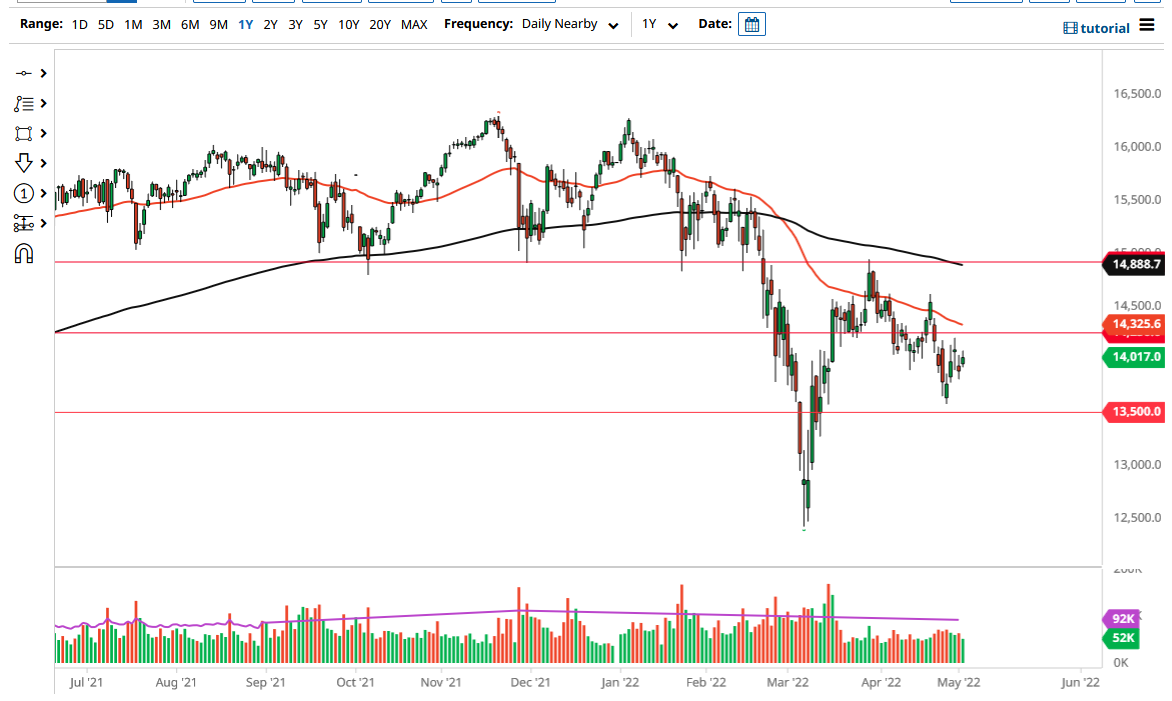

The German DAX Index rallied a bit in the futures markets on Tuesday to reach above the €14,000 level. However, we have seen a lot of back and forth over the last couple of weeks, and I think it will continue to be the case. The €14,250 level above is significant resistance, especially now that the 50-day EMA is racing towards it as well. Ultimately, I do think that short-term rallies will more than likely be sold into at the first signs of exhaustion.

If we do break above the 50-day EMA, then it is possible that the DAX could go looking to the €14,500 level, perhaps even higher than that. Ultimately, the €15,000 level above could be a longer-term target, as the area has offered both support and resistance previously, and of course, it also has the 200-day EMA as well. There would have to be a lot of bullish pressure attached to that move, so you would probably see a transfer into multiple other indices around the world.

On the other side of this argument would be that we will break down below the €13,000 level, which would more likely than not be accompanied by selling in other major indices. Because of this, you need to be very cautious about what is going on, but I do think that it is probably only a matter of time before we have to make a bigger decision. With that in mind, it is likely that we will see a lot of volatility in the DAX, so keep an eye on these levels and of course other indices such as the Nikkei, S&P 500, FTSE 100, etc.

I think the next couple of days will more than likely be choppy and indecisive, so keep in mind that you need to be very cautious as the most likely of things will be a short-term rally that we can start shorting at the first signs of exhaustion. We have been in a downtrend for a while, and I think we will probably have to continue fading short-term rallies. However, I would be rather quick to take profits as the occasional bounce will more likely than not be part of this market. You can almost draw a bit of a negative channel over the last several weeks.