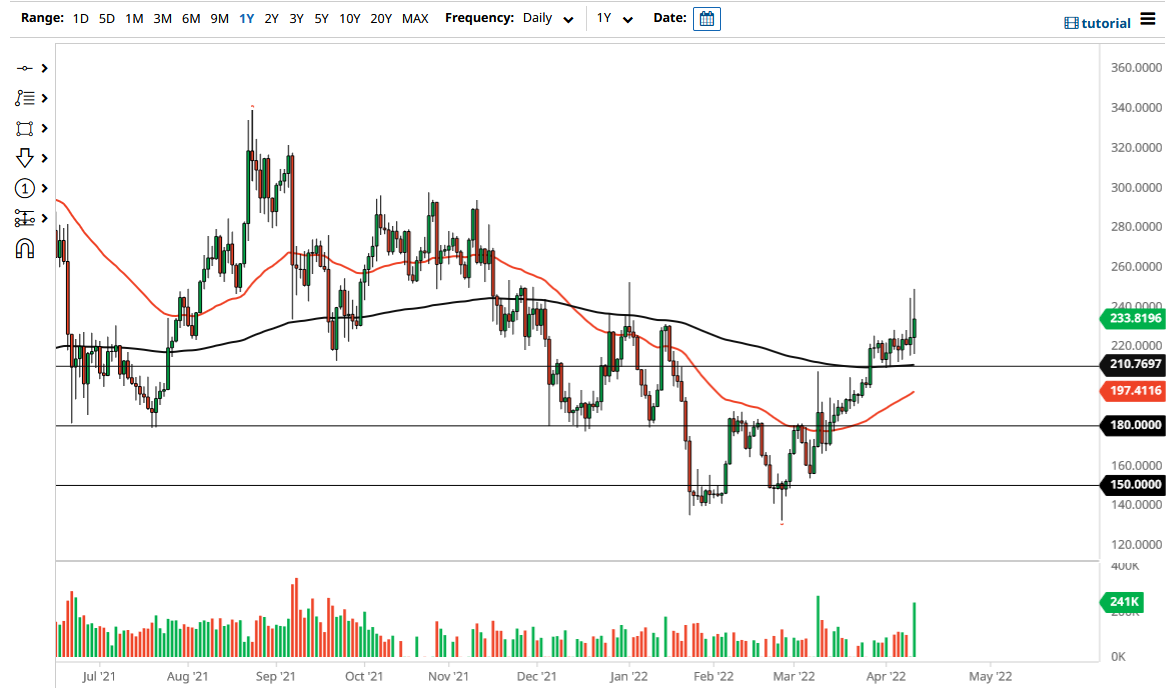

Monero rallied Tuesday to show signs of life again, threatening the $240 area. This is an area that has been resistant more than once, so it does make sense that we would continue to pay close attention to it. Furthermore, we recently broke above the $210 level, and now the 200-day EMA sits there. In other words, it is very likely that we will continue to see a lot of support just below. In fact, I think that support might run all the way down to the 50-day EMA, and it is worth noting that Monero seems to be doing much better than many of the other major coins.

Take Bitcoin for example. It did nothing during the day on Tuesday, but you can say that Monero at least try to break out to the upside, and the fact that we had done it during the previous session shows that either this is an area where we are going to see a massive amount of selling pressure, or we will eventually watch the resistance give way, and we will go much higher. In other words, the next couple of days could determine where Monero goes over the next several weeks.

A break above the highs of the last couple of days could open up the possibility of Monero going to the $250 level, maybe even as high as the $300 level over the longer term. If we can get Bitcoin to turn things around and show signs of life again, that could also add more momentum to this market as Bitcoin can most certainly push the rest of the crypto markets around. On the other hand, if we were to break down below the 50-day EMA, is likely that Monero could go looking to reach the $180 level, which was the previous support and resistance level that had been so clear on the charts.

Another part of the market to pay close attention to is what the US dollar is doing, because Monero is priced in those same US dollars. If we continue to see a lot of strength in the greenback, that could make this market a bit sluggish. On the other hand, if the US dollar falls apart, that could send Monero quite a bit higher.