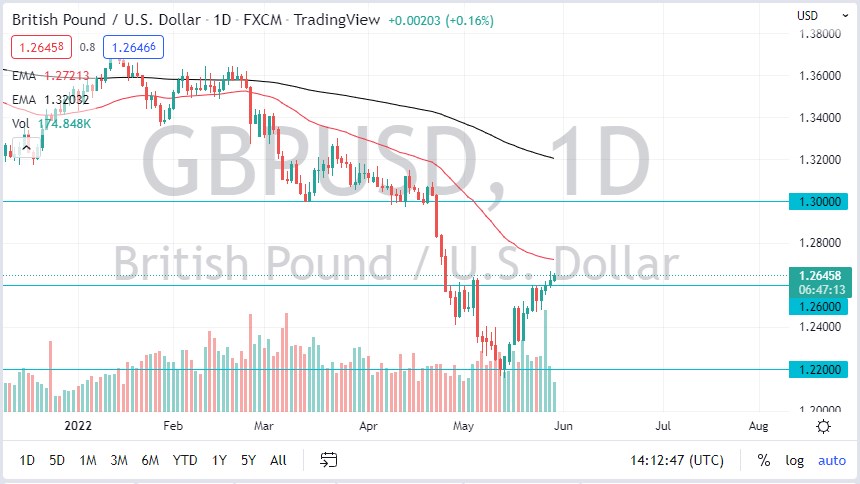

The British pound continued to grind to the upside on Monday, although it should be noted that it was a very quiet session as Americans were away for Memorial Day. Ultimately, we also have the 50-day EMA above that should offer resistance as well. Regardless, even if we rally from here, I think that it is going to be more of a grind higher and it will probably set up for a longer-term selling opportunity.

The 1.30 level above is massive resistance just waiting to happen because it is “market memory” that comes into play here. It had been previous support, so I would certainly think that the sellers would be interested in getting involved again. The 1.30 level is also a large, round, psychologically significant figure, so in and of itself it could cause a certain amount of noise.

Ultimately, this is a market that has been in a downtrend for quite some time, and I think that any breakdown should be looked at as a potential selling opportunity. If we break down below the 1.25 on a daily close, that will more than likely continue to put sellers back into the marketplace. The 1.22 level underneath could be the target, perhaps even the 1.20 level after that. The market has been in a downtrend for quite a few different reasons, not the least of which would be risk aversion. There are still plenty of reasons to think that fear will be out there, which would have money drive into the US dollar.

Part of what we have been seeing lately has been yields dropping in America, but we have sold off so drastically that a bit of a bounce had to happen. Ultimately, this is a market that will eventually start to look at people buying bonds as driving up demand for the greenback as well. In fact, it’s not till we break above the 1.31 level that I would consider buying the British pound, and until the Bank of England changes its overall outlook on interest rate hikes. Yes, it’s been a nice rally as of late, but the reality is that it is but a blip on the radar of what we had seen for so long. I’m looking for signs of exhaustion to start selling again.