Despite the successive statements by the monetary policy officials of the European Central Bank and the record European inflation figures that support the hints of these statements, the price of EUR/USD was exposed to profit-taking operations from the resistance level 1.0786 to the support level 1.0680 before settling around the 1.0730 level at the time of writing the analysis.

Inflation rates in Europe jumped stronger than markets once again when it rose to new highs for the month of May, proving in the process a shift in the current monetary policy stance at the European Central Bank (ECB) but also likely to add fuel to an already spirited debate. Yesterday's Eurostat figures suggested Europe's headline inflation rose from 7.5% to 8.1% this month, echoing increases announced in France and Germany during the previous session while topping the market consensus that had been eyeing annual price growth to just 7.7%.

This was higher than some professional forecasters had expected even after taking into account Monday's numbers from Germany and France. However, core inflation has risen by a smaller percentage, with the annual rate rising from 3.5% to 3.8% and in the process indicating the significant extent to which price pressures in the Eurozone are driven by largely inorganic and imported factors.

Core inflation removes the volatile prices of mostly imported commodities such as food and energy from the consumer basket, so it is seen as a better representation of domestically generated inflation pressures. Energy prices rose at an annual rate of 39.2% in May, up from 37.5%, although the food, alcohol and tobacco sector saw the second strongest increases from already high levels of inflation when it rose from 6.3% to 7.5%.

Core inflation also overlooks alcohol and tobacco prices.

However, being lower compared to the main gauge of inflation will not be comfortable for the ECB as it is close to twice the level of the identical 2% ECB target and is still rising. According to experts, the main concern is about core inflation. The jump from 3.5 to 3.8% today shows that higher input prices are being paid to the consumer at a rapid pace. While sales price expectations from companies eased slightly in May, expectations are that the underlying will remain well above target in the coming quarters as input prices continue to rise.

Yesterday's data justifies the European Central Bank's December decision to begin steadily changing its monetary policy in the direction of less stimulus calibration, although it also leaves the bank in a bind. That's because the data is effectively throwing gasoline into an already fiery board debate about how fast it should move forward.

ECB Chief Economist Philip Lane said: “I think it was important for President Lagarde to put in place a roadmap indicating the end of net asset purchases in July and the end of negative interest rates in September. And it is a strong and appropriate decision, although it is too early to know what will happen next, because it will depend on how the economy develops.” He added, “Normalization naturally focuses on moving in 25 basis point units, so 25 basis point increases at the July and September meetings are a reference pace. In a conversation with Nuño Rodrigo and Laura Salces, he added that any discussion of further moves would have to prove to move more aggressively from this sequence of rallies in July and September.

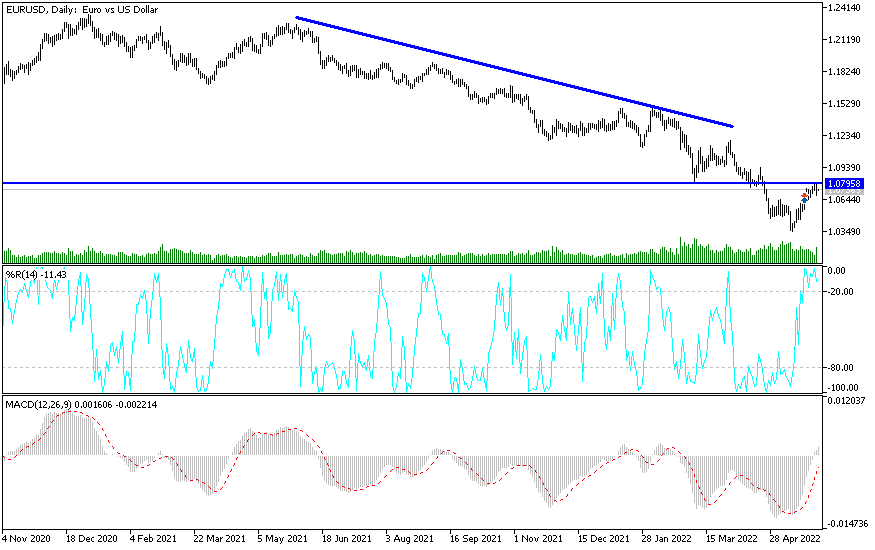

According to the technical analysis of the pair: Yesterday’s performance confirms the correctness of our expectation that the price of the euro currency pair against the dollar EUR/USD is subject to profit-taking operations at any time. The factors of the US dollar’s strength continue for a longer period and the date for the European Central to raise interest rates is not soon and the continuation of the Russian-Ukrainian war will continue hinder the euro's future gains. I still prefer to sell EUR/USD from every bullish level and the most notable current highs are 1.0785, 1.0830 and 1.0900 respectively.

On the other hand, according to the performance on the daily chart below, the bears' control will be strengthened if the support levels 1.0650 and 1.0540 are breached, respectively.