In the middle of this week’s trading, gold tried to rebound higher, but its gains did not exceed the level of $1836. It returned to stability around $1812 at the time of writing the analysis. The bulls are looking for strong catalysts to avoid a collapse below the psychological support level of $1800, which may increase the movement of the bears strongly towards lower levels. The return of the strength of the US dollar was a strong catalyst to prevent the gold price from moving further.

The US Federal Reserve has re-emphasized strongly to the financial markets that it is ready for the pace of raising US interest rates, which is losing investors' appetite for buying gold a little.

On the other hand, the gold market finds momentum from the continuation of the Russian-Ukrainian war and negative expectations for the future growth of the Chinese economy in light of a new outbreak and restrictions imposed to contain Covid-19. Its forecast for China's GDP growth this year to 4% from 4.5%, citing worse-than-expected economic data in April.

Economists also lowered their second-quarter growth forecast to 1.5% year-on-year from 4% previously, according to a report on Wednesday. Goldman said the full-year growth estimates are based on the assumption that Covid will remain mostly under control, that the property market is improving and the government is boosting infrastructure spending. “Despite the significant economic costs incurred in controlling the omicron variable in March and April, the leadership has not faltered from the GDP growth target of 'about 5.5%' thus far and doubled down on its 'dynamic zero-covid' policy in early March," the economists wrote in the special note. mayo ".

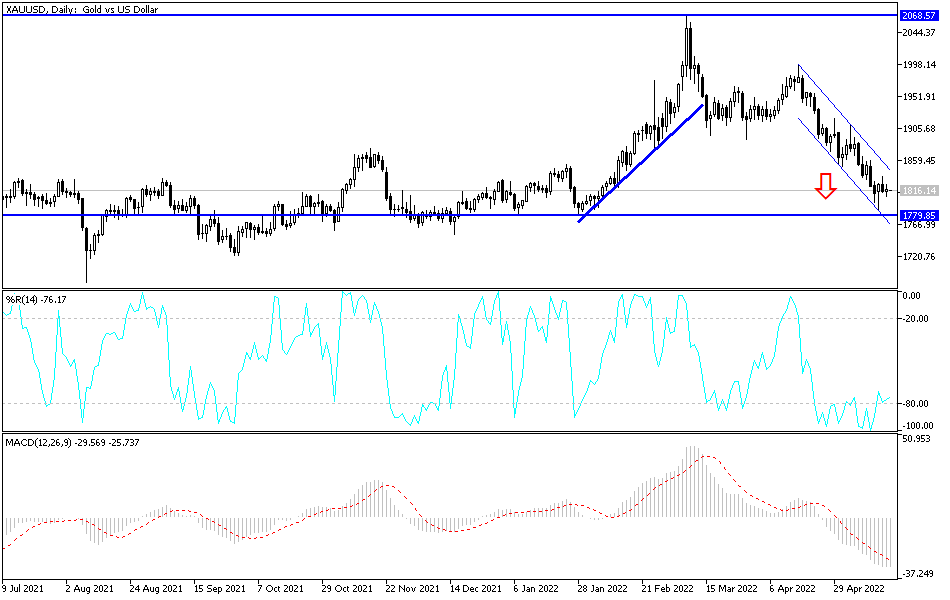

On the daily chart, the price of gold is still around the $1800 level, a separating line between the two directions, and the stability above gives the bulls some hope to launch higher again, as it supports a move towards the resistance levels $1825 and $1855, which supports the upward trend. Then it can move back to the psychological top of $1900 again.

On the other hand, breaking the support level of $1785 supports the bears to launch in the same last performance, but I still prefer buying gold from every descending level, despite the desire of global central banks to raise interest rates, which will be negative for gold. Other factors include geopolitical tensions due to the Russian-Ukrainian war and skirmishes from both sides of the Brexit, along with a new outbreak of the epidemic that threatens the second largest economy in the world.