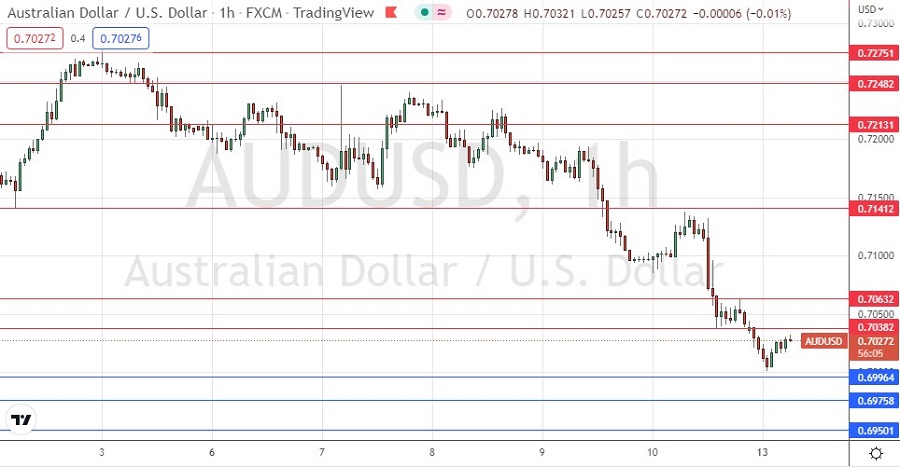

My previous signal on 7th June was not triggered, as there was no bearish price action when the resistance level which I identified at 0.7213 was first reached.

Today’s AUD/USD Signals

Risk 0.75%

Trades may only be taken prior to 5pm Tokyo time Tuesday.

Short Trade Ideas

- Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7038 or 0.7063.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

- Long entry following a bullish price action reversal on the 1H1 time frame H1H1H1 time frame immediately upon the next touch of 0.6995, 0.6976, or 0.6950.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

I wrote in my previous forecast on 7th June that this pair was trading in a choppy, wide range, making trading unpredictable except when fading price extremes. This would point to a long trade from a bullish bounce at 0.7143 or a short trade from a bearish reversal at 0.7275. I recommended waiting for two consecutive higher hourly closes above the resistance level at 0.7213, and then enter a cautious long trade if you want to trade this currency pair today. This was not a good call as it led to a losing trade.

The technical picture and markets in general have moved quite dramatically since then, with risk-off sentiment coming to dominate after US CPI data last week showed a shock rise to an annualized rate of 0.75%. This sent the US Dollar higher and risk assets falling, and the AUD is a major risk asset, so the price here has come down heavily.

A few hours ago, we saw the price hit the big round number at 0.7000 and make a bullish bounce there. For how long this low will hold, is anyone’s guess – I suggest not to have any faith in it until the price gets established above at least 0.7038 or ideally 0.7063.

A short trade from a strong bearish reversal at 0.7063 is likely to be the best opportunity which might set up here today, as it is unlikely that we are going to see anything happen which really changes the risk-off sentiment currently dominating markets.

There is nothing of high importance scheduled today regarding either the AUD or the USD.