These moves are peculiar in that dollar weakness comes hand in hand with stagnation in global stock markets: the safe-haven US currency usually tends to outperform in times of nervous investor sentiment. There was low investor sentiment during the last Wednesday and Thursday sessions, sparked by a jump in fears that the US economy may suffer from a marked slowdown.

These fears were raised after US retailer Target issued some poor trading guidance, leading investors to worry that the US economy will slow sharply over the coming months. It may be this dawning realization that US economic exceptionalism is not a cast-iron guarantee, as the prevailing assumption in recent years has been, that has led to a recalibration of the dollar's position.

Shares of Target plunged 25% last week after the US retailer said rising costs would hurt its annual profit, echoing a warning from rival Walmart. Accordingly, economist Ajay Rajadiaksha of Barclays says: "Earning disappointment from Wal-Mart and Target pushed markets lower amid fears of a consumer-driven recession." Further decline in US sentiment was led by existing home sales data which showed a decline of 2.4% to 5.61 million from 5.75 million.

Commenting on this, Ian Shepherdson, chief economist at Pantheon Macroeconomics says: “The third straight decline in sales is no accident; Activity is now clearly responding to the drop in mortgage demand, which indicates that bigger declines are coming very soon.”

The drop in mortgage demand is the first clear sign that higher interest rates at the Federal Reserve are beginning to be felt, and with more hikes to come the economy is likely to cool off even more. Accordingly, Dr. Jörg Kramer, chief economist at Commerzbank says, “In the US, a rapid rise in key interest rates threatens to stifle demand and trigger a recession. In contrast, there is less shortage of demand in Europe than in intermediate products and labour. This means that, unlike in the US, there is no risk of a classic recession — with consequences for inflation and financial markets."

The question now is: Could the forex market finally see the end of the dollar's rally, which will complete one year in May?

These currencies now include the euro, which appears to have benefited from an intensification of expectations for a 50bp rate hike by the European Central Bank. The minutes of the European Central Bank's April monetary policy meeting were released last Thursday and showed that Governing Council members were concerned that the rise in inflation expectations could become "disorderly". This describes a scenario that was an inflationary shock - in this case through higher energy and commodity prices - becoming embedded in the broader economy.

For example, companies can raise the prices of the goods and services they provide, while employees can demand higher wages. Some Council members believe that the ECB cannot wait for real wage developments to confirm rising inflation expectations, so the time to raise interest rates quickly is approaching.

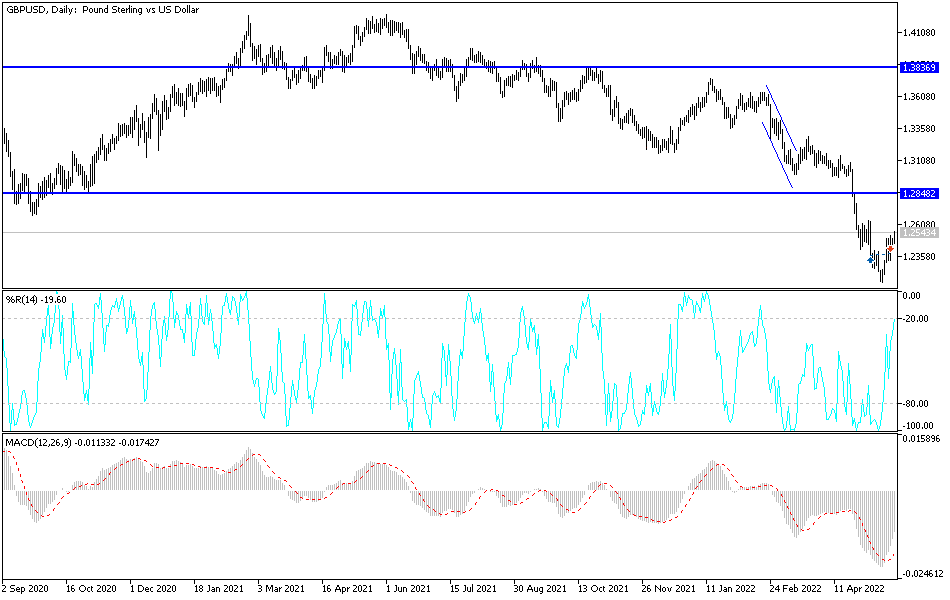

As per the pair's technical analysis: GBP/USD may be in the process of reversing its downtrend, as the price has completed an inverted head and shoulders on the short-term chart. The pair has yet to breach the neckline around 1.2500 to confirm that an uptrend is on the way.

The 100 SMA has crossed above the 200 SMA to indicate that the trend has turned bullish but lacks strong momentum and that neckline resistance is more likely to break than resistance. This could result in a spike similar to the height of the chart shape, which spans nearly 300 points. Stochastic is also ready to move higher after a slight dip into the oversold territory, indicating that the bullish pressure is about to rise. However, if resistance persists, GBP/USD may fall back to the nearby support areas at the moving averages.