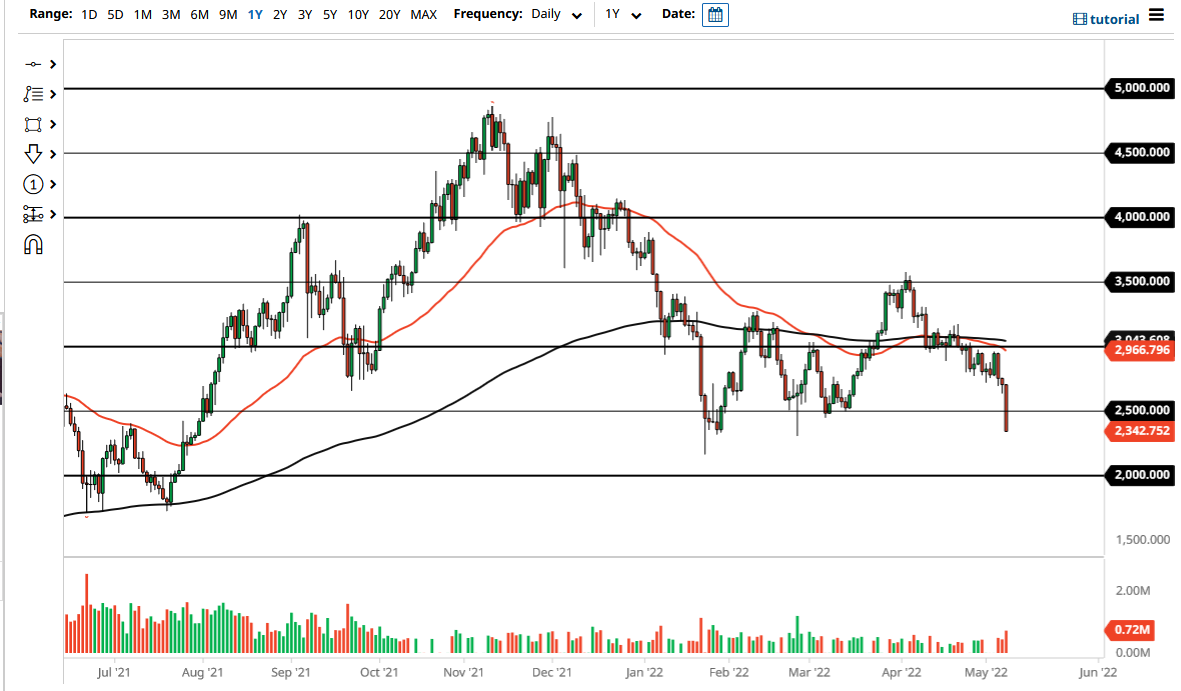

Ethereum has lost 15%, or $400, to kick off the Monday session. The $2300 level is an area where we are starting to see buyers try to pick the market up in the past, so it will be interesting to see if they can do it now. The fact that we are closing at the very bottom of this candlestick dictates that we are more likely than not going to continue to see downward pressure. At that point, the market is likely to go looking to reach the $2000 level.

The $2000 level is a major round figure that a lot of people will pay close attention to, and will cause quite a bit of headline risks. The $2000 level being broken would open up the trapdoor to much lower pricing, and I think we could eventually enter what is typically called “crypto winter.” In that scenario, the market is likely to see a lot of acceleration, and therefore a massive unwinding of long positions.

It is interesting to see that we have given up so much during the day and the fact that we have formed such a huge candlestick does suggest that there are going to be plenty of people jumping ship. You need to pay attention to the fact that a lot of institutions have gotten involved in Ethereum and are taking massive losses not only in this market but in other markets as well. When we have losses across-the-board, a lot of times these larger funds will have to liquidate almost anything and everything they can get their hands on. At that point, it is about trying to find bits and pieces of liquidity.

It is also worth noting that Bitcoin was absolutely annihilated during the day as well, and it certainly looks as if we are getting relatively close to kicking off another “crypto winter.” If you are a longer-term investor, you should get an opportunity to pick up crypto at a much cheaper price, not just Ethereum. At this point, we are likely in the “do or die” area that we need to pay close attention to. Rallies at this point will more than likely offer a significant amount of resistance that we can sell into, but I do not have any interest in trying to get long of Ethereum at the moment.