The difference between success and failure in Forex / CFD trading is very likely to depend mostly upon which assets you choose to trade each week and in which direction, and not on the exact methods you might use to determine trade entries and exits.

So, when starting the week, it is a good idea to look at the big picture of what is developing in the market as a whole, and how such developments and affected by macro fundamentals, technical factors, and market sentiment. Read on to get my weekly analysis below.

Fundamental Analysis & Market Sentiment

I wrote in my previous piece last week that the best trades for the week were likely to be:

- Long of USD/JPY. This produced a gain of 0.35%.

- Long of the 2YR US Treasury Yield. This produced a gain of 1.35%.

- Short of BTC/USD. This produced a whopping gain of 30.97%.

These were great calls overall, especially my short Bitcoin forecast, resulting in a huge weekly profit.

After more than four months, the war in Ukraine has faded away from its former place as a lead news item. Russian forces are currently conducting a strong offensive in eastern Ukraine and are having some success through massive firepower and a willingness to use artillery regardless of civilian casualties, which are numbering tens of thousands. As a permanent member of the UN Security Council, Russia cannot be diplomatically censured, showing what the United Nations has become, and putting its twisted focus on smaller conflicts with far lower civilian death tolls into sharp focus for all to see. The war initially caused quite strong movements in some markets, especially in certain agricultural commodities such as Wheat and Corn, but now seems to be having little effect as agricultural commodities have generally begun to trade lower.

Last week was dominated by continuing risk-off sentiment, with a focus on inflation and rate hikes, as three major central banks raised their interest rates, broadly by more than had been expected: the US Federal Reserve, the Bank of England, and the Swiss National Bank.

A continuing strong decline in cryptocurrencies, especially the week’s 30% decline in the US Dollar value of Bitcoin, was also a prominent news item. Several cryptocurrency exchanges have frozen withdrawals. Short trades in cryptocurrencies will continue to attract speculators in this environment, while margin calls will force retail liquidations. There will be more casualties in the cryptocurrency ecosystem.

Last week’s important economic data releases came in as follows:

The US Federal Reserve hiked its Federal Funds Rate by 0.75% to 1.75%, at a time when many analysts had been expecting a hike of only 0.50%. This higher-than-expected inflation print at the end of the previous week convinced the Fed to hike by more than 0.50%.

The Bank of England hiked its Official Bank Rate by 0.25% to 1.25% as was widely expected.

The Swiss National Bank made a shock rate hike of 0.50%, putting its Policy Rate up to -0.25%: still negative, and the lowest interest rate of any major central bank.

The Bank of Japan left its Policy Rate at -0.10%, and its Statement contained no surprises: the bank continues to pursue a dovish policy aimed at reflating the economy and bringing inflation up to the 2% target, giving an overall unusually dovish policy by global standards.

US Retail Sales data came in lower than expected, suggesting consumer spending may be getting impacted by rising inflation.

The Forex market saw a minor selloff in the US Dollar while the Japanese Yen, whose weakness is still tacitly encouraged by the Bank of Japan, continues to weaken. However, the greenback regained some of its strength to close the week higher against other major currencies.

There is increasing hope that the coronavirus pandemic may be almost over, although rates of coronavirus infection globally rose last week against the long-term downwards trend. The significant growths in new confirmed coronavirus cases overall right now are happening in Austria, Bahrain, Morocco, Chile, Germany, Guatemala, Israel, and the UAE.

The Week Ahead: 20th June – 24th June 2022

The coming week in the markets is likely to be less volatile than last week. There are fewer releases of high importance scheduled which have the potential to significantly move markets. They are, in order of likely importance:

Chair of the US Federal Reserve Testifies Before Congress.

British CPI – an annualized rate of 9.1% is expected.

Canadian CPI – a month on month increase of 1.0% is expected.

Reserve Bank of Australia Monetary Policy Meeting Minutes.

German Flash Manufacturing & Services PMI.

Canadian Retail Sales.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows the U.S. Dollar Index hit a 20-year high last week, in line with the long-term bullish trend, but printed an indecisive doji candlestick signaling a potential bearish reversal. This is significant as a trend reversal would have a major impact on the Forex market.

