The British pound succeeded in achieving gains against the euro and the dollar after the release of British labor market statistics that revealed a strong jump in wages and a larger-than-expected drop in unemployment. In the case of the GBP/USD currency pair, it moved towards the resistance level of 1.2498. It rebounded from its lowest level in two years, when it tested the support level of 1.2155 last week, amid the collapse of the price of sterling in the forex market amid the sharp pessimism of the Bank of England.

According to official figures, the United Kingdom added 83,000 jobs in the three months to March, the Office for National Statistics said, far more than the 5,000 jobs the market was looking for. The unemployment rate unexpectedly fell to 3.7% from 3.8%, a 50-year low. Average wages, including bonuses, rose 7.0% in March, well above the 5.4% that the market was looking for.

The data was stronger than the markets had expected and will continue to pressure the Bank of England to continue raising interest rates.

This is because a "tight" labor market - one in which unemployment is low but demand for workers is strong - of the kind seen in the UK will continue to put pressure on wages, which in turn will drive up inflation. The bank can't simply stand back and do nothing in the face of this kind of data.

The data risks making the Bank of England's outlook for the economic outlook too pessimistic. Bank Governor Andrew Bailey told members of Parliament's Treasury Committee on Monday that the bank continues to expect unemployment to rise in the coming months as the effects of the slowdown in the economy become more felt. The assumption is that inflation - which the bank expects to rise to 10% - will eventually cause economic growth to stall as consumers are forced to become more conservative.

This is expected to lead to higher unemployment, so the bank said that limited increases in interest rates are needed from here. This contrasts with a market that still expects about 100 more basis points of gains in 2022 alone. Given the recent labor market data, it may be the bank that has to move toward market expectations.

This ultimately supports the pound sterling.

Commenting on this, Ricardo Evangelista, chief analyst at ActivTrades said, “The British pound is benefiting from the surprisingly positive data released recently, with both unemployment and wages figures beating expectations, painting a more positive picture of the UK economy than expected. Against this background, expectations of the Bank of England's intervention - an increase in the pace of monetary policy tightening - have risen; With inflation data expected today to top 9%, Bank of England officials will have little choice but to continue raising interest rates, creating scope for further pound gains.”

He added that the number of job vacancies in February to April 2022 rose to a new record high of 1,295,000; An increase of 33,700 from the previous quarter and an increase of 499,300 from the pre-coronavirus pandemic level in January-March 2020. In January-March 2022, the ratio of unemployed to each vacancy remained at 1.0 and for the first time the number of vacancies was greater than the number of vacancies Unemployed people, according to the Office for National Statistics.

This suggests that the UK labor market will remain strong for some time now, even in the face of rising inflation.

However, much of the labor market's "tightness" is a symptom of a troubled workforce due to a number of factors, including fewer EU citizens coming to the UK to work, long-term sickness rates after Covid and older workers who offer Retirement plans after the pandemic. Rising inflation will prompt more people to look for work again as income levels are reassessed. Falling stock markets and falling cryptocurrency values will also cause more people to return to the workforce.

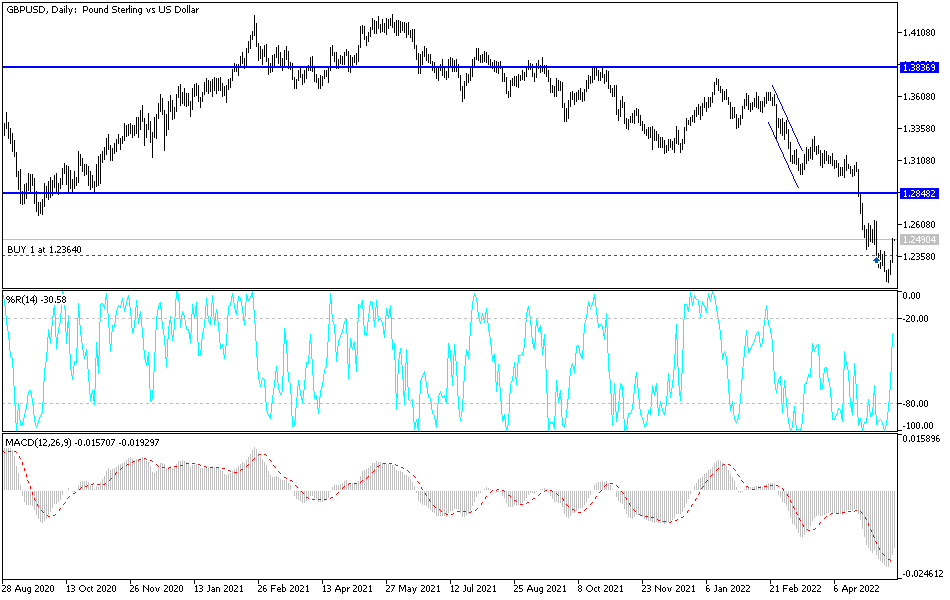

According to the technical analysis of the pair: According to the performance on the daily chart below, and despite the attempts to rebound, the general trend of the GBP/USD pair is still bearish. Over the same period of time, there will be no reversal of the trend without breaching the 1.2848 resistance levels and the psychological top 1.3000, the boundary between recovery and continuing the current bearish trend . On the other hand, the support level at 1.2330 is still important for further launch of the bears towards the most expected psychological support at 1.2000 after that. Today, the sterling will be affected by the announcement of British inflation figures.