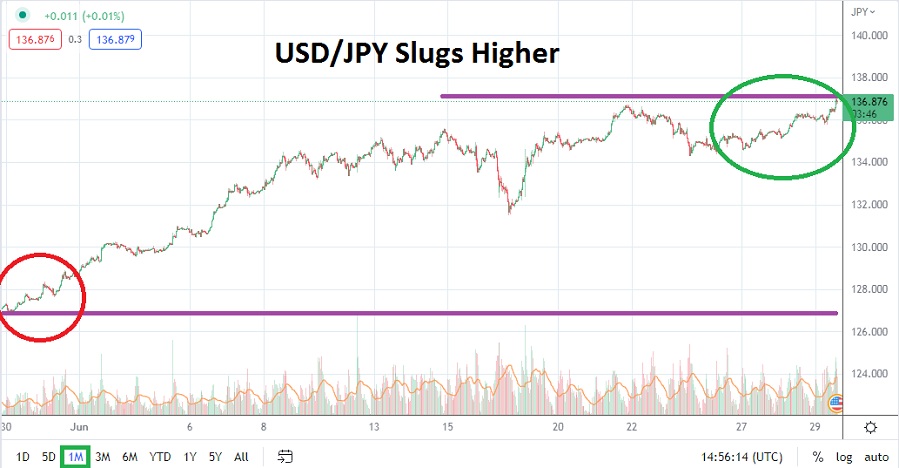

As the month of July gets ready to begin for the USD/JPY, it is likely the USD/JPY will be trading near very long term highs. As of this writing the USD/JPY is trading near the 136.650 ratio. Technical traders who want a perspective regarding this higher terrain need to look at charts that stretch back to 1998. Yes, the last time the USD/JPY traded within this vicinity was in October of 1998.

The month of June began with the USD/JPY trading what could be considered as a very high price range as it flirted with the 130.000 level. On the 9th of May the USD/JPY reached a high of nearly 131.500 which was considered quite lofty. However, as it became clear the Bank of Japan would maintain its interest rate policy, which is extremely dovish with negative interest rates still ruling the central bank’s mantras; and the U.S Federal Reserve becoming quite hawkish as it battles inflation, financial institutions have simply continued to balance their holdings and buy the USD/JPY.

While many speculators and even some financial institutions may believe the Bank of Japan will give in at some point and start to counter the U.S Fed’s interest rate hikes, the BoJ has actually sat on its hands and done nothing. The U.S central bank continues to speak about the dangers of high inflation and the need to potentially maintain its rate hikes until inflation is curtailed. The Federal Reserve’s Chairman Jerome Powell is on record saying the Fed may have to continue hiking its interest rates even if it risks recession in the States.

The USD/JPY has a history of being a solid trending Forex pair. The USD/JPY also has a past which has seen volatility and spikes triggered with lightning speed. Traders need to be careful if they decide to pursue the upwards momentum which has turned into a startling bullish run for the USD/JPY. Because when the Japanese Yen starts to reverse and become stronger it could cause a swift trajectory in the opposite direction it has tracked since the first week of March 2022, when the USD/JPY was trading near 115.500.

However, technical traders who want to pursue buying positions may have history on their side for additional upwards movement to continue. Way back in 1998 the USD/JPY traded near the 146.000 level in July of that year, actually to be fair the USD/JPY moved to the 147.000 juncture briefly around that time, but let’s not get overly greedy. The simple message is the USD/JPY has traded higher than its current value. There are no guarantees it will accomplish those values this time around. Yet, plenty of evidence suggests that financial institutions may be bracing for a higher USD/JPY. If the 138.000 mark is flirted with, it seems natural that some speculators will start to whisper about the potential of the 140.000 ratio as a natural psychological target.

USD/JPY Outlook for July 2022

Speculative price range for USD/JPY is 131.470 to 141.290

If and when the USD/JPY begins an earnest decline in value it could be fast. On the 14th of June the USD/JPY was trading near the 135.600 ratio, and when the U.S Fed made its interest rate hike official the Forex pair promptly dropped to the 131.550 level for a brief moment on the 16th of June, this was only about two weeks ago. Since then the USD/JPY has incrementally climbed, but the above is mentioned to provide evidence that selling movement can occur and be violent. If the 136.000 level falters and the USD/JPY is not able to climb back above this mark for a sustained amount of time, additional selling could easily spark a move toward 135.000 and the 134.000 ratios.

Speculators who want to remain buyers cannot be blamed. Traders will need a full arsenal of risk taking tactics to participate with the USD/JPY. Entry price orders are urged to make sure fills meet expectations. Stop loss and take profit orders are also highly encouraged. Speculators should not become overly ambitious and be willing to cash out winning wagers in the USD/JPY. If the 137.000 is approached and surpassed it could spark additional buying action. Traders targeting higher price levels need to monitor the USD/JPY carefully, if the Forex pair begins challenging higher values. The USD/JPY has put on an astonishing upwards show in June and its pace upwards may not be done yet.