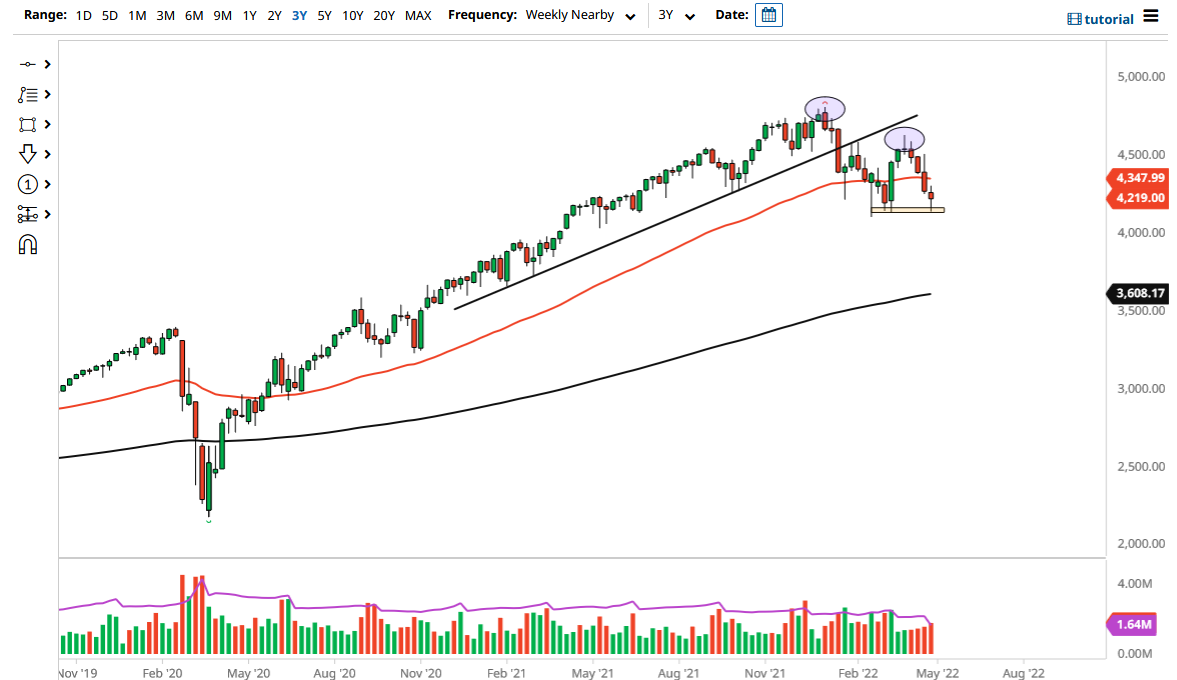

The S&P 500 has had a very rough month of April, as have all stock markets around the world. The market is currently threatening the 4200 level, which is an area that will attract a certain amount of attention. That being said, the question is going to be whether or not that area is going to continue to offer support, or if it is going to simply be broken through?

If we break through the recent lows, the 4000 level would be the most logical of targets going forward. I do not necessarily think that this is a scenario where it is going to be easy to short this market, but it is obvious to me that going “all in” into the S&P 500 is going to be reckless in this current environment. With the uncertainty out there, it is difficult to get overly excited about owning stocks, and it should be noted that a lot of institutional money is starting to get underwater at this point. I do think that sooner or later we are going to see some massive forced liquidations, but we do not necessarily know when that could happen. In this scenario, we could see a massive selloff happen in a very short amount of time.

The main question now is how much the tightening the Federal Reserve is going to do, because quite frankly there are plenty of people on Wall Street that still do not believe that the Fed will raise interest rates five or six times, let alone the 13 times that have recently been priced into Fed futures market. This is because an entire generation of traders have no idea what it is like to trade against the Fed, which is essentially what happens when they are raising rates. With that in mind, expect that any rally up to the 4500 level will be looked at with a significant amount of suspicion unless of course something fundamentally changes. Earnings have been okay, but not necessarily stellar. Furthermore, the GDP number that came out on 28 April was much weaker than anticipated. This adds a new layer of indigestion to the market. The 50 Week EMA is right in the middle of the current trading range, so the best-case scenario is probably a back and forth month.