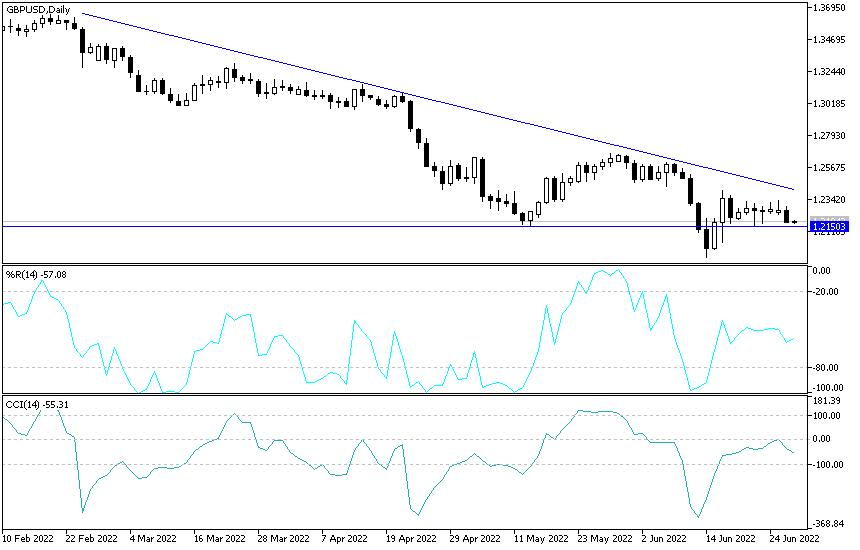

We recommend a lot to sell the sterling-dollar pair from every rising level. The GBP/USD currency pair returned to its bearish track, and its recent gains evaporated. It is reaching the resistance level 1.2333 this week, as it returned amid profit-taking sales to the support area 1.2180 at the beginning of trading today, Wednesday. This may increase the strength of the stronger bearish expectations towards the psychological support 1.2000 at the earliest.

Despite the last performance the Standard Chartered Wealth Management division is bearish on the US dollar in a six to twelve month period as they feel that a major turning point in the global forex currency markets is approaching. Meanwhile, the UK-based lender focused on Asia updated its stance on UK stocks saying they now offer good value and exposure to the commodity pool, a development that supports their bullish thesis on sterling in the medium term.

Accordingly, Steve Price, chief investment officer of the principal investment office at Standard Chartered Wealth Management, says that there are two opportunities in the markets at the moment: “The first is in Asian stocks, excluding Japan,” adding, “The second opportunity is in British stocks, which we expect to benefit from their relatively greater weight. towards sectors with value and profits as well as from a more attractive valuation, compared to the euro area and the United States.”

The forecasts form part of Standard Chartered Wealth Management's mid-term review detailing their investment thesis for the next half year. We also upgraded UK stocks to 'favorites' on the back of their heavy exposure to sectors that could benefit from higher inflation, such as energy, mining, and finance," says Daniel Lamm, equity analyst at Standard Chartered.

The expected outperformance of UK assets in turn is likely to provide the Sterling with a source of additional support as global investors seek better returns. Indeed, Manpreet Gill, an analyst at Standard Chartered, says he is bullish on a few select currencies against the dollar over the next six to twelve months, most notably the euro and the British pound.

This bullish stance on sterling is based on expectations of "strong growth and employment" as well as the "hard-line" Bank of England. But Standard Chartered warns of downside risks to their fundamental view as the Pound could remain vulnerable to stagflation pressures and geopolitical risks. The big call that will eventually raise the pound-to-dollar exchange rate is the expectation that the US dollar will peak in the second half of 2022. This is as optimistic expectations about Fed policy fade as inflation eases.

Meanwhile, global central banks will continue to tighten monetary policy to avoid a weakening of their currency as this leads to increased inflation. Accordingly, the bank analyst says, “Global central banks are following the Fed with a tighter policy, aiming to avoid weaker currencies and even higher inflation. And that would eventually weigh on the dollar.” He adds that capital inflows should revolve away from the US towards more attractive value assets, such as UK stocks. Indeed, Standard Chartered Bank remains in the near term "broadly neutral" towards the dollar and warns that sticky US inflation data may leave the Fed unilaterally focusing on tightening policy.

Moreover, the global economic slowdown and financial market constraints may prevent global central banks from the opportunity to raise interest rates and close the Fed's gap, thus preserving the dollar's yield advantage. Another support for the dollar in the near term is the increase in risk aversion due to the Ukraine war and other geopolitical tensions.

So, as a major turning point looms, some patience may have to be exercised in the near term.

The forecast for the pound against the dollar today:

As I expected before, the general trend of the GBP/USD pair will remain bearish and testing the support level 1.2175 will support the next downside move, the psychological support level 1.2000. As I mentioned before, the pessimistic factors of the Bank of England and the superiority of the US Federal Reserve over the latter in the course of raising interest rates, in addition to British political anxiety, will remain factors that negatively affect any gains for the sterling-dollar pair in the coming days.

On the upside, according to the performance on the daily chart, a break of the resistance levels 1.2400 and 1.2665 will be important for a first break of the current trend.