During the recent trading sessions, we noticed a rebound in the price of the euro currency pair against the dollar, EUR/USD, with gains to the resistance level of 1.0556. It is stable near it at the beginning of trading today, Wednesday. The rebound came from a recovery for the currency pair after it tested its lowest level in five years to the support level 1.0349 and the euro's gains came after the detailed European Central Bank talks showed a significant increase in interest rates in July. The European Central Bank is increasingly likely to raise interest rates in July, with a member of the Governing Council warning of the possibility of a surprise rate hike. In this regard, Dutch Central Bank Governor Claes Knott said in an interview on Tuesday that the European Central Bank should raise its key interest rate by 25 basis points in July, but it should not rule out a larger increase.

Knot's comments were reported by the Dutch College Tour TV show. Comments have supported the possibility of a rate hike in July, but opening the door to any hike above 25 basis points is a hawkish surprise from a currency perspective. "The first rate hike at the July 21 monetary policy meeting is now being priced in, and that looks realistic to me," added member Knott.

He also said that the European Central Bank should keep the door open for greater action if data over the next few months indicates inflation is "widening further or accumulating". He also said, "A larger increase should not be ruled out ... the next logical step would be half a percentage point."

Nott's comments come a day after European Central Bank Governing Council member Francois Villeroy de Gallo expressed concern that the euro was too weak, and thus was contributing to inflation. “Let me stress this: We will carefully monitor developments in the effective exchange rate as an important driver of imported inflation,” Villeroy said at a conference at the Bank of France. The comments are the latest in a string of indications that the European Central Bank is preparing the market to raise interest rates in response to rising inflation, a development that could support the euro's view against the dollar, especially if expectations of a Fed rate hike are at saturation point.

The European Union has lowered its forecast for economic growth in the 27-nation bloc amid the prospect of a protracted Russian war in Ukraine and disruption of energy supplies. The EU's executive arm has said that the EU's gross domestic product will grow by 2.7% this year and 2.3% in 2023 - its first economic forecast since Russia's invasion of Ukraine on February 24.

The European Commission's previous forecast included growth of 4% this year and 2.8% in 2023. The EU economy grew 5.4% last year after the deep recession caused by the COVID-19 pandemic. GDP contracted by 5.9% in 2020. "The Russian invasion of Ukraine has presented new challenges, just as the Union has recovered from the economic effects of the pandemic," the commission said when releasing the forecast. "War exacerbates pre-existing headwinds for growth".

The war has darkened the generally bright economic picture of the European Union. Early this year, European policymakers were counting on strong, if weaker growth, as they grappled with rising inflation caused by global energy pressures.

Now, energy is a major problem for the European Union as it seeks to impose sanctions that are depriving Russia of tens of billions of trade revenue without plunging member states into recession. Higher energy prices are driving record-high inflation, making everything from food to transportation and housing more expensive. Russia is the largest supplier of oil, natural gas and coal in the European Union, accounting for about a quarter of the bloc's total energy. The EU's total energy imports from Russia last year amounted to 99 billion euros ($103 billion), or 62% of the bloc's purchases of Russian goods.

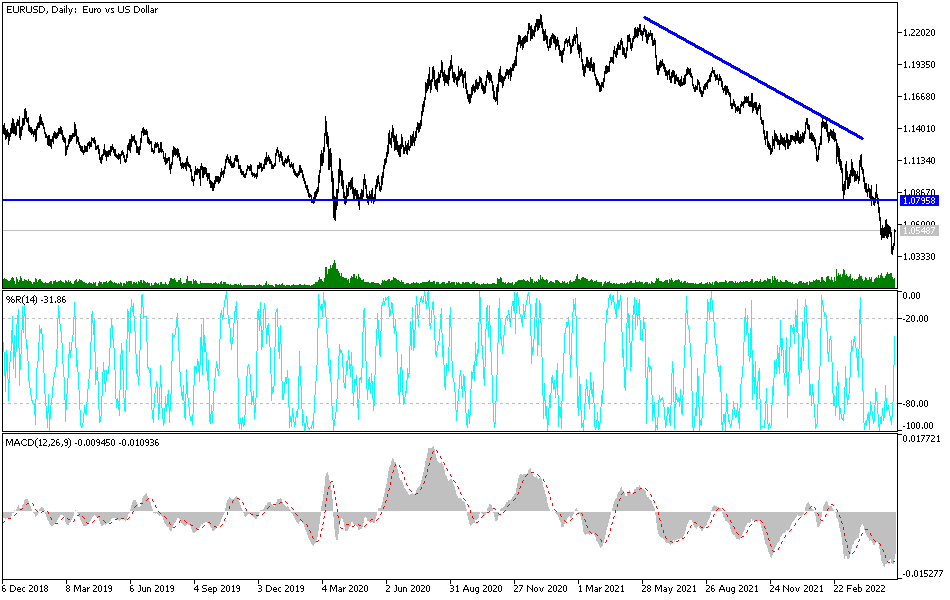

According to the technical analysis of the pair: Despite the recent attempts to rebound in the EUR/USD price, the general trend according to the daily chart is still bearish. As I mentioned before over the same time period, a reversal will not occur without breaching the 1.0795 and 1.1000 resistance levels, respectively. Bears may return to control the trend as soon as the 1.0450 support is breached so far Eurodollar gains will remain subject to sale as the Fed's monetary policy tightening path remains stronger than the ambiguous ECB tightening path. Today, the euro-dollar will be affected by the announcement of inflation figures in the euro zone.