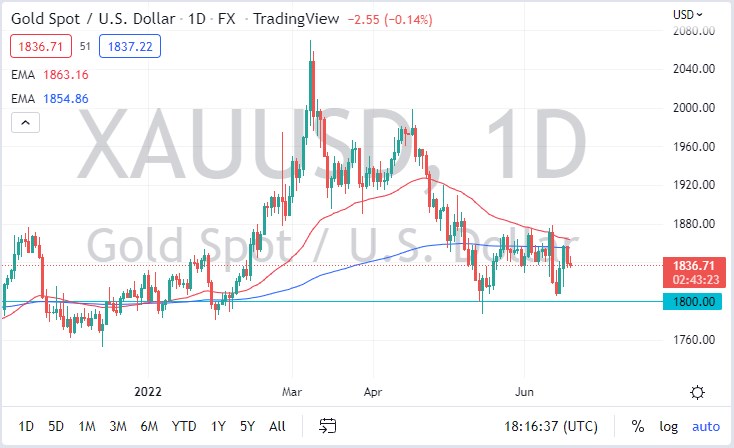

Gold markets went back and forth during the trading session on Monday, as the Americans were away celebrating Juneteenth. This pulled a lot of the volume out of the market, so therefore it looks as if it’s a day you can essentially write off. Nonetheless, the 200 Day EMA sits just above, and now it looks as if it’s going to offer a little bit of resistance. Furthermore, the 50 Day EMA is dropping down to perhaps cross underneath the 200 Day EMA, which is essentially the “death cross” that a lot of longer-term traders pay close attention to.

However, it’s very likely that we are going to be more range bound than anything else, because quite frankly the bond market is oversold, so if we see rates drop in that market, it’s likely that we will see gold take off. Furthermore, we formed a little bit of a “double bottom” down at the $1800 region, so as long as we can say above that can make an argument for support. If we were to break down below the $1800 level, then it’s likely that the $1750 level would be targeted. After that, then you are looking at a move to the $1700 level.

On the other hand, if we were to turn around and take out the $1850 level, it would wipe through a lot of resistance and therefore it opens up the possibility of reaching the $1900 level, and then possibly even the $2000 level. All things being equal, I think this market remains a bit of a “buy on the dip” type of situation, but if we do break down below that $1800 level, that would be a huge red flag. I think this continues to be a situation where the market is trying to build a bit of a base, perhaps to recover.

Gold should have a good future because there are a lot of financial concerns out there, and a lot of people will take advantage of gold for safety. That being said, we also have the US dollar strengthening overall, so that does work against the value of gold, but do not think that we can have both gold in the US dollar rights at the same time, because it has happened in the past. However, it does cause a lot of crosswinds and therefore you should be cautious with your position size.