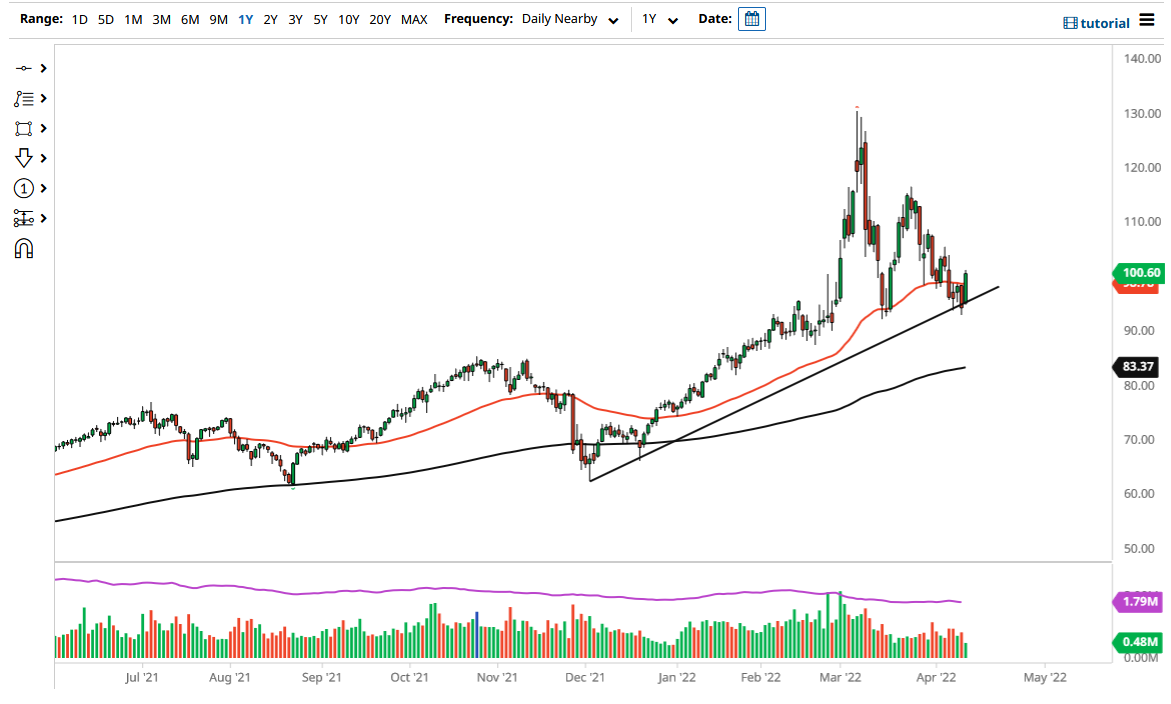

The West Texas Intermediate Crude Oil market took off to the upside on Tuesday as the uptrend line has been tested, and it has been strong enough to turn this market around. At this point, we then broke above the 50-day EMA, which is a very bullish sign, and the size of the candlestick does suggest that there is some real push underneath. Because of this, if we can take out the top of the candlestick, then we may go looking to reach the $105 level.

At this juncture, the uptrend line continues to be very crucial, so as long as we stay above the lows from the Monday session, I think we will have the possibility of the market saving itself, but it does not necessarily mean that you should jump in and started buying right away. After all, the market is very noisy, and we have seen a lot of selling pressure as of late.

You can also make an argument for a falling wedge, which is a bullish pattern, but really at this point, I do not have any interest in trying to get too bullish, at least until we see a little bit of follow-through. If we get a little bit of follow-through, is likely that the market will continue to try to grind higher, maybe even as high as the $115 level.

It is probably worth noting that this was a very bullish candlestick, but if we were to turn around and break down from here, that would be an extraordinarily bearish turn of events. Breaking down below the Monday candlestick probably reaches toward the $90 level after that, and then possibly even the 200-day EMA. The 200-day EMA is something that longer-term traders pay attention to, and it is down at the $83.37 level. Beyond the “falling wedge”, you can also talk about a descending triangle. Confused yet? Good. That is exactly the way most traders are right now when it comes to crude oil because there are major concerns about demand as global economies continue to look like they are about to slow down. A slow economy does not need much in the way of oil, and the Americans are starting to finally pump out more.