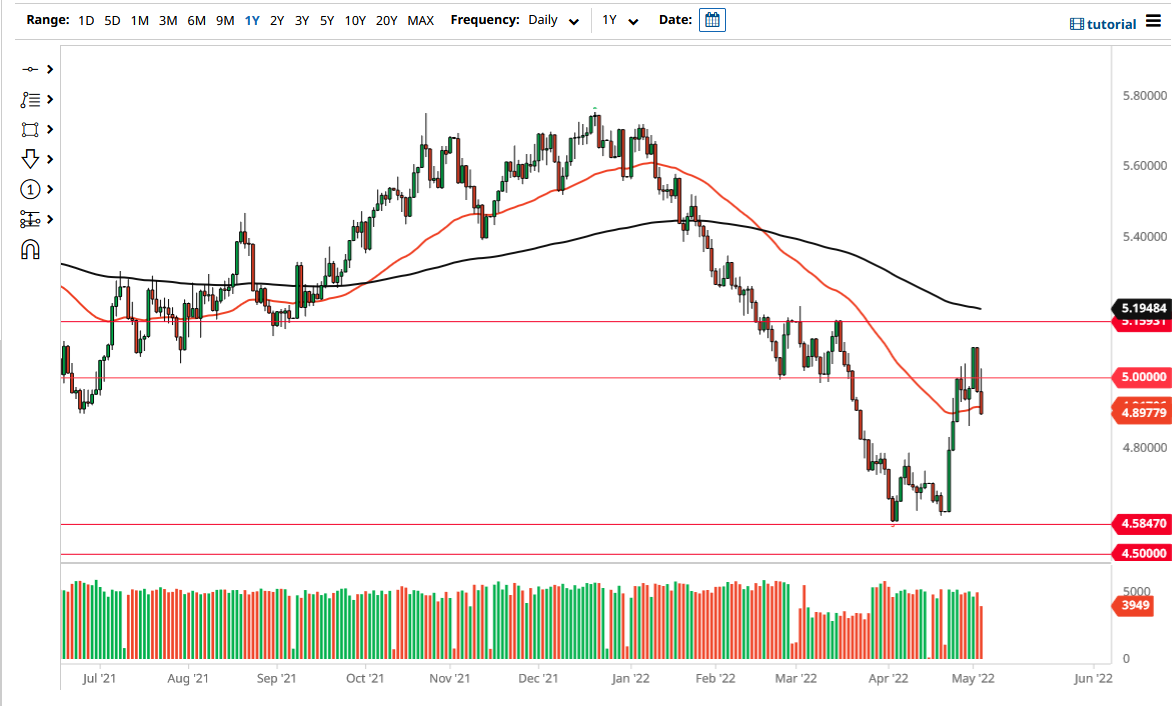

The US dollar rallied to break above the 5.00 BRL level on Wednesday but gave back a little bit of the gains. It was the Federal Reserve statement day, so is not a huge surprise to see that the market was somewhat all over the place. That being said, it is worth noting that the area above 5.00 extends resistance to the 5.20 level. Quite frankly, this is an area that I think is going to be crucial for the directionality of the market going forward.

Looking at this chart, you can see that the 50 Day EMA sits just below and should offer a bit of support. This would be an indicator that a lot of people are following, just as the 200 Day EMA above could offer a bit of resistance. With that being said, it is another reason to think that there is going to be a lot of noise just above. However, I also think that there is a significant amount of support. The market does not know what to do at the moment due to inflationary problems, and of course, concerns about global growth. If we are going to have problems with global growth, then it stands to reason that the US dollar might be one of the first places that people run to. This will be especially true when it comes to a currency like the Brazilian real, which is an emerging market currency.

If we were to break down below the hammer from Friday, that would be a negative sign, perhaps allowing the pair to fall to the 4.80 area, where we had previously seen a bit of resistance. In that scenario, I think you would see US dollar weakness across the board, not just against this currency. Keep in mind that Brazil represents emerging markets, Latin America, and of course soft commodities. With all that being said, pay attention to all of those markets to get an idea of how the Brazilian real may trade. I think that we have a lot of noise ahead of us, but quite frankly with all of the concerns around the world, it does make a certain amount of sense that we would see the US dollar continue to at least attract attention.