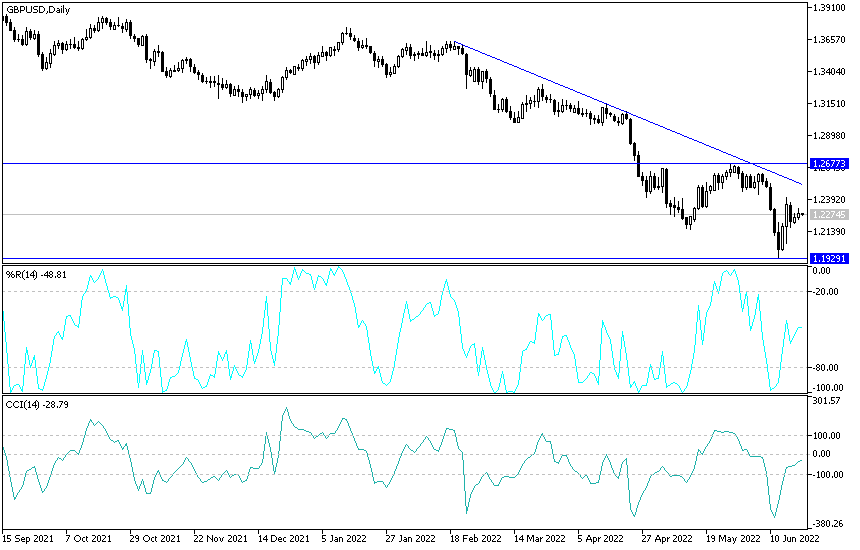

Before the launch of the most important events of this week, the exchange rate of the GBP/USD currency pair attempted to rebound upwards. Its gains did not exceed the 1.2324 resistance level, as it settled around the 1.2275 level at the time of writing the analysis, before the announcement of inflation figures in Britain and the testimony of US Federal Reserve Governor Jerome Powell. As I mentioned before, the sterling dollar gains always collide with the pessimism of the Bank of England about the path of raising interest rates and the imminent economic recession.

The British Pound seems to be attracting buyers from the market amid the price action which may be driven by the seemingly increased risk of a more aggressive Bank of England (BoE) interest rate. BoE chief economist Howe Bell reportedly told the Institute of Chartered Accountants in England and Wales on Tuesday that the Bank of England was prepared to act "more aggressively" to bring down inflation in the coming months, even if it comes at the expense of the economy.

This echoed the newly approved guidance given by the Bank of England after the June decision to raise the bank rate from 1% to 1.25%, and came tough on the heels of Monday's speech from MPC member Catherine Mann, who also called for more serious action in the coming months. Commenting on this, “The British pound remains one of our favorite short positions precisely because of the reasoning presented by Mann – the BoE is less responsive to inflationary shock than other central banks,” says Biban Ray, FX analyst at CIBC Capital Markets.

“Prioritizing growth over inflation means you have to deal with a weaker currency as well,” the analyst added.

This week, Catherine Mann argued that with the Fed set to aggressively raise interest rates in the coming months, and perhaps also the European Central Bank (ECB), sterling would be at risk of further depreciation of the dollar and the euro without compensation from the Bank of England. This would add further to the BoE's inflation challenge and could, if taken to an extreme, force the Bank to take more aggressive and potentially harmful action at a later date.

As per the forecast: Analysts at Goldman Sachs and Deutsche Bank say the Bank of England will accelerate the pace at which it intends to raise interest rates, but NatWest Markets is not convinced and expects one additional 25 basis points increase in 2022. The difference of opinion reflects the growing uncertainty among analysts. Since the Bank of England raised interest rates again last week, it has, crucially, deviated from previous guidance.

GBP/USD Forecast for Today:

I still expect that any gains in the GBP/USD pair will be subject to selling as the future of interest rate hikes by global central banks remains in favor of a stronger US dollar. Coupled with that, British political anxiety will be an additional pressure factor on the Pound. The closest retracement gains for the currency pair are the 1.2400 and 1.2565 resistance levels, respectively. On the other hand, the strength of expectations for a collapse will return to the vicinity of the psychological support level 1.2000 if the sterling dollar pair returns to the vicinity of the support 1.2175. British inflation figures, Jerome Powell's testimony, and the performance of global financial markets are the main factors affecting the sterling dollar pair today.