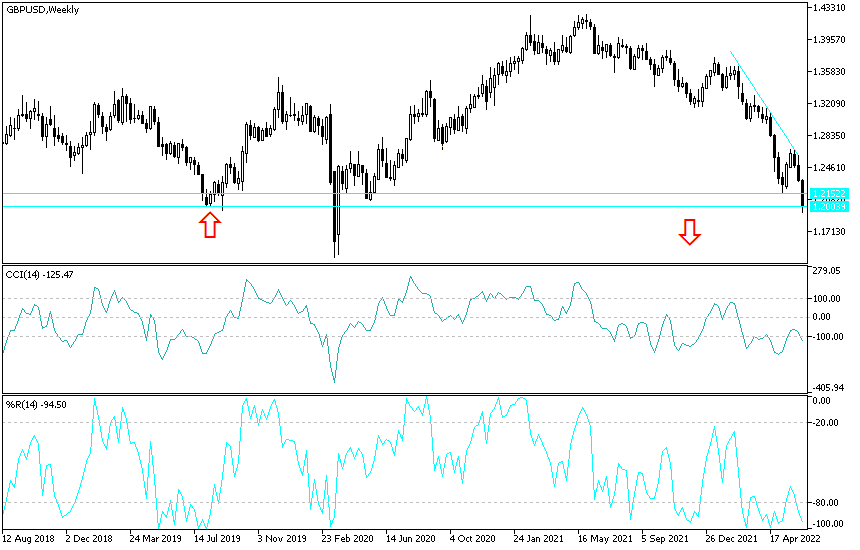

The price of Sterling came under severe and widespread pressure as global stock and bond markets plunged. This occurred while events in Westminster sparked incorrect speculation about the UK-EU trade relationship, creating a perfect storm for sterling assets in the process. According to the performance in the forex market, the British pound tumbled, and its biggest losses were at the hands of the Indonesian rupiah, the South African rand, the Indian rupee, and the Korean won, but with the US dollar and the euro closely behind them in this exact order. In the case of the GBP/USD currency pair, it fell to the 1.1933 support level, its lowest in years, and is settling around the 1.2000 level at the time of writing the analysis.

Returning to our recent technical analyzes for this pair, we mentioned that the chance of falling to the psychological support level 1.2000 is very likely if it breaches the 1.2165 support, which happened more than we expected.

The losses came alongside declines in the stock and bond markets but were also sharp and broad enough to indicate the domestic impact in action on sterling. “But with the Federal Reserve seemingly close to announcing a massive 75 basis point rise tonight, and after the pound has already weakened to $1.22, we are sticking with our expectations for a 50 point increase,” said Paul Dills, chief UK economist at Capital Economics. basis from 1.00% to 1.50%.”

Sterling's losses started early when figures from the Office for National Statistics (ONS) indicated that the UK labor market may cool down faster than the Bank of England and other forecasters had forecast. According to the official announcement, the country's unemployment rates rose from a multi-decade low of 3.7% in March to 3.8% in April, while the National Statistics Office's measures of wage and salary growth came in less than what economists had expected, barely a day after other data that indicated that Britain's economic growth may slow faster than many expected.

These numbers followed other figures released in May which showed UK inflation rose to 9% in April, the highest level in several decades for price growth, but also below the Bank of England's forecast of 9.1%, which finds the same Now in lag. This is a critical situation ahead of Thursday's interest rate decision by the Bank of England.

All the latest data from the UK suggests economic demand is waning, and there is a risk that the Bank of England will feel tempted to raise rates by just 0.25% on Thursday, which goes against more recent market expectations. Inclined towards a greater movement of 0.50%. The above is an important reason behind the poor performance of the pound in the market, although it is appropriate that these losses come in the wake of the government putting in place domestic legislation to address the Northern Ireland Protocol and the risks it poses to stability in the province.

This protocol device was previously known as the “Northern Irish Backstop” something that was widely misreported as well as misunderstood in the media and across financial markets, meaning it could have been a contributing driver to the pound's losses on Tuesday. This is a reasonable and practical solution to the problems facing Northern Ireland. It will protect the EU's single market and ensure that there is no hard border on the island of Ireland. We are ready to achieve this through talks with the European Union. Foreign Secretary Liz Truss said: "But we can only make progress through negotiations if the EU is willing to change the protocol itself - at the moment they are not."

The UK government has embarked on changes to the Northern Ireland Protocol under Article 16 after 18 months of fruitless discussions with the European Commission and members of the EU bloc.

According to the technical analysis of the pair: There is no doubt that the collapse in the price of the GBP/USD currency pair below the psychological support confirms the strength and control of the bears on the trend. Despite the movement of technical indicators towards strong and sharp saturation levels, forex investors will not think In the demand for buying, except until the reaction from the announcement of the US Federal Reserve today, and the Bank of England tomorrow. The path of raising interest rates from the two banks, in addition to the performance of global stock markets, are important factors to determine the continuation of the current collapse or rebound, even if temporarily.

The closest support levels for the Sterling dollar today are 1.1945 and 1.1830, respectively. According to the performance on the daily chart, it will be important to break the resistance levels 1.2520 and 1.2700 to change the current bearish outlook.