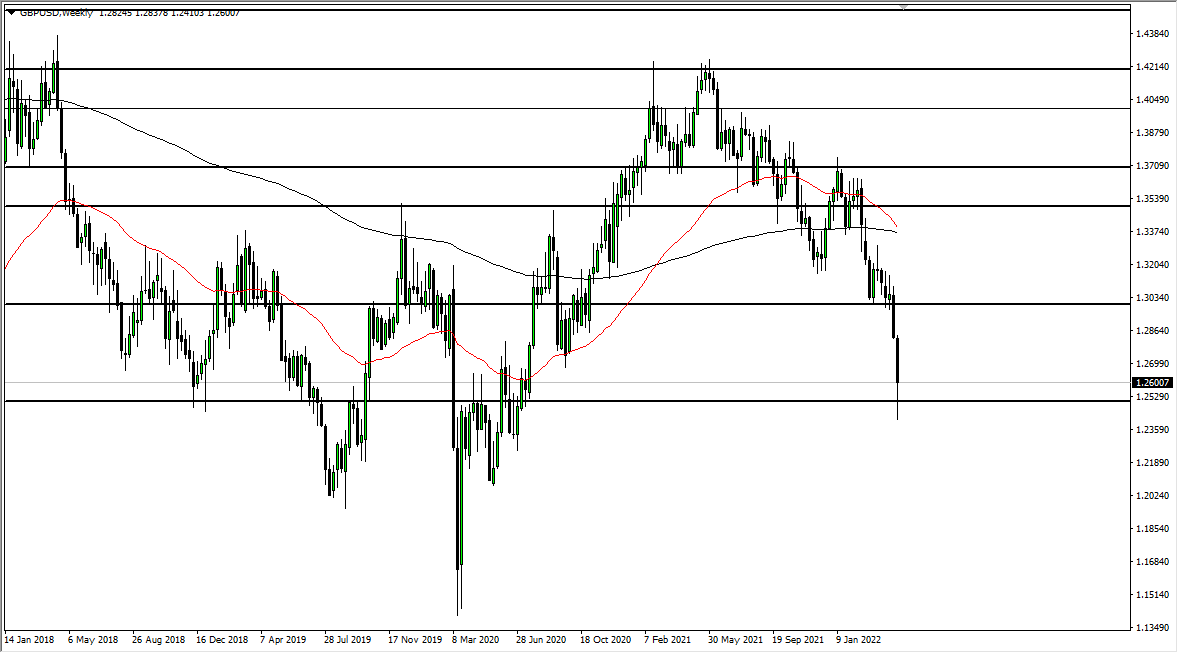

GBP/JPY

The British pound broke down significantly last week, reaching down to the ¥160 level. The ¥160 level is an area that is a large, round, psychologically significant figure, and the fact that we bounced from there should not be a huge surprise. The question now is whether or not we can break above that massive shooting star from the previous week? I suspect we cannot, at least not anytime soon. In the short term, I think we are simply going to go back and forth between the ¥160 level on the bottom and the ¥165 level on the top.

