It may remain so until the most important event for this week, which is the interest decisions from the US Federal Reserve, through which it is expected to raise rates. I have often noted in the past that the divergence in economic performance and the future of monetary policy tightening between the eurozone and the United States will ultimately be in favor of the US dollar.

The euro can avoid falling to parity against the dollar as long as current expectations of continued economic growth in the eurozone are met, says an analyst at a major European investment bank and lender. However, Rabobank warns customers that they are reconsidering their current set of expectations for the euro-dollar exchange rate because of the ongoing pressures from high energy prices and the war in Ukraine.

The EUR/USD exchange rate rebounded a bit ahead of the weekend as the market was eyeing a series of six consecutive daily declines which fueled talk of a possible drop to 1.0 EUR/USD. Expectations have grown that the Euro and the Dollar may only reach parity after the exchange rate fell about 2.0% in the week ending April 29th and remains weak at the time of writing on Tuesday May 3rd.

A combination of unbridled US dollar strength and fears that the eurozone economy will continue to face headwinds from rising energy costs contributed to these declines. Accordingly, Jane Foley, senior FX analyst at Rabobank, said, “The strength of the US dollar in recent sessions has prompted a debate about whether the EUR/USD is heading towards parity.” A large part of the reason for the euro's drop to 1.0471 in the middle of last week was on the back of reports that Russia cut energy supplies to Poland and Bulgaria. Accordingly, Foley says, this "exposes the risks associated with energy security in Europe".

Economists fear that more energy constraints are looming, especially as Russia may seek to weaponize goods in the face of increased Western arms supplies to Ukraine. This will have a significant impact on the eurozone economy: the consensus and the European Central Bank (ECB) do not currently expect the bloc to fall into recession, but an intensification of the energy supply shock could lead to such an outcome.

The European Central Bank forecast shows that the war between Russia and Ukraine is likely to reduce the GDP of the Eurozone for 2022 by 0.5 percentage point, bringing GDP growth at 3.7% in 2022 and 2.8% in 2023. Economists say AMP Capital says the ECB is overly optimistic: they see GDP growth of 2.9% in 2022 and 3% in 2023.

“The risk of a recession in the first half of 2022 is high,” says Diana Musina, an economist at AMP Capital.

Whether the eurozone slips into recession will affect how the European Central Bank deals with the issue of raising interest rates, which in turn will have implications for the euro exchange rates. If the economy is in recession, the European Central Bank may argue again about indications that it is now ready to raise interest rates as soon as possible in July in order to fend off inflation.

Any pullback from the current ECB rate hike is likely to deprive the Euro of support. Accordingly, forex analysts at Italian bank UniCredit say that the significant uncertainty across the markets means that there is now a need to focus on “extreme scenarios” pursued by the European Central Bank.

They say the ECB could either:

1) He decided to back away from plans for a policy of “normalization” (i.e., move towards higher interest rates) in the face of a complete stagnation in the eurozone.

2) Raising interest rates to get inflation back on track.

“In a pessimistic scenario, the ECB backs away from normalization plans to tackle a systemic stagnation across the eurozone even in the face of inflation approaching 10%, while in a hawkish scenario, the bank becomes The European Central is constrained, raises the deposit rate to 2.0 -2.50%.”

The European Central Bank is likely to continue raising interest rates and "normalizing" policy if a recession is averted.

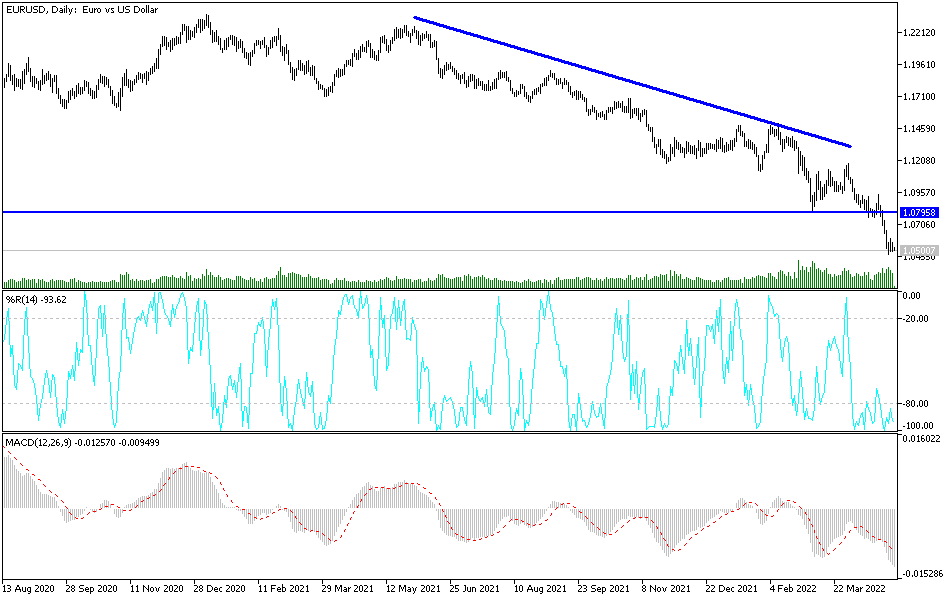

According to the technical analysis of the pair: There is no change in my technical view of the performance of the EUR/USD currency pair. The general trend is still bearish and the current stability around the 1.0500 support may not be the end as long as the weakness factors of the currency pair exist. The continuation of the Russian-Ukrainian war and its repercussions, in addition to the European Central Bank's abandonment of the passage of raising interest rates, as do the rest of the global central banks led by the Federal Reserve. Factors will continue to push the euro to lower levels, and the closest to it is currently 1.0455 and 1.0300, respectively.

On the other hand, according to the performance on the daily chart, breaking the resistance levels 1.0790 and 1.1000 will be important in causing a change in the current outlook. Today, the German unemployment rate and the producer price index in the Eurozone will be announced, along with the unemployment rate. From the United States of America, job opportunities and US factory orders will be announced.