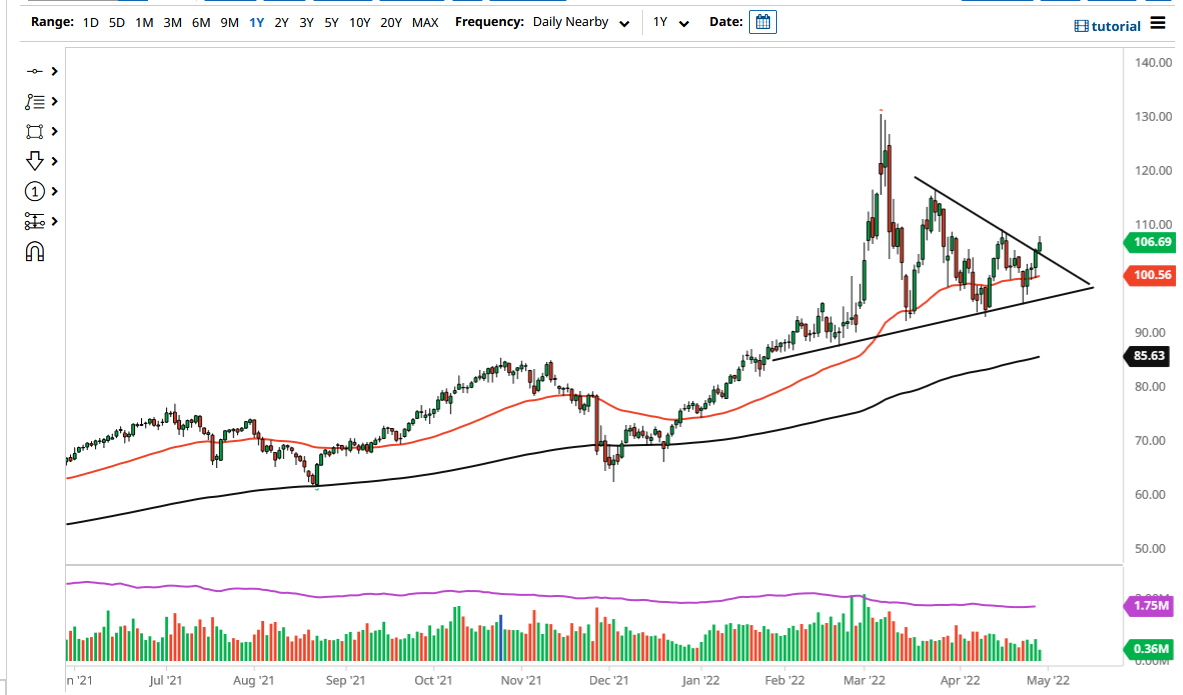

The West Texas Intermediate Crude Oil market rallied a bit during the Friday session to break above the $105 level. That being said, the market looks as if it has broken above a major downtrend line that formed the massive triangle that I have been paying close attention to. Ultimately, this is a market that looks as if it is trying to break out to the upside even further, perhaps testing the $110 level.

If we were to break above the $110 level, then the market could go looking to reach the $115 level, maybe even the $120 level. I suppose that it is worth noting that we have given back quite a bit of the gain during the session, but it is clear that crude oil continues to try everything it can to rally and break out. Just as noteworthy is that the 50-day EMA sits at the $100 level and is rising. It has acted as dynamic support recently, so that comes into the picture as well.

The market breaking down below the 50-day EMA could be an issue, and if we were to break down below there, then the market will try to reach the uptrend line of the triangle. Breaking down below there would change everything, but right now it certainly does not look as if we can have that happen anytime soon, so with that being the case I think it is only a matter of time before the market finds buyers on any dip. The biggest concern at this point is that the supply of Russian oil has been cut off, and therefore we will continue to see a bit of bullish pressure.

The only thing that I think you can guarantee at this point is that we are going to be very choppy, just as we have seen multiple times. At this juncture, the market will eventually have to make up its mind, but it certainly looks as if Friday was a serious attempt to make a move to the upside and it will more than likely continue to attract buyers. One of the main reasons why we pulled back was probably more or less due to the weekend coming and people willing to take profit heading into it.