The Governor of the US Central Bank, Jerome Powell, reiterated his bank's intention to raise the pace of increasing US interest rates at any rates in order to control the bank's goal in US inflation. It reached its highest level in 40 years and is likely to increase. What Powell mentioned is a confirmation of what he mentioned previously, and accordingly, the price of the currency pair EUR/USD remained stable in its recent trading range. The price of the euro dollar is now around the 1.0582 level, and yesterday it jumped to the highest resistance 1.0605 for the currency pair since the start of trading this week.

Eurozone consumer confidence is nearing its lowest level since the pandemic's early months, as high inflation weighs on purchasing power and households fear the spillover effects of the Russian war in Ukraine. Accordingly, a monthly gauge from the European Commission showed a reading of confidence at -23.6 in June down from 21.1 in May and worse than a reading of -20.5, the median estimate in a Bloomberg survey of economists.

This was below an all-time low in April 2020 as Covid-19 swept the continent.

The war on the borders of the currency bloc and the renewed pressure on global supply chains have severely affected the Eurozone. Therefore, economic growth is expected to slow later this year - with some banks warning of a possible recession, while inflation has accelerated to more than four times the European Central Bank's 2% target. Consumer spending has held up so far, as wasteful vacations after two years of coronavirus shutdowns offset cuts elsewhere. However, there is doubt that the impulse can continue, especially as the European Central Bank prepares to raise interest rates for the first time in more than a decade.

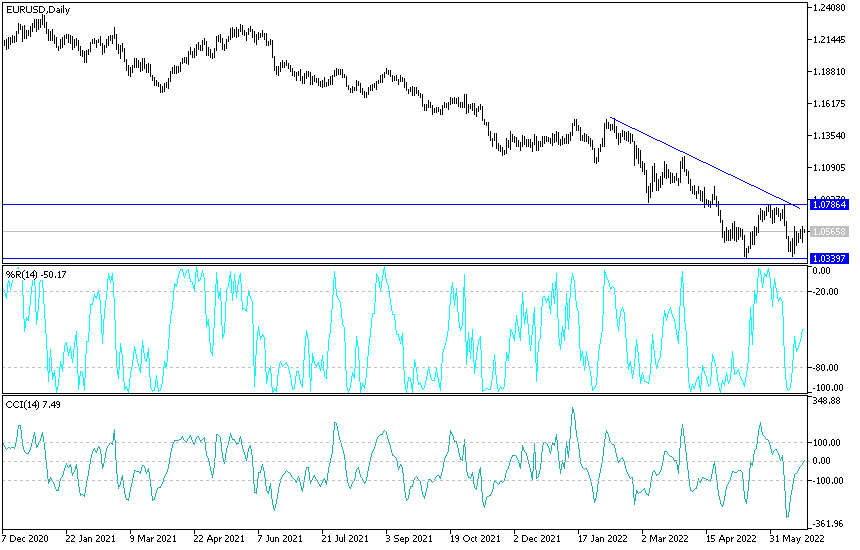

EUR/USD analysis today:

There is no change in my technical view of the price performance of the EUR/USD currency pair. The general trend is still the closest to the continuation of the decline, especially if the bears move in prices below the support level of 1.0500. I still see that the clear contrast between the future of raising interest rates by the European Central Bank and the Bank of The US Federal Reserve, as well as the continuation of the Russian-Ukrainian war, are factors that negatively affect any gains achieved by the euro-dollar pair in the coming days.

The closest targets for the bulls are currently 1.0635, 1.0700 and 1.0785, respectively. The euro dollar will be affected today by the announcement of the readings of the manufacturing and services PMI for the economies of the euro zone. From the United States, the same data, along with the number of weekly jobless claims and current account numbers, as well as the second testimony of US Federal Reserve Governor Jerome Powell.