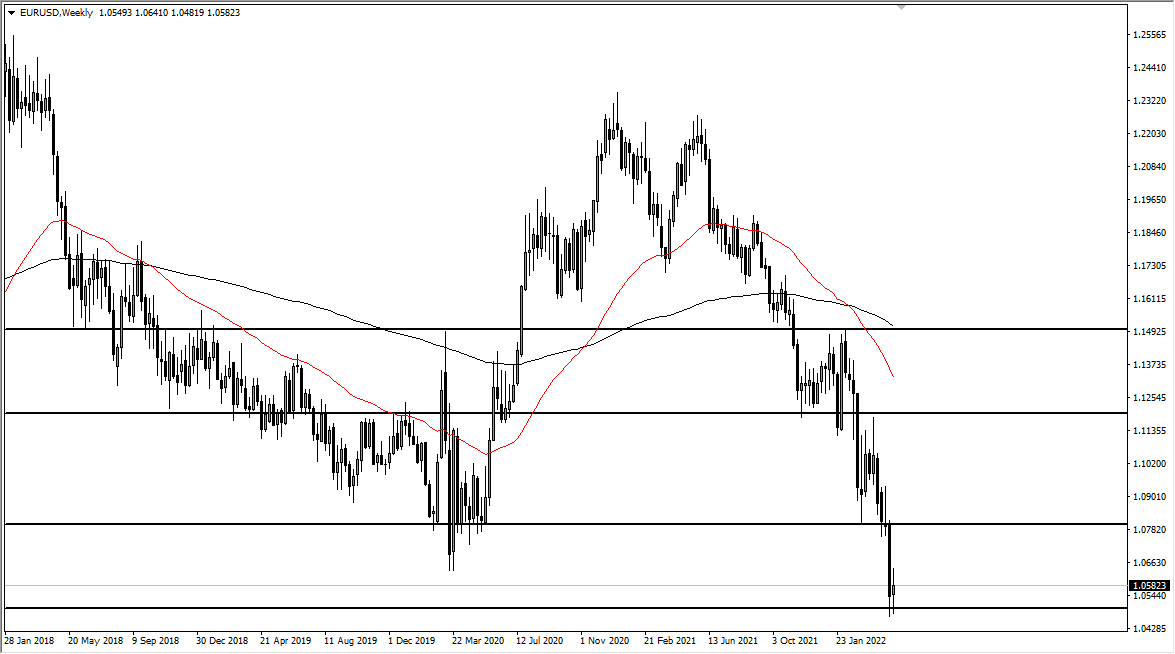

EUR/USD

The euro went back and forth last week as the 1.05 level continues to offer support. That being said, the market looks as if it is going to continue to be very noisy, and will pay close attention to that 1.05 level. The 1.05 level is an area where we have seen a lot of support underneath, and therefore I think we are looking at a situation where the market breaking down below there could kick off more selling, but I believe it will more likely than not be difficult to break through. The most likely scenario is a short-term rally that will sell off the closer we get to the 1.08 level.

