira approached its lowest level recorded at the end of last year. This was before the Turkish president intervened with a new program aimed at protecting Turkish lira deposit holders from the local currency’s declines against the dollar. It seems that the impact of Turkish President Recep Tayyip Erdogan's plans did not bear fruit, as the lira continued its decline two months ago, after the stability of the price against the dollar during the months of February and March. The Turkish President's statements yesterday were the bell for the collapse of the lira, as Erdogan said, "This government will not raise interest rates. On the contrary, we will continue to lower interest rates." He added that such policies only benefit "those who lead a glamorous life to benefit from high interest ", including foreign investors. After these statements, the dollar broke the levels of 17 pounds and is still continuing to decline

On the technical front, the Turkish currency continued to decline against the dollar, as it broke the 17 levels during yesterday's trading. 17.00. The lira fell to its lowest level against the dollar, which it recorded at the end of last year. The pair maintained its trading in a general bullish trend, as the pair continued trading above the moving averages 50, 100 and 200, respectively, on the four-hour time frame as well as on the 60-minute time frame. At the same time, the pair is trading above the support levels that are concentrated at 17.00 and 16.80 levels, respectively. On the other hand, the lira is trading below the resistance levels at 17.40 and 17.80, respectively. We expect a continuation of the lira's decline, as each decline in the pair represents an opportunity to buy back. Please adhere to the numbers in the recommendation with the need to maintain capital management.