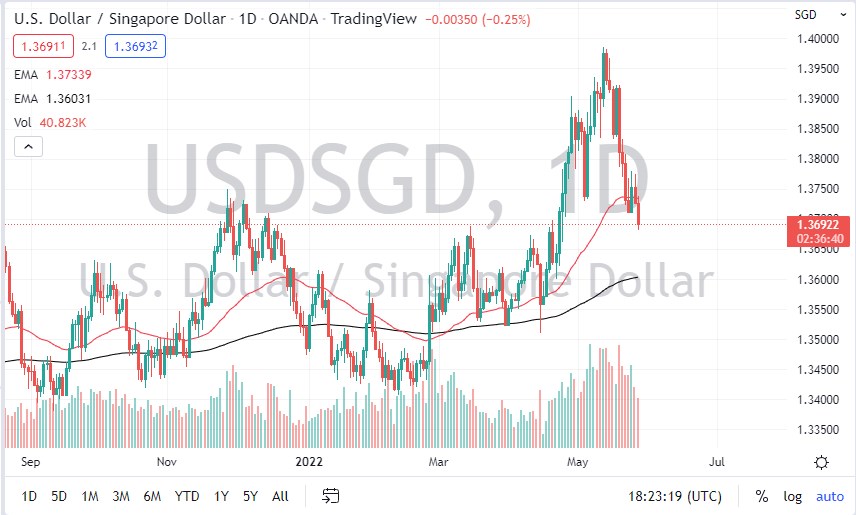

The Singapore dollar was strong against the US dollar over the last several days. As we are now breaking below the 1.37 level at this point, the market is likely to continue finding momentum a major problem. The area that we are in now was previous resistance, so it could be supported. It will be interesting to see what happens - it seems that the Singapore dollar has been resilient even though the US dollar strengthened a bit later in the session on Friday.

The 50-day EMA is now above, and now that we are below that area, it’s possible that we will see the market start to focus on the fact that it is sandwiched between the 50-day EMA and the 200-day EMA indicators. When that happens, a lot of times you see a squeeze. I don’t know that’s going to happen quite yet, but it is worth noting that we had gone higher in a parabolic way, so it makes sense that we would see this pullback. The question now is whether or not we can find some type of support?

It is worth noting that we did see the US dollar fight back late in the day against other currencies, so one could anticipate that we could see it here as well. However, I would need to see this market close above the 1.3750 level on a daily close to be comfortable going long. If we do get that, then I think we will probably go back toward the recent highs that we had just made near the 1.40 level.

On the other hand, if we do continue to go lower, once we break down below the 200-day EMA, it sets up a technical bearish move, and it is likely that we will go much lower. The 1.36 level is where that indicator currently sits, so it’ll be interesting to see how that plays out. In this scenario, you will need to look at other currency pairs to see what’s going on with the US dollar before you can make some type of educated decision over here. Because of this, you probably have plenty of time to make a decision, but that’s typically how the Singapore dollar moves anyway. A little bit of patience may go a long way, but we are entering a zone of interest.