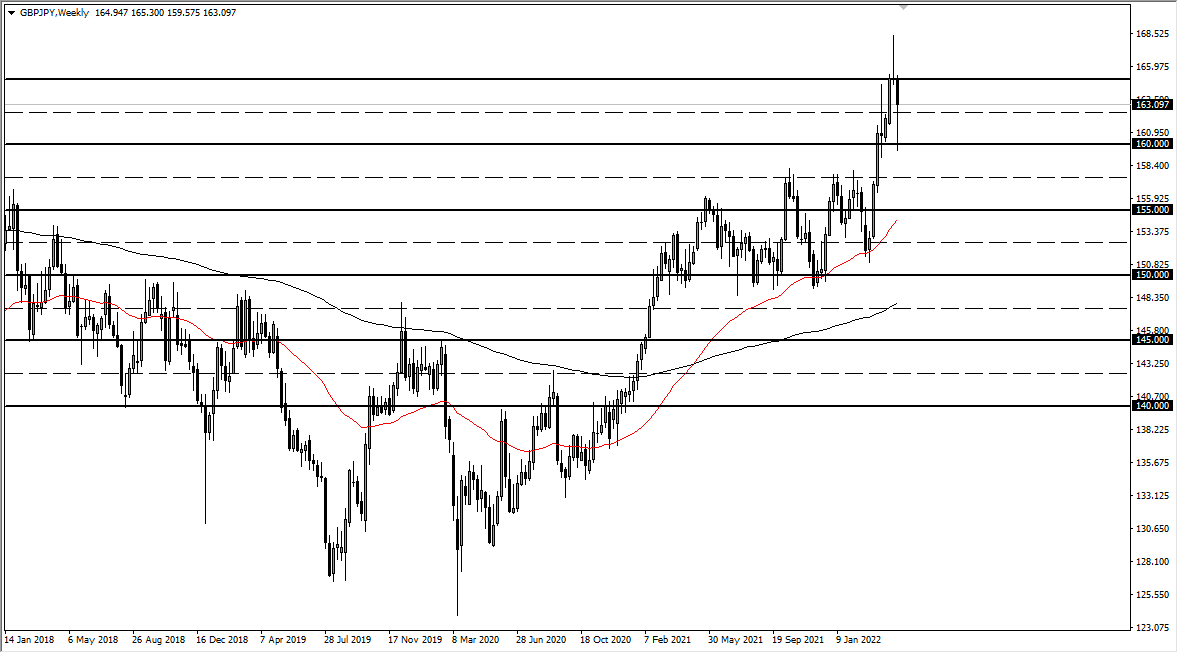

USD/JPY

The US dollar has been all over the place against the Japanese yen, as we had broken above the ¥130 level. However, we have pulled back a bit to form a bit of a neutral candlestick, and in fact, it almost looks as if a shooting star is being formed. Ultimately, the ¥127.50 level should be supported, but if we break down below there, then it is likely that we will pull back to the ¥125 level. This is an overbought market, so a corrected pullback should be expected. This will more often than not end up being a nice buying opportunity.