It is worth noting that the US Dollar’s long-term bullish trend has been boosted, so far, by rising inflation and interest rates. However, as the US economy comes closer to a statistical recession, the more the US Dollar may become subject to bearish pressures.

Despite the potential reversal, the Dollar gained everywhere over the week, so it remains unwise to trade Forex short Dollar over the coming week.

BTC/USD

Bitcoin fell very strongly last week in line with its long-term bearish trend. The week ended with a close at a new 18-month low and the printing of a large bearish candlestick, showing a decline in value of more than 30%.

These are very bearish signs, and there has been panic in the crypto sector due to the collapse of certain stablecoins such as Luna/Terra. This helps the bearish case. Even worse, we are beginning to see crypto exchange refuse withdrawal requests, suggesting there will be corporate collapses and lawsuits galore.

It looks like Bitcoin is likely to keep falling, as it is showing strong downwards momentum and trading in “blue sky.” The price could easily reach the $13k area very soon, meaning a short here could still be an interesting trade.

The price chart below shows that $13,788 looks like the technical support level which might signify a full bursting of the Bitcoin bubble.

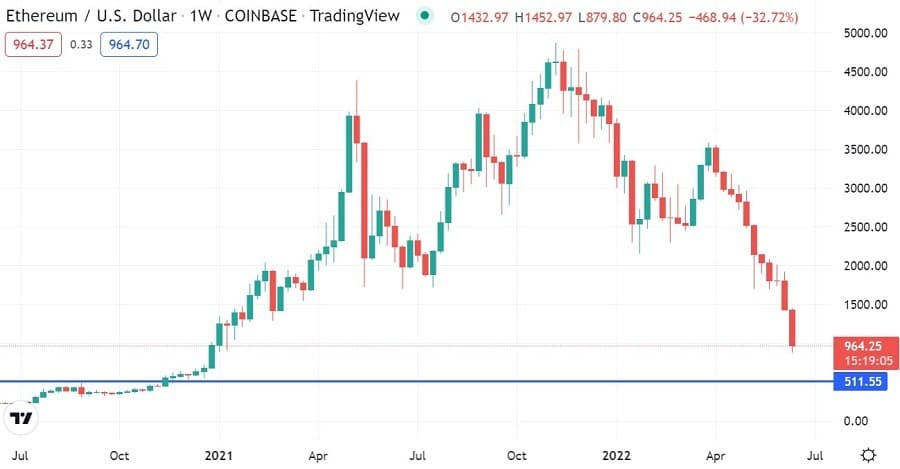

ETH/USD

Ethereum fell very strongly last week in line with its long-term bearish trend. The week ended with a close at a new 18-month low and the printing of a large bearish candlestick, showing a decline in value of more than 32%.

These are very bearish signs, and there has been panic in the crypto sector due to the collapse of certain stablecoins such as Luna/Terra. This helps the bearish case. Even worse, we are beginning to see crypto exchange refuse withdrawal requests, suggesting there will be corporate collapses and lawsuits galore.

It looks like Ethereum is likely to keep falling, as it is showing strong downwards momentum and trading in “blue sky.” The price could easily reach the $512 area very soon, meaning a short here could still be an interesting trade.

The price chart below shows that $512 looks like the technical support level which might signify a full bursting of the Ethereum bubble.

USD/JPY

The USD/JPY currency pair dropped quite sharply but then rose firmly to recover most of its losses after the Bank of Japan signaled no change in its very dovish, inflationary monetary policy. Volatility and momentum are unusually strong, which supports the case for a further rise in the price, which made another new 20-year high earlier in the week.

We have a “perfect storm” here dominating the Forex market, with the US Dollar the strongest major currency with long-term strength behind it as the Federal Reserve implemented an exceptionally large rate hike of 0.75% last week. Meanwhile, the Japanese Yen is the weakest major currency and is being talked down by its central bank, the Bank of Japan, which desperately needs to reflate the Japanese economy, whose inflation remains below the target of 2%.

It is of course unclear how much further the move might run, but clear opportunities like this are rare in Forex, so trading this currency pair long is worthy of very serious consideration. USD/JPY remains a buy if we see a daily (New York) close above €135.47.

Bottom Line

I see the best opportunities in the financial markets this week as likely to be:

- Long of USD/JPY following a daily (New York) close above €135.47.

- Short of BTC/USD.

- Short of ETH/USD.