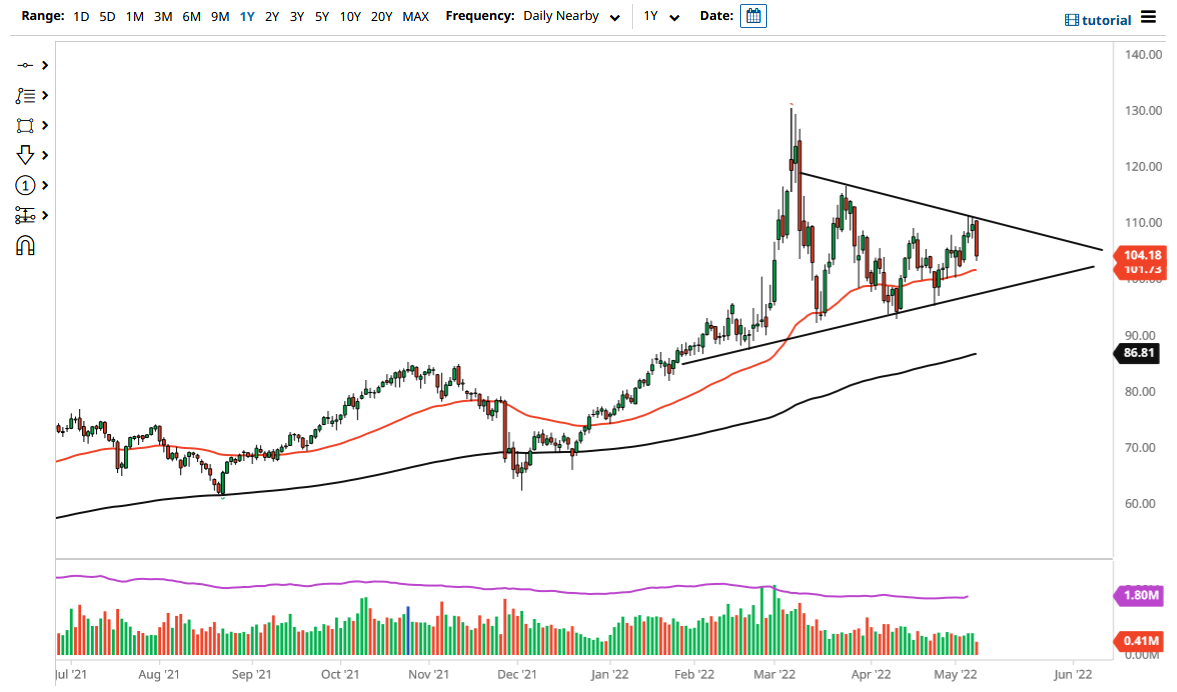

The West Texas Intermediate Crude Oil market pulled back a bit on Monday as we continue to see a lot of volatility in the markets overall. The $110 level continues to be a bit of a barrier, but so does the downtrend line in this massive triangle that I have drawn on the chart. Because of this, I think we will continue to see more choppy behavior than anything else.

Underneath, the 50-day EMA continues to offer support, and I think at this point it is only a matter of time before we see buyers come back into this market somewhere near there. Underneath, the uptrend line comes into the picture to offer support as well, so I think this is a market that will continue to be very noisy, but there are plenty of buyers underneath that should step in given half a chance. That being said, it is also worth noting that there are a lot of concerns when it comes to whether or not there is going to be a lot of demand, as the global economy seems to be slowing down. With that being said, the oil demand could drop, but as things stand right now, I still believe that we have more upward momentum than down.

Because of this, some type of pullback that shows signs of support will be used as an entry as far as I can tell. I think the 50-day EMA also shows the overall attitude of the market quite nicely, as we continue to see a lot of supply and demand disruptions in both directions depending on which part of the world, and then whether or not the economic activity is going to pick up.

There is a slightly negative influence on this market due to a stronger US dollar, but at the end of the day, that is a relatively minor factor. If we can finally break above the $110 level, then it is likely that we could send this market to much higher levels, perhaps the $120 level. The action on Monday shows that it will not be easy to make that happen. Alternately, if we were to break down below the $98 level, I think that could open up quite a bit of selling pressure.