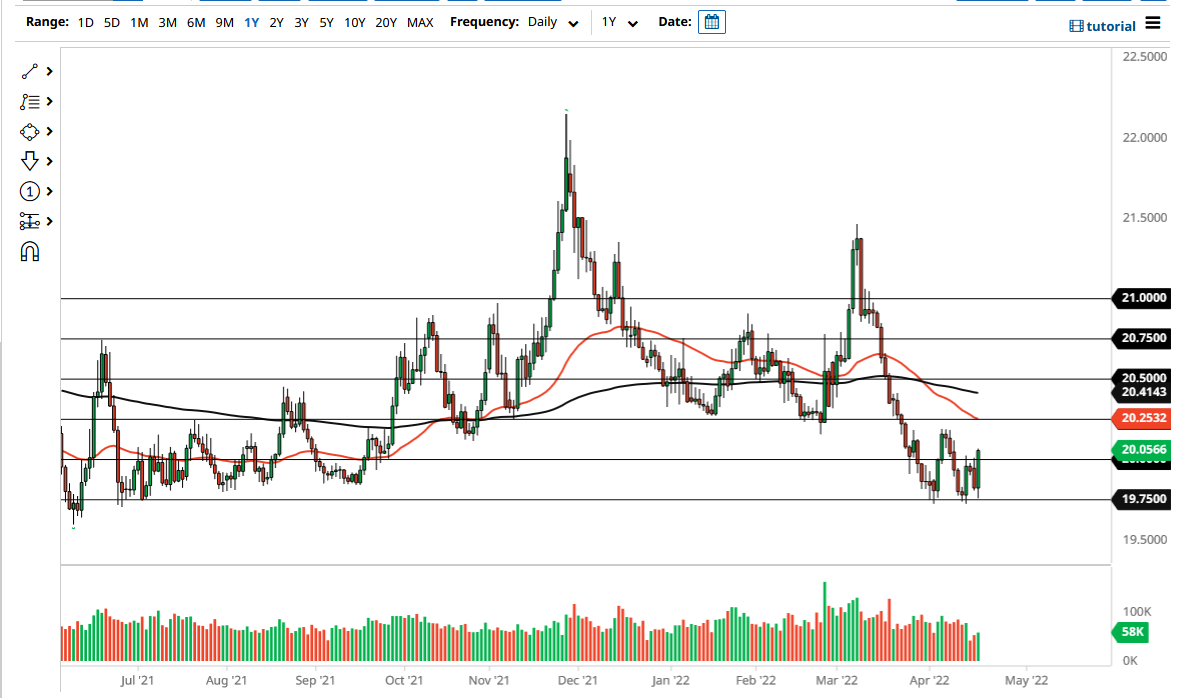

The US dollar has found buyers during the trading session on Tuesday against most currencies, and of course, the Mexican peso was going to be no different. The 19.75 MXN level has been supported multiple times now, and it looks as if we are trying to form a major support level. The area in this general vicinity seems to be attracting a lot of buyers, so the fact that we bounced is not a big surprise.

What the surprise is would be the size of the candlestick. Breaking above the 20 MXN level is something worth paying attention to, and at this point, we have to start to ask the question as to whether or not we are forming some type of larger W pattern? If we do, a break above the 20.25 MXN level would kick off a longer-term buying opportunity, but I also recognize that there is a lot of noise above there that could come into the picture and cause a few headaches. In other words, it will be more of a grind higher than anything else.

Keep in mind that the pair does have a crude oil dynamic attached to it, as the Mexican peso is quite often used as a proxy for crude oil, but at the same time the United States is one of the world’s biggest producers. In other words, that dynamic may not be as strong as it once was, but if we do see a huge run higher in the crude oil market, we could turn around and break below the 19.75 level, which of course could send this market much lower.

The market had previously fallen apart to get down to this area, so one has to keep in mind that you need to see a bigger move than the one that we had on Tuesday, so the next candlestick or two could be rather crucial. The other possibility is that we simply go back and forth in a grinding consolidation area, but only time will tell. The 50 Day EMA is also sitting at the 20.25 level, so that is yet another reason that we should be paying attention to that level if we do approach it. Keep in mind that the Mexican peso tends to move in the 0.25 MXN increments, so pay attention to that.