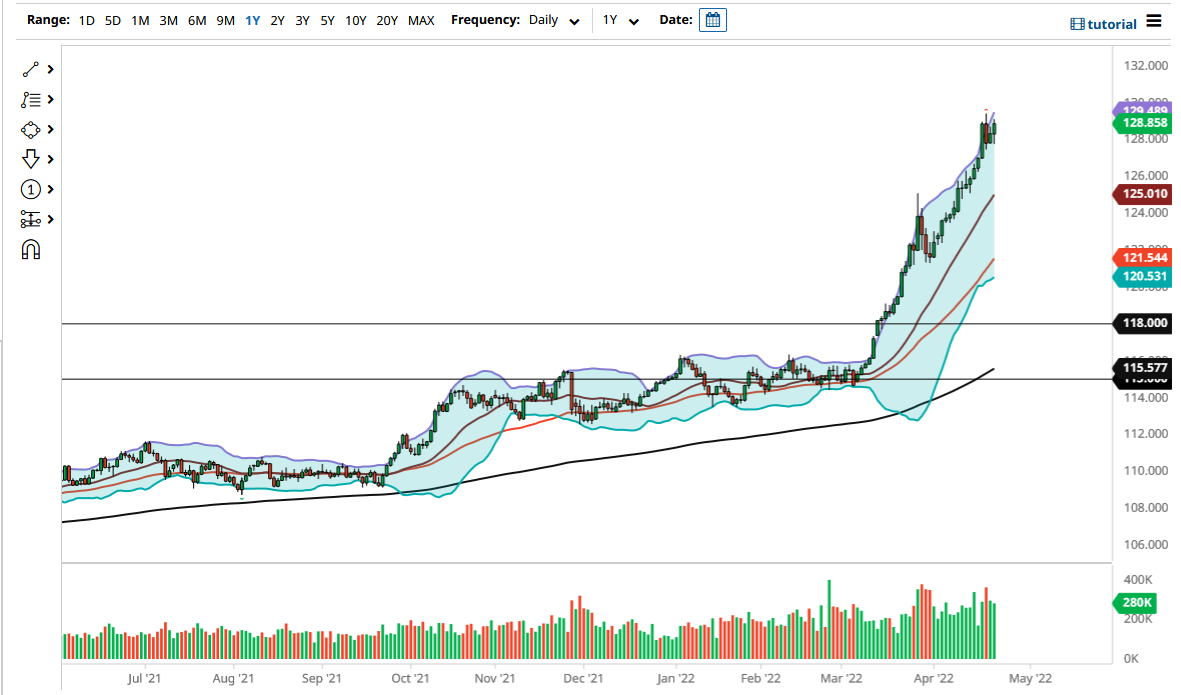

The US dollar rallied on Friday as we continue to reach fresh highs. The ¥129 level is an area of resistance, and it is probably worth noting that we are sitting at the top of the Bollinger Band indicator. Because of this, we will likely continue to see a lot of noisy behavior, so I do think that a short-term pullback will more than likely continue to find plenty of buyers. It is also worth noting that the 20 SMA on the daily chart is sitting at the ¥125 level, which is also a large, round, psychologically significant figure, and an area where we have seen resistance there previously.

Even though we may pull back as we are overextended, the reality is that we have so much in the way of bullish pressure that it is difficult to short this market for any significant amount of time. The 20 SMA is more likely than not going to be something that people pay close attention to, so if we were to break it down below there, it could be a very negative turn of events.

On the upside, the market more than likely will look at the ¥130 level as a major barrier that is going to be difficult to overcome and should bring in fresh selling. Having said that, the market had recently broken above a multi-year high, and any resistance is more likely than not going to be short-term. The market will likely become a “buy-and-hold” type of situation, as it is obvious that the buyers are in complete control and the interest rate differential between the United States and Japan continues to widen. As the Federal Reserve is looking to tighten monetary policy, and the Bank of Japan is desperately fighting rising interest rates, we have a complete divergence between the two central banks, and therefore a perfect storm.

This pair does tend to be quite noisy, and at this point, I would not be surprised at all to see a 200-point pullback. It is because of this that I do not like the idea of jumping in and buying this market in big positions. However, I will be aggressive on pullbacks that show signs of support. Building up a bigger position over time is probably the best way to go.