The German DAX Index gapped lower in the futures market right away on Monday, turned around to fill that gap, and then fell again. The DAX continues to get a bit of a beat down, as the European Union continues to worry about things like energy, something that is not exactly conducive to a bullish attitude. Ultimately, this is a market that I think will continue to be very negative as we have to worry about so many moving pieces in the European Union.

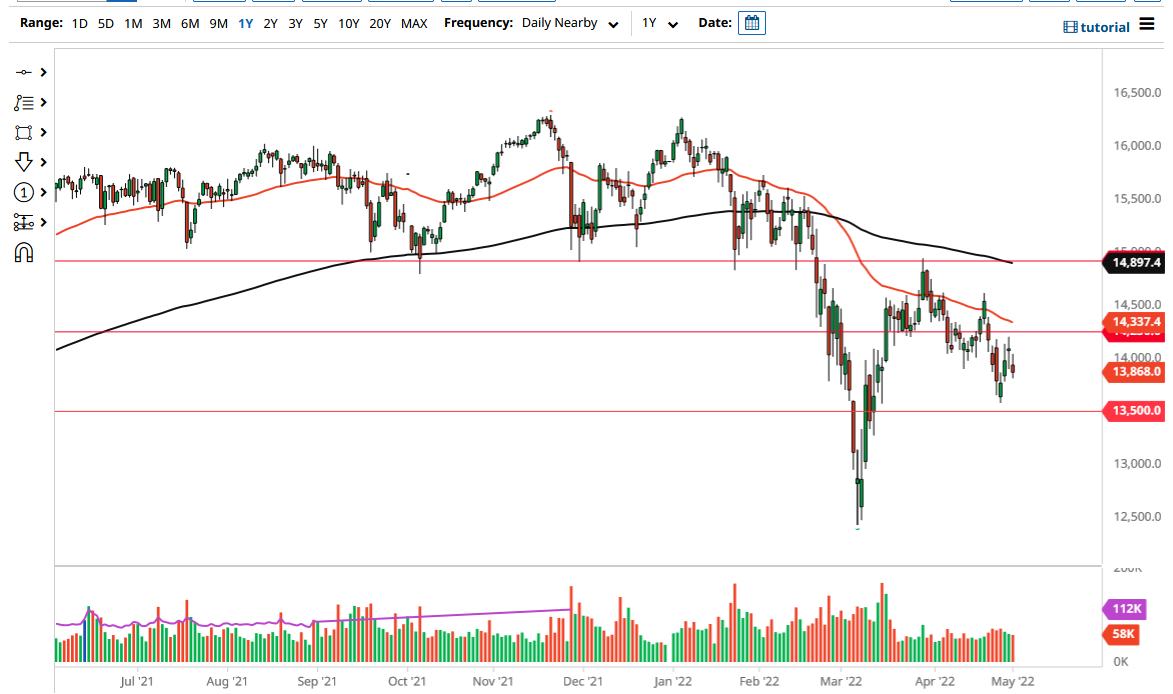

The continued war in Ukraine has a bit of a knock-on effect over in the EU as well, and as the DAX is one of the first places that people put money into when it comes to the EU, it also ends up being one of the first places people take money out of. As the world economy continues to slow down, a lot of the bigger companies in the index are major exporters, so the rest of the world and its economy have a massive effect on how the DAX prepares. This is a market that will continue to struggle with rallies so I am paying close attention to the 50ay-dEMA. The 50-day EMA has been rather consistent as far as resistance is concerned, and it is likely that we will see plenty of sellers above.

Underneath, I see the €13,500 level as a short-term support level, one that a lot of people will pay close attention to. If we were to break down below there, then the market is likely to go much further, perhaps down to the €13,000 level, maybe even the €12,500 level. The market breaking down below there would be extraordinarily negative. On the other hand, if we were to turn around and break above the €14,500 level, then it is possible that the market could go higher to reach the €15,000 level. In that general vicinity, the 200-day EMA sits there as well, so it certainly makes sense that we would continue to see selling pressure there as well. I believe that you will continue to see a lot of selling pressure at the first signs of trouble. The market will continue to be very choppy, but favor the overall downside.