Today's recommendation on the lira against the dollar

- Risk 0.50%.

Yesterday's sell recommendation was activated and it is still trading

Best entry points buy

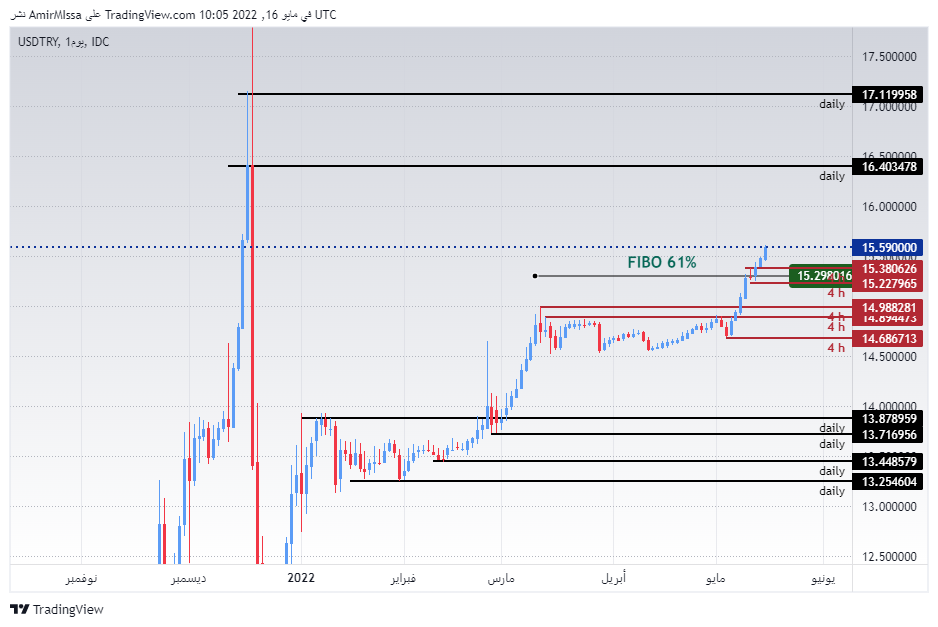

Entering a long position with a pending order from 15.29 . levels

- Set a stop loss point to close the lowest support levels 15.15.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the strong resistance levels at 15.05.

Best selling entry points

Entering a short position with a pending order from 16.00 . levels

- The best points for setting the stop loss are closing the highest levels of 16.11.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the support levels 15.58

The Turkish lira continued its free fall against the dollar, as it fell for the third day in a row. Reports issued at the end of last week showed that the lira is declining under the supervision of the Turkish Central Bank, which no longer has many tools to limit the lira's decline, especially with the continuous rise of the US dollar after reaching its highest level in twenty years during last week's trading. In the meantime, many of the decisions adopted by Turkish President Recep Tayyip Erdogan did not succeed in stabilizing the price of the lira against the dollar, especially with the Turkish president's insistence on reducing the interest rate despite the international central banks keeping pace with the Federal Reserve in raising the interest rate. It is noteworthy that a report published via Reuters showed the distress that the Turkish Central Bank is experiencing in the volume of hard currency reserves, which leads to the exclusion of the Central Bank's direct intervention by pumping more dollars into the markets.

On the technical front, the Turkish lira fell against the dollar during today's early trading, as the pair continued to rise above the moving averages 50, 100 and 200, respectively, on the four-hour time frame as well as on the 60-minute time frame. At the same time. The pair is also trading the highest support levels, which are concentrated at 16.30 and 15.10 levels, respectively. On the other hand, the lira is trading below the resistance levels at 16.00 and 16.40. At the moment, the pair has crossed 15.29 levels, which represents the 61 Fibonacci level of the descending wave that recorded its top on 12-12-2021 and recorded its bottom on 12-23-2021. If the pound's current decline continues, the way is open to reach 16.63 levels, which it recorded at the end of last year, as it is the first major resistance level. Please adhere to the numbers in the recommendation with the need to maintain capital management.