After four trading sessions in a row, the USD/JPY currency pair moved on its impact, amid profit-taking sales, and it moved towards the 126.92 level. Strongly raising US interest rates to stem record inflation in the United States. The currency pair USD/JPY moved towards the resistance level 128.50 at the time of writing the analysis.

The Fed may be on track to raise US interest rates by more than 200 basis points in 2022 alone, much higher than the Bank of England can do. As for the Japanese central bank, it is far from taking such steps. But for now, the continued deterioration in market sentiment appears to be spurring demand for the dollar. This occurred amid concern from China due to a new outbreak of the Corona virus and the subsequent harsh containment measures, which may impede the path of economic recovery for the second largest economy in the world.

The Japanese yen has fallen along with several other major currencies in this week's mid-session, but it faces additional risks from the looming Bank of Japan (BoJ) monetary policy decision which many believe will reinforce a wide gap between Japanese government bond yields and America. The Japanese yen rose against the euro and the Norwegian krone on Wednesday but fell against most other major currencies as the forex market pondered the possibility of a disruption to Russian energy supplies to "unfriendly countries".

A sudden stop in Russian gas supplies to Europe could push the continent into recession. It is difficult to predict the exact impact of such an immediate ban on gas, and it came after news of a halt in gas supplies to Poland and Bulgaria after companies operating there refused to comply with the terms of the Kremlin gas ruse in exchange for the ruble, which led to speculation about similar measures that will affect other countries in the future.

Japan is one of the "unfriendly countries" that engage in sanctions against the Russian government and is also, to a similar extent as Europe, highly dependent on energy imports from Russia, which is why the Japanese yen has fallen. Wednesday's losses mirrored what was considered a strong performance for the yen, which appeared to have taken respite from weeks of heavy selling when US government bond yields tumbled over the course of Monday and Tuesday.

However, the burden of these returns - or the gap between them and their Japanese equivalent - will return to focus Thursday when the Bank of Japan prepares to announce its latest monetary policy decision. Commenting on this, John Hardy, FX analyst at Saxo Bank, said: "While very few expect a turnaround, it would not take much to suggest that the pressure on the BoJ through the weak currency is becoming too strong to ignore."

"Even a hint that the bank is considering tightening without details may be enough to spur a rally in the Japanese yen, but clarifying that the bank is willing to manipulate the maximum yield policy on 10-year JGBs is likely to lead to a sharper move," he added.

Overall, the BOJ's policy of seeking to maintain the 10-year JGB yield at around 0.10%, while imposing a fixed cap at 0.25% for its long-term borrowing costs benchmark, has left the JPY vulnerable to a sharp increase in US government bonds. Revenues seen in recent months.

The depreciation of the Japanese currency linked to the yield differential has prompted repeated expressions of concern from the Ministry of Finance and fueled market speculation about a possible intervention in order to calm the decline of the yen.

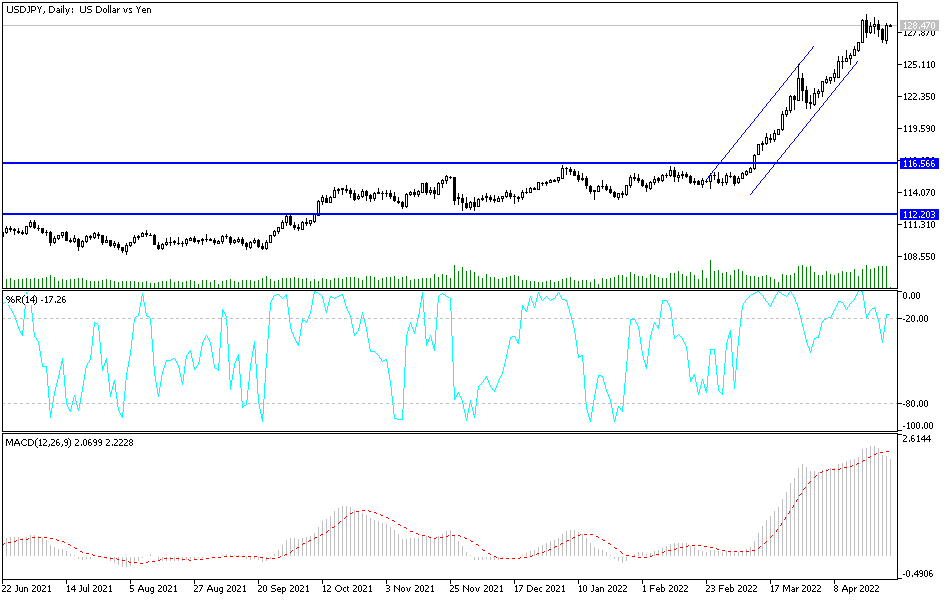

According to the technical analysis of the pair: On the daily chart, the price of the USD/JPY currency pair is still moving in an upward direction. The formation of the bullish flag supports the idea of moving towards the 130.00 psychological resistance as soon as possible, as the US dollar is still stronger than expectations of raising US interest rates by rates which are strong in 2022. Breaking the resistance 128.85 supports the move towards that top. On the other hand, there will not be an initial break of the trend without the currency pair moving towards the 125.20 support level. The US dollar pairs will be affected today by the announcement of the US economic growth rate, in addition to the number of weekly jobless claims. In addition to the extent to which investors are willing to risk or not.