For the second day in a row, the price of gold is trying to rebound higher to compensate for the losses of the recent selling operations, which drove it towards the support level of 1787 dollars per ounce. Gold futures trimmed their losses as the US dollar fell from its highest level in two decades last week.

Concerns about growth after data showed a contraction in Chinese industrial production. A report showing an unexpected contraction in manufacturing activity in New York in May boosted demand for the safe-haven metal. Data from the National Bureau of Statistics showed that China's industrial output shrank 2.9% year-on-year in April, missing expectations for an increase of 0.4% and down from 5% in March.

On the US economic news front, manufacturing activity in New York contracted unexpectedly in May, according to a report from the Federal Reserve Bank of New York. Where the Federal Reserve Bank of New York said that the general business conditions index fell to -11.6 negative in May from positive 24.6 in April. The negative reading indicates a contraction in regional manufacturing activity. Economists had expected the index to decline to a positive 15.5, which would still indicate growth in the sector.

Today, the US dollar will be affected by the announcement of US retail sales figures, along with the industrial production rate and new statements from US Central Bank Governor Jerome Powell.

The Federal Reserve is gradually pushing its benchmark US short-term interest rate away from its record low near zero, where it has spent most of the pandemic. He also said that he may continue to raise rates by twice the usual amount in upcoming meetings. Investors are concerned that the US central bank could cause a recession if it raises interest rates too much or too quickly. Meanwhile, persistent supply chain problems continue to fuel inflation, and the recent COVID-19 lockdowns in China have raised fears that they may worsen. Russia's war against Ukraine has heightened the volatility of already high energy prices, which could also drive up inflation.

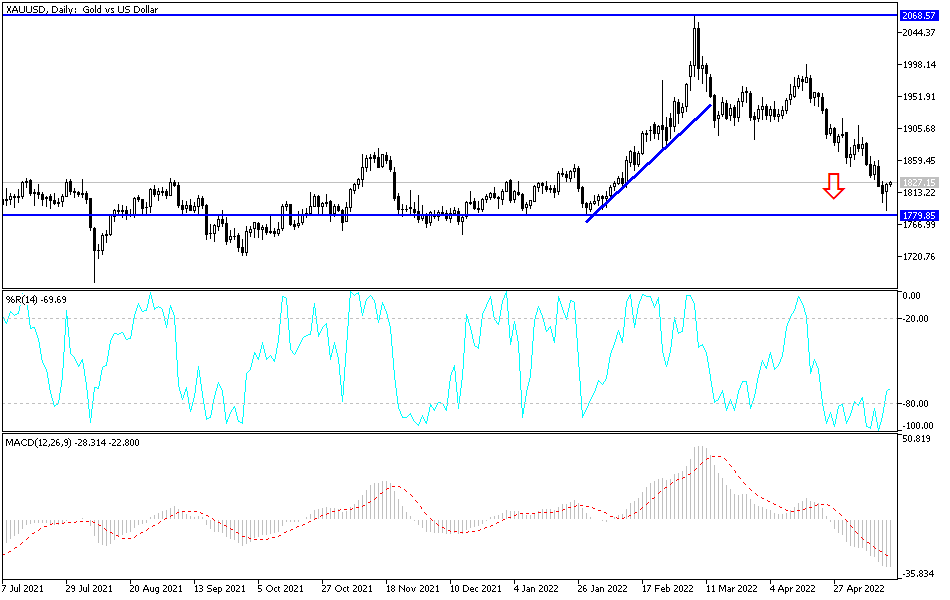

According to gold technical analysis: On the daily chart, the price of gold will have 1800 dollars per ounce, a separating line between bears and bulls. Stability below it will support the move towards the support levels of 1782 and 1760 dollars per ounce, thus strengthening the downside trend. On the other hand, the resistance levels of 1842 and 1865 dollars for an ounce are important for the bulls to control the direction of gold again. I still prefer buying gold from every bearish level. The price of gold today will be affected by the price of the US dollar and the extent to which investors take risks or not, as well as the reaction from the situation in China and the course of the Russian-Ukrainian war.