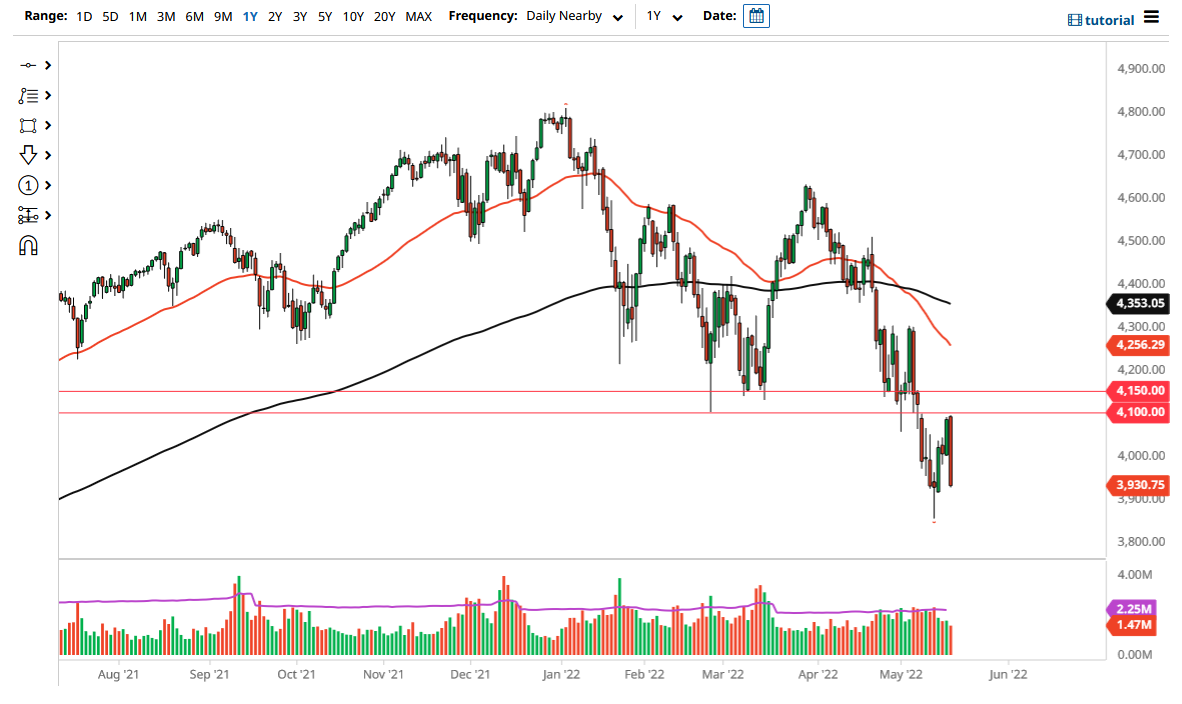

The S&P 500 pulled back rather drastically on Wednesday as the negative pressure continues to be drastic. The markets are finally coming to grips with the idea that the Federal Reserve is not there to save them. It has been quite a ride, but at this point, we look ready to meltdown. Ultimately, if we break down below the hammer from last week, that opens up the floor for significant downward pressure. The S&P 500 has a lot of risks built into it, and I think it is likely that we will continue to see people bail on the markets.

Any rally at this point will be looked at with suspicion, as the earnings season is starting to look rather ugly for retailers, which suggests that the consumer is not going to be there to bail things out. Without the ability to drum up a narrative, this suggests that Wall Street has a lot of pain ahead of it. The size of the candlestick is rather impressive, and I think we will probably have some follow-through. Any rally at this point in time is an invitation to start shorting again.

Whether or not we can find buyers is a completely different question, because you would have to be very brave to get involved at this point. In fact, we need to break above the top of the candlestick to even think about the idea of buying. That being said, these types of candlesticks almost never happen in a vacuum, so I would anticipate quite a bit of follow-through. It is also worth noting that the later we got through the day, the more selling came into the picture. As the US is heading into a recession this year, it is difficult to imagine a scenario where people want to start buying stocks. Yes, there will be the occasional rally, and it could even be a very bullish move. However, those are short-lived, as we have just seen over the last week or so. Speaking of the last week or so, the Wednesday candlestick just wiped out most of the gains from that same timeframe. 3850 is a real potential target at this point, opening up the possibility of even further downward pressure going forward.