Today's recommendation on the lira against the dollar

Risk 0.50%.

I was not active in the buy or sell trades of yesterday's recommendation

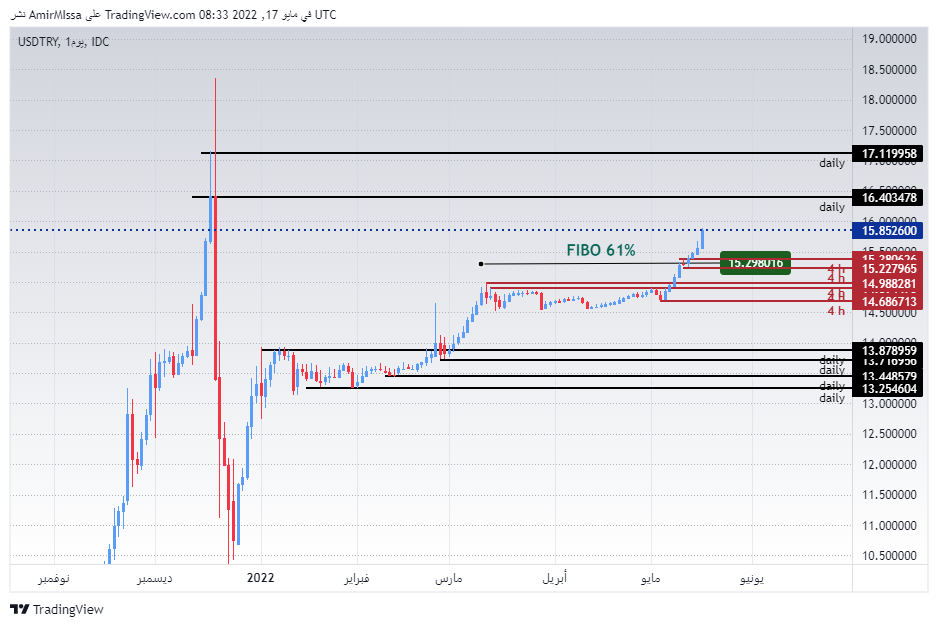

Best entry points buy

- Entering a buy position with a direct order from the current levels 15.85

- Set a stop loss point to close the lowest support levels 15.65.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the strong resistance levels at 16.05.

Best selling entry points

- Entering a short position with a pending order from 16.00 . levels

- The best points for setting the stop loss are closing the highest levels of 16.11.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the support levels 15.58

The Turkish lira continues to fall against the dollar without any significant correction. Analysts suggest that the Turkish Central Bank has largely lifted its hand from the movement of the lira, especially with the combination of a few factors that forced it to do so. The most important of which is the lack of tools and solutions available in the hands of the bank in light of the administration’s adherence. The policy is not to raise the interest rate, which has been fixed since late last year. The decline in the Turkish Central Bank's real reserve deterred the bank from intervening in the currency market, as it dumped more billions in the markets, which may end the already flailing cash reserve. Finally, the bad data, the latest of which was the rise in Turkey's current account deficit, widened in March to $5.554 billion. The rise in the prices of energy imports raises concerns about the possibility of Ankara controlling inflation. This prompted traders and dealers in the local market to expect a major collapse in the price of the lira amid a question about the government's ability to defend the levels of 16 pounds per dollar, as Reuters published in a report yesterday.

On the technical front, the Turkish lira fell strongly against the dollar, as the pair continued to rise above the 50, 100 and 200 moving averages, respectively, on the four-hour time frame as well as on the 60-minute time frame. The pair is also trading the highest support levels that are concentrated at 15.30 and 15.10, respectively. On the other hand, the lira is trading below the resistance levels at 16.00 and 16.40. At the moment, the pair has crossed 15.29 levels, which represents the 61 Fibonacci level of the descending wave that recorded its top on 12-12-2021 and recorded its bottom on 12-23-2021. If the pound's current decline continues, the way is open to reach 16.63 levels, which it recorded at the end of last year, as it is the first major resistance level. Please adhere to the numbers in the recommendation with the need to maintain capital management.