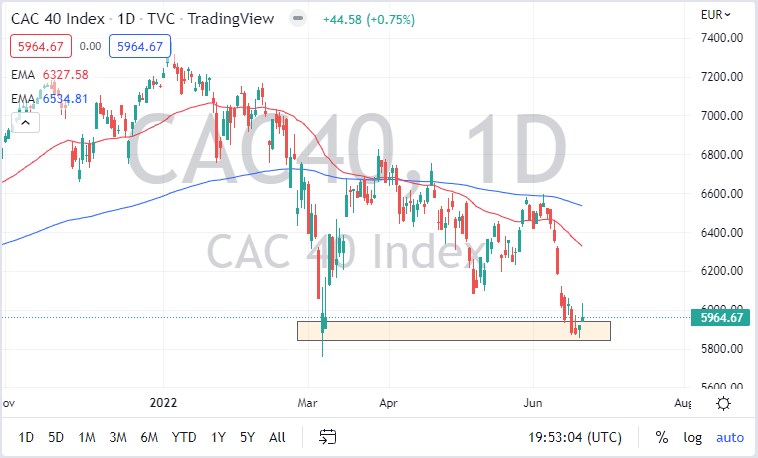

The French markets rallied initially on Tuesday to reach the €6000 level, but the CAC could not hold on to the gain. This was seen across the board, as initially risk appetite returned on Tuesday, but was given back rather quickly. It’s interesting that this happened, as we have just formed a “double bottom” just below. If that bottom gets broken, that could open up massive selling in the CAC, as well as be a sign that even more trouble is on its way for stock markets in general. The European Union of course will be very sensitive to the CAC as it is the second-largest market.

On the upside, the €6100 level did offer a bit of resistance, but if we were to break above the top of the candle from Tuesday, that would extensively turn it into an inverted hammer, which can be a bullish sign. At that point, I would anticipate that the CAC would try to get to the €6200 level, perhaps even as high as the 50-day EMA. That being said, it is difficult to imagine a scenario in which European stocks suddenly take off, because there have been comments here and there from the ECB about possibly tightening, and even if that weren’t the case, there are a lot of concerns when it comes to growth and energy.

On a break down below the double bottom, I think we have a real shot at going down to the €5500 level over the longer term. The stock markets in general around the world look very miserable at the moment, so I just don’t see how this will change. Given enough time, three likely that we see them all move in the same direction, and that is going to be lower. There are concerns about recession around the world, and France is no different.

Keep in mind that the French index has a lot of exposure to luxury goods, so it needs people out there willing to spend on luxury goods. In a recessionary environment, those are normally the first things to get thrown out, although it should be noted that the ultra-wealthy do tend to survive quite well. It will be a case-by-case basis, but overall it should bring down the index if we do in fact see growth get hit.