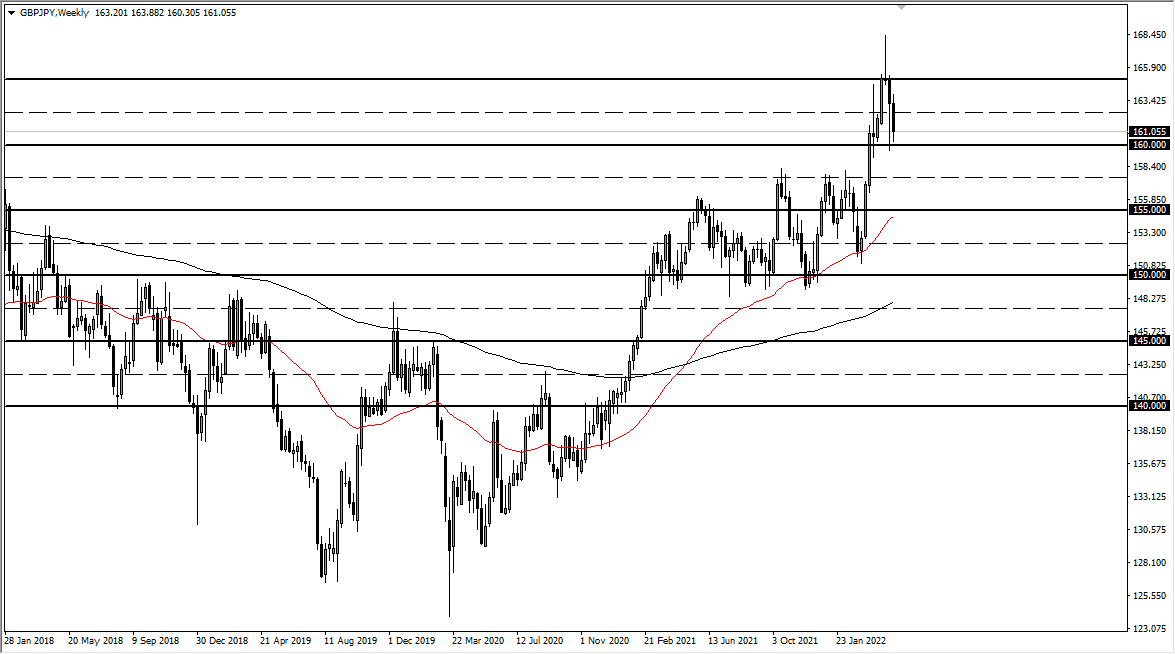

GBP/JPY

The British pound continues to sell off in general, but this particular pair is going to be a little bit different due to the fact that the Bank of Japan continues to fight higher interest rates in that country. As long as that is going to be the case, the British pound has at least a chance of staying bullish. However, the Bank of England has stated that they expect a recession, so if you are looking to capitalize on the weak Japanese yen trend, you may want to do it in other pairs. Alternately, if we see this market break down below the ¥159 level, it is very likely that we will drop it a couple of hundred pips.

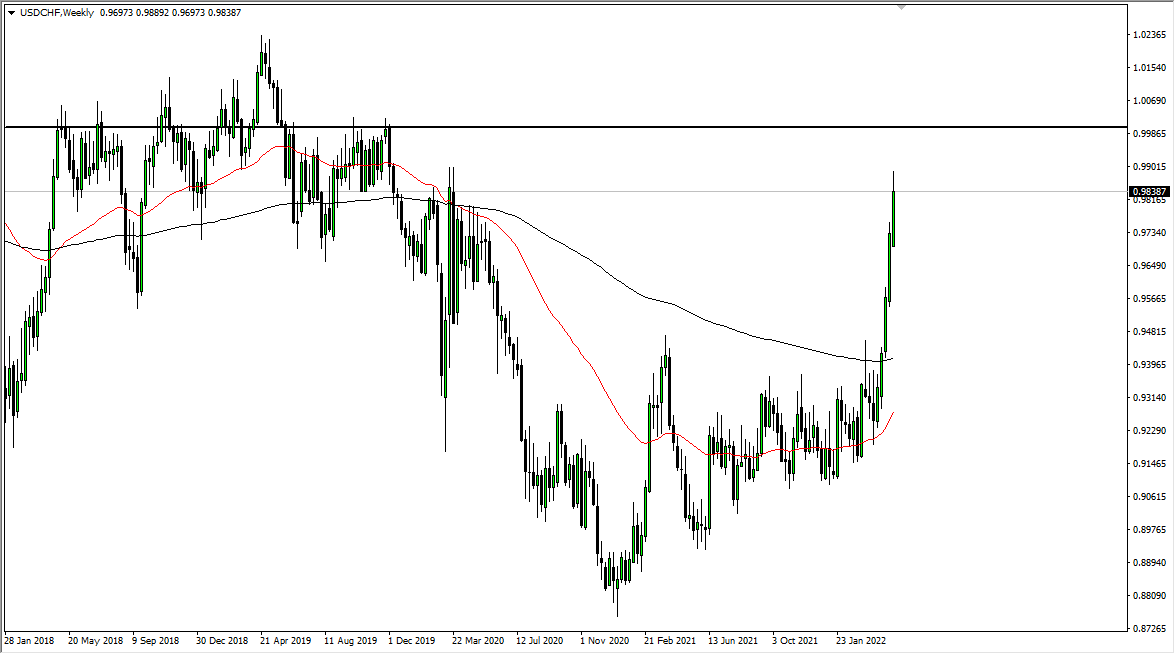

USD/CHF

The US dollar has rallied for the last month relentlessly against the Swiss franc. This will more likely than not continue to be the case, but we are getting a bit overstretched. I would anticipate a short-term pullback this coming week, with buyers coming back in to pick up the market. Longer term, it is very likely that we will go looking to reach the parity area, which will attract quite a bit of attention in and of itself.

NZD/USD

The New Zealand dollar went back and forth last week but is a bit overextended to the downside. What is worth noting is that we ended up forming a bit of an inverted hammer, so it is likely that we will eventually find sellers on short-term rallies. Any sign of exhaustion on a short-term chart I will be shorting, and I do believe that it is likely that we will try to get down to the 0.63 level.