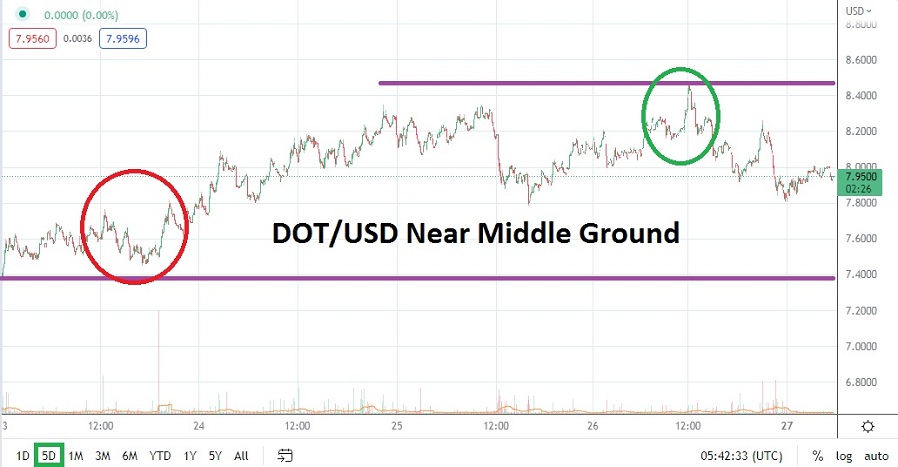

DOT/USD is traversing slightly under the 8.0000 mark as of this writing; this after coming within looking distance of 8.5000 in yesterday’s trading. Sunday’s high of nearly 8.4740 touched values not seen since the 15th of June. The abrupt selloff in Polkadot after reaching the technical high was strong and nervous conditions in the broad cryptocurrency market still exists, even after last week’s run up among many of the major digital assets.

The move lower in DOT/USD the past handful of hours is a fresh reminder that the long term bearish trend remains plainly in view. Although DOT/USD is trading in the middle of its five-day technical chart, Polkadot remains locked near long term lows which have not been challenged for a sustained amount of time since December of 2020. Traders who are looking for further downside price action only have to look at results from one week ago to see Polkadot was below 7.4000.

However the near term range of DOT/USD has seen support hold rather demonstratively near the 7.7500 mark the past handful of days. Certainly, optimistic bullish traders who believe the sun is set to come out in the world of cryptocurrency again are awaiting better upwards results, but the question is when a sustained rally will really be produced. Yesterday’s highs may have enticed some bullish speculation, but it does appear sellers were looking at yesterday’s apex junctures as a place to launch short positions.

Traders should remain cautious, the results the past week upwards in DOT/USD were solid, but the rather swift reversal seen the past handful of hours is a stark reminder fragile sentiment remains abundant. If DOT/USD cannot sustain momentum above the 8.000 in the short term, skeptics may consider support near the 7.8800 level as a target for quick hitting selling positions. If the 7.8600 ratio were to suddenly falter, the next target below would likely be the 7.7500 mark.

Bullish traders who want to be part of a renewed upwards climb in DOT/USD should not be overly ambitious. A positive move above the 8.0000 mark and a track towards the 8.1000 level would be good, but not a sign of a vast recovery in Polkadot. Until DOT/USD sustains strong price velocity upwards and breaks through the 8.5000 level – which it clearly did not do yesterday – Polkadot remains in a bearish grip, and could be considered a selling opportunity when brief reversals higher have been attained.

Polkadot Short-Term Outlook

Current Resistance: 8.1050

Current Support: 7.8600

High Target: 8.3700

Low Target: 7.6100