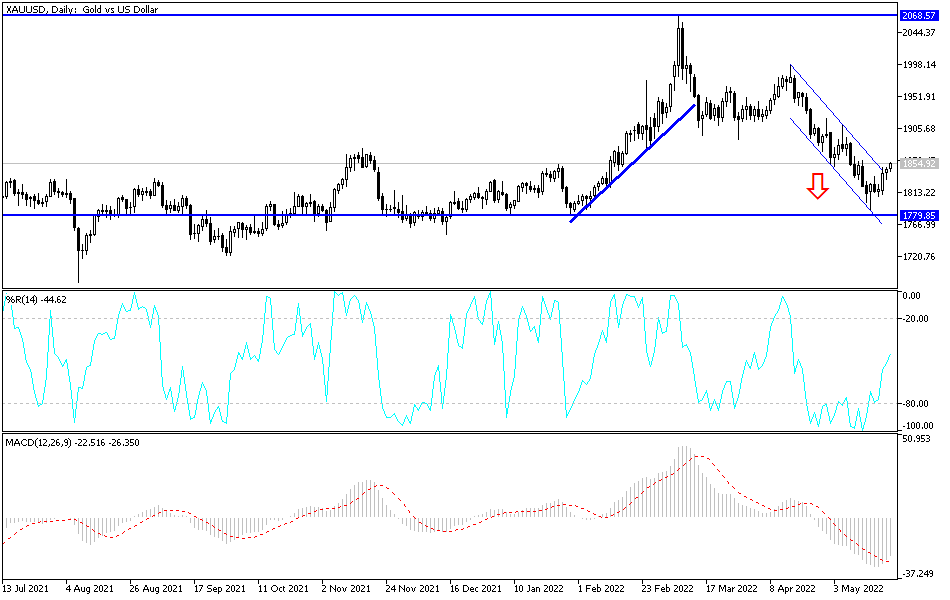

This is shown on the daily chart below, where the rebound was good to break the last descending channel. It pushed the gold price to collapse towards the 1786 support level for an ounce. At that time, I recommended a lot to think about buying gold from every descending level, which I confirm now as well.

Despite the trend of global central banks in one path towards raising interest rates strongly during the year 2022, the gold market receives another stimulus from the continuation of the pandemic. This affects the second largest economy in the world, in addition to the continuation of global geopolitical tensions led by the Russian / Ukrainian war. Its most negative consequences on the future of the global economic recovery, is a good environment for gold, the traditional safe haven for investors in times of uncertainty.

The price of gold appears to be benefiting from the latest round of US data. Initial jobless claims for the week ending May 13 exceeded the expected number of claims at 200K with a tally above 218K, while continuing claims for the period ending May 6 outnumbered 1.32 million with the tally below 1.317 million. On the other hand, the Philadelphia Fed Manufacturing Survey disappointed with a reading of 2.6 compared to market expectations of 16.

US Existing Home Sales for the month of April missed expectations at 5.65M with a decrease of 5.61M (MoM). The change in existing home sales also came in less than the expected change of -0.7% with a change of -2.4% (MoM). Earlier in the week, US housing starts for April missed expectations, while building permits came in better than expected. The price of the yellow metal is also affected by the fragile situation in Europe amid Russia's invasion of Ukraine, where Western economies have imposed sanctions to stifle Putin's economy.

According to the technical analysis of gold prices: In the near term and according to the performance on the hourly chart, it appears that the price of gold is swinging within the formation of a gently ascending channel. This indicates a slight short-term bullish bias in market sentiment. Therefore, the bulls will target extended gains at around $1,854 or higher at $1,864 an ounce. On the other hand, the bears will look to make profits at around $1,835 or lower at $1,823 an ounce.

In the long term and according to the performance on the daily chart, it appears that the price of gold rebounded recently after completing the bearish XABCD reversal pattern. This indicates that the bulls are trying to control the price of gold. Therefore, they will look to extend the current retracement towards $1,885 an ounce or higher to $1,934. On the other hand, the bears will target long-term profits around $1813 an ounce or lower at the $1764 support level.