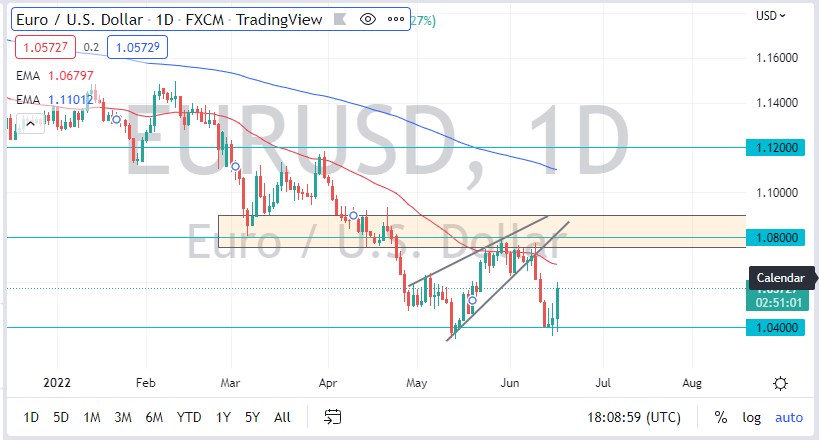

The Euro has bounced significantly from the 1.04 level during the trading session on Thursday, as the previous support level has come back in with quite a bit of “market memory” in order to stabilize a bit. At this point, the Bureau had been oversold so it does make a certain amount of sense that we would have a relief rally. Having said that, the market is more likely than not going to continue to see sellers above, so I think it’s only a matter of time before the sellers come back into the picture and punish the Euro.

Higher interest rates in the United States and a tight central bank has a lot of money flowing toward the US dollar, not the least of which is due to the fear out there. If we break down below the 1.04 level, and I do think we will eventually, that opens up the Euro for an exchange rate of 1.02 given enough time, perhaps even down to parity by the end of summer. In this environment, moves happen rather quickly, so be aware that you could see a lot of noisy behavior, but the trend is still most decisively to the downside.

The 50 Day EMA is above and tilting lower, so I think it is probably only a matter of time before that offers a certain amount of dynamic resistance that people will clamor toward, and start selling again. After that, we have the 1.08 level as a significant resistance barrier, and I think that if we were to suddenly reach that area, there’s a lot of selling between there and the 1.09 level that will have to be paid close attention to. It’s not until we break above all of that that I would consider buying this pair, despite the fact that this was a rather impressive rally. That being said, Friday can also be a bit bullish but by the time you get through the weekend, I would have to think that there will be more bad news out there that people are willing to jump on. With this, I’m civilly waiting for a candlestick that shows exhaustion and I will start shorting again once it occurs. Until then, I’m sitting on my hands and waiting for my opportunity to pick up “cheap US dollars.”