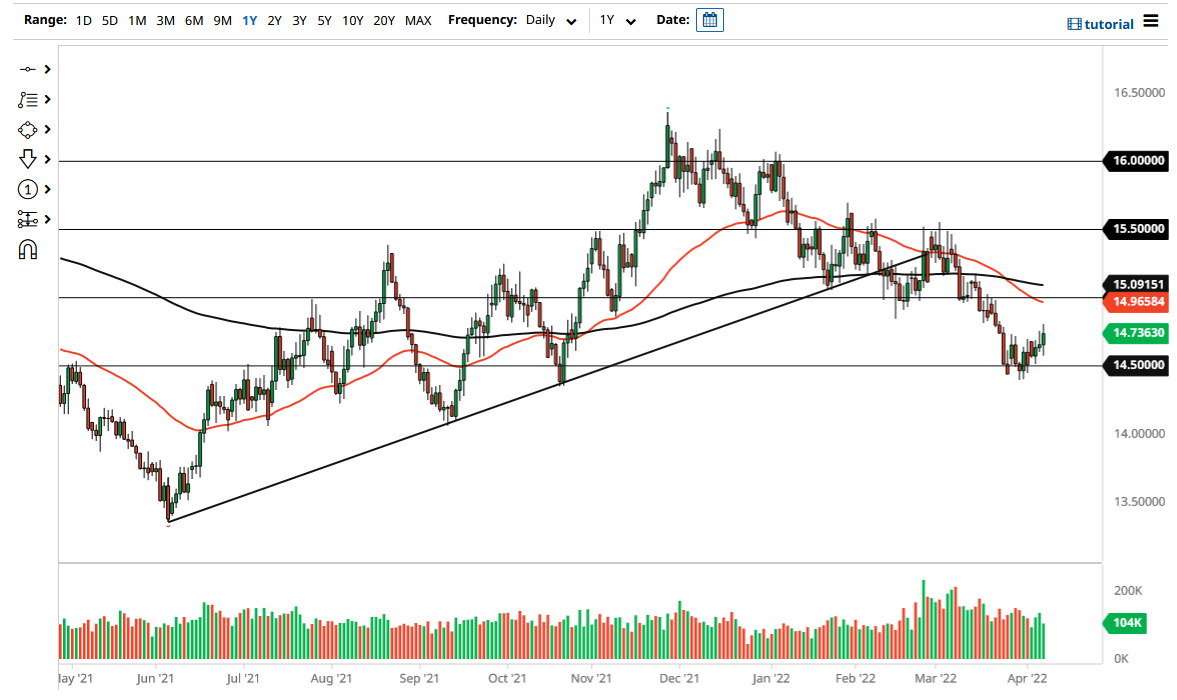

The US dollar has been all over the place during the trading session on Thursday, as we initially fell, but then turned around to show signs of strength. We have broken out of a short-term consolidation area during the trading session, and therefore it looks as if we are trying to recover. The 14.50 Rand level is an area that has been important more than once, so is not a huge surprise to see a bit of a bounce here.

The question now is whether or not this candlestick? After all, South Africa has seen a massive decline in coronavirus numbers, so it does suggest that perhaps the economy will wake back up. The interest rate differential comes into the picture as well, and it is worth noting that the US dollar has seen interest rates in the 10-year note rise rather rapidly, so perhaps that is starting to have a bit of an influence on this market as well. Nonetheless, the obvious thing is that the 14.50 Rand level now looks as if it is significant support.

The 50 Day EMA above is breaking through the 15 Rand level, and therefore I think that if we can go to the upside and test the 50 Day EMA, it will be an interesting resistance barrier. Breaking above that could then have buyers coming back in for a bigger move. This is a market that has been very negative for a while, and therefore it would take quite a bit of momentum to make that happen.

Keep in mind that the South African Rand is essentially a commodity currency, so you need to pay attention to the commodity markets. Commodity markets are starting to turn around a bit, selling off in several different areas. If that keeps up, it could work against the value of the Rand going forward, especially if it is more of a “risk-off” type of situation, as the US dollar is considered to be safe in the currency markets. In the short term, it certainly looks as if we are going to get a little bit of a recovery, the question of course is whether or not it can sustain itself.

On the downside, if we were to break down below the lows of last week, it opens up the possibility of a move down to the 14 Rand level. However, the Thursday candlestick does suggest that it may not happen in the short term.