With the beginning of this week's trading, which was mostly quiet due to an American holiday, gold futures rose to the level of 1864 dollars an ounce. Gold's gains were supported primarily by the weakness of the US dollar and the mixed performance of US Treasury bond yields. In general, gold prices are looking to maintain their meager monthly gains and ensure that they remain positive during the year.

The question now is: Can the price of gold return to $1,900 an ounce this summer?

The price of gold is emerging from a weekly rise of about 0.6%. It's on track for a 0.05% monthly increase, taking its 2022 year-to-date jump to nearly 2%. The price of silver, the sister commodity of gold, is trying to stay above the level of $ 22 an ounce and the price of the white metal is enjoying a weekly rise of 1.3%, but it will end the month down by nearly 3%. Since the beginning of 2022 to date, silver prices have fallen by more than 5%.

Ahead of the important US jobs numbers, the US Dollar Index (DXY), which measures the performance of the US currency against a basket of other major currencies, fell to 101.49, from an opening at 101.67. The DXY was not bearish heading into the end of May, but it is down more than 2%. However, the index is up about 6% so far this year. A weaker dollar is good for dollar-priced commodities because it makes them cheaper to buy for foreign investors.

The US Treasury market ended last week with mixed results, with the 10-year yield falling 1.5 basis points to 2.743%. One-year yields rose 2.3 basis points to 1.998%, while 30-year yields fell 2 basis points to 2.972%. The price of gold is usually sensitive to a price appreciation environment because it increases the opportunity cost of holding bullion that is not yielding.

With the US central bank's main inflation gauge - the personal consumption expenditures (PCE) price index - showing signs of slowing, there is an expectation that the Fed may slow the cycle of quantitative tightening by only going ahead with a quarter-point hike in US interest rates after September. The global inflation trajectory will be beneficial for gold prices in the short term because inflation will remain high while interest rate hikes will not be as aggressive. The US holiday also reduced trading volumes, supporting gold on the rise.

In other metals markets, copper futures rose to $4.3455 a pound. Platinum futures rose to $948.30 an ounce. Palladium futures fell to $2,034.50 an ounce.

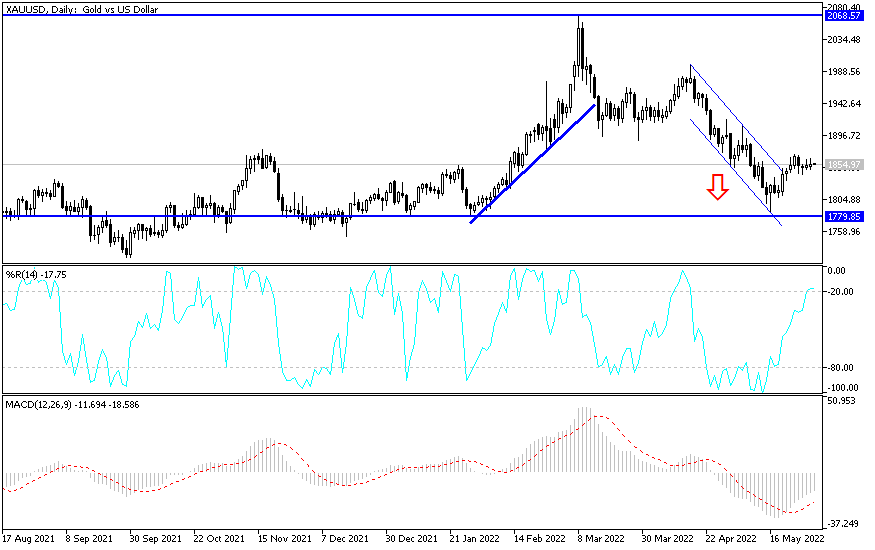

According to the technical analysis of gold: on the daily chart, the price of gold is still in a neutral position with an upward tendency. As mentioned before, the bulls’ control over the general trend will be strengthened if the gold price moves towards the resistance levels of 1878 and 1900 dollars per ounce, respectively. This may be possible and strongly in the event Global geopolitical tensions increased, led by the consequences of the continuation of the Russo-Ukrainian war. In addition to the halt in the dollar's gains and the calm tone of global central banks towards tightening their policy.

On the other hand, the bears will return to control the direction of gold if prices move towards the support levels of 1838 dollars and 1820 dollars an ounce, respectively. I still prefer buying gold from every bearish level.