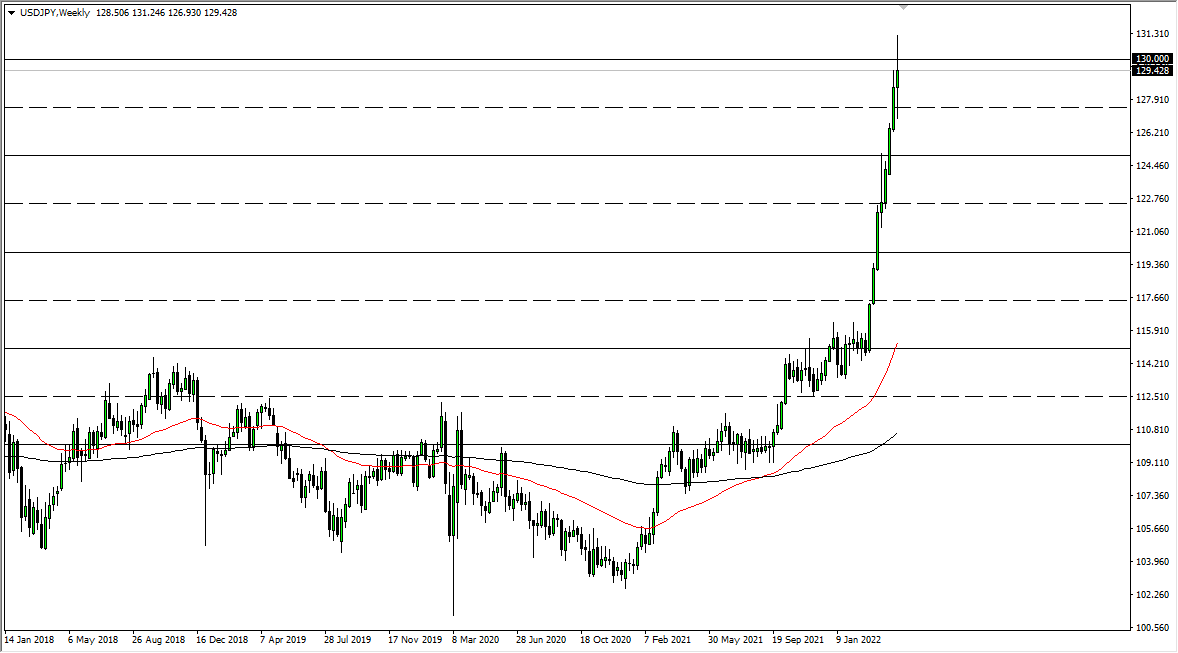

EUR/USD

The euro broke own significantly during the week, dropping down to the 1.05 level. The 1.05 level is a large, round, psychologically significant figure. Because of this, the market turned around and showed signs of life, and I think that if we do continue to rally as we did on Friday, it is likely that we will jump in and start shorting. The 1.08 level above is a massive resistance barrier, so I think plenty of selling pressure will jump in if we get anywhere near there. That being said, rallies are going to continue to be sold, but you should pay close attention to the 1.05 level, as it is a major barrier on longer-term charts.

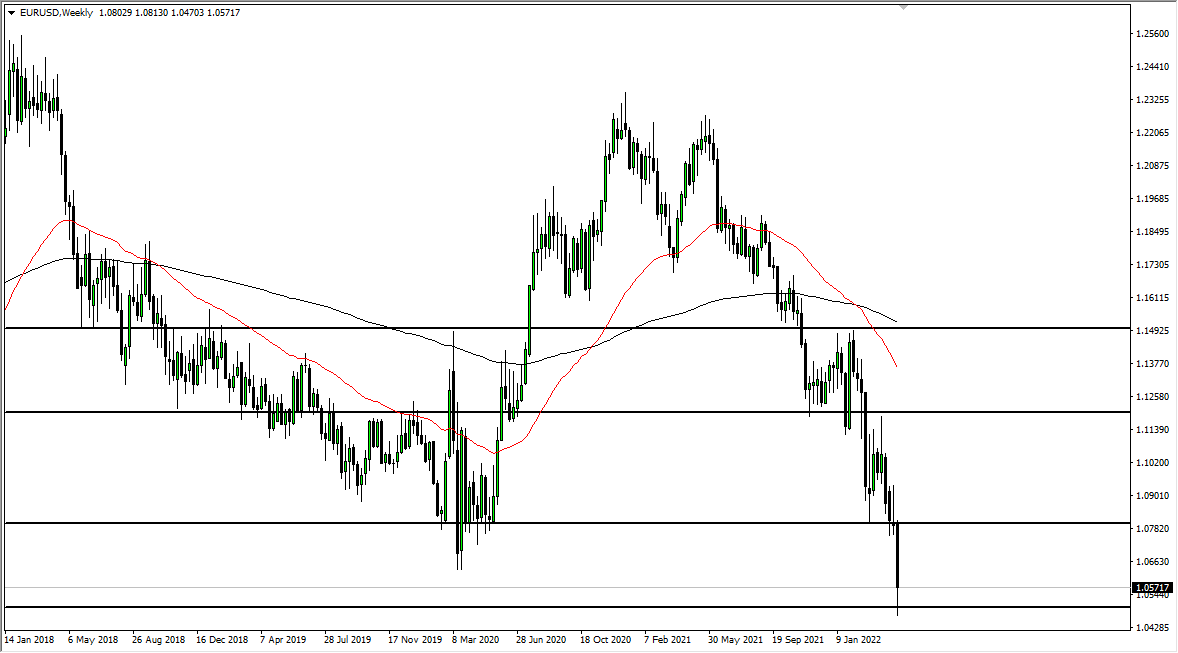

GBP/USD

The British pound also broke down against the US dollar during the week, breaking to the one point to zero level. The one point to zero level is an area that will attract a certain amount of attention, so it should not be a huge surprise that we have found a bit of a bounce here. I think any time we rally at this point, the sellers will come in and start pushing the market back down. I would expect a little bit of a recovery, but it will be short-term at best.