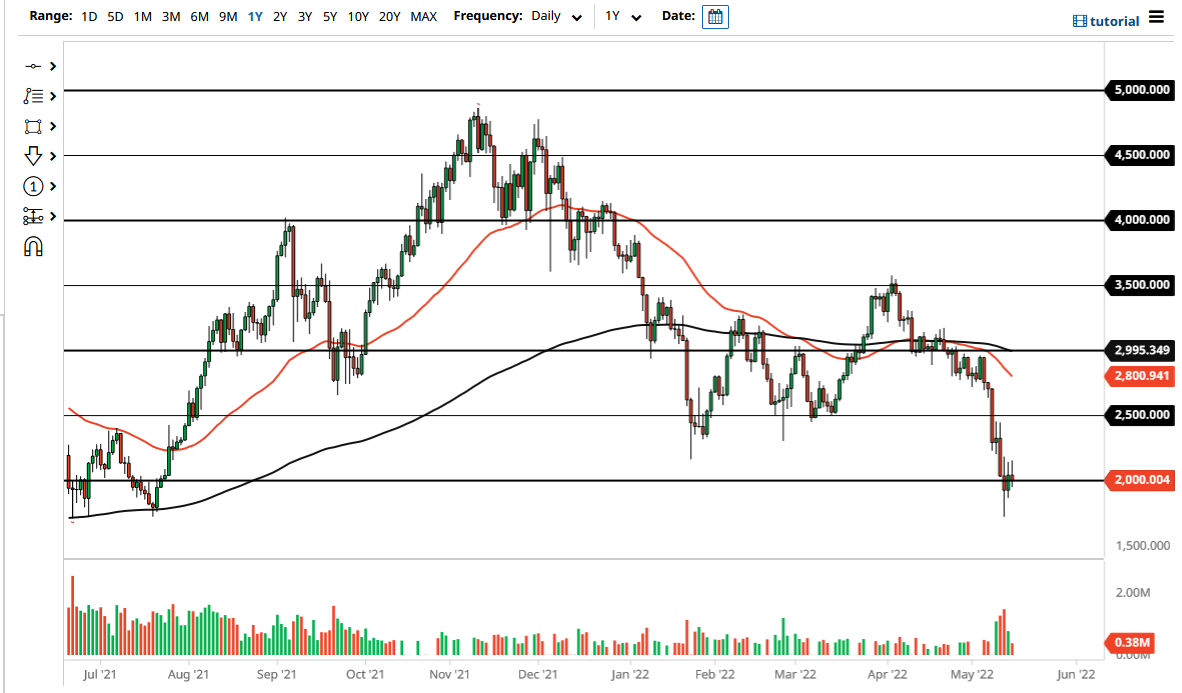

The Ethereum market initially tried to rally on Monday, but then gave back the gains to form a less-than-impressive candlestick. Because of this, it looks like Ethereum will continue to struggle, as we are hanging around the psychologically and structurally important $2000 level. That being said, the market is going to continue to be volatile, and at this point, it looks as if Ethereum will continue to struggle.

If we break above the highs of the last couple of days, it could kick off a relief rally to go looking towards the $2500 level. That is an area that I think would be a major barrier, and as a result, if we were to break above there it would be an extraordinarily bullish sign. That being said, I think that the market would need a lot of external pressure to make this market go higher. There is a little bit of an overbought condition in the US dollar, so that could have something to do with what we see next, and as a result, the market participants will have to continue to see a huge change in risk appetite to make Ethereum look viable.

If we break down below the lows of last week, is very likely that Ethereum will crumble, looking to reach the $1500 level. After that, we could have a significant collapse as well. That being said, I think that the market is more likely than not going to continue to see plenty of negativity, as the crypto markets are in serious trouble. Whether or not we have reached the bottom is a completely different question, but at this point, it is very unlikely that the attitude will change enough to make that happen, and unless something drastic happens.

Keep in mind that the US dollar is like a wrecking ball to almost everything, and Ethereum will be no different. Rallies are to be sold into at the first signs of exhaustion and is likely that Ethereum has much further to go over the longer term. The market would of course have a completely different attitude if we managed to break above the $2500 level, but that would take something rather extraordinary to happen over the next couple of days to make that happen. More likely than not, we will break down and go much